Estonia

A small beautiful country near the Baltic sea with 1.3 million in population is making history today on how they are adapting to technological advancements.

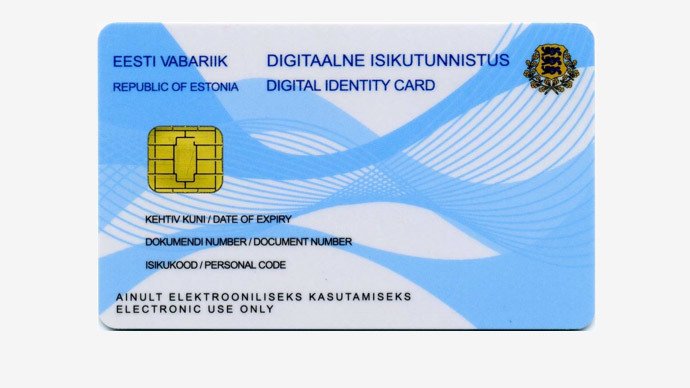

In 2014, The Estonia government rolled out the first e-residency program where they allowed most people around the world to acquire an e-residency in Estonia remotely for relatively cheap. Not to be confused with permanent residency, an e-residency only allows you to create a corporation and do other services online. The card also acts as a sort of Estonian ID as well.

To acquire an e-residency it is relatively cheap and quick; it only took me about 3 months to receive it. Once the application and payment was sent online, I was notified by the Estonian Embassy in my home country to visit them, and pick up the card. For more info on the e-residency check see here. http://e-resident.gov.ee/

Until today, opening a bank account remotely was not possible in Estonia. It required one or two visits to an bank in Estonia.

However, today marks the first day where someone with an e-residency can open a IBAN business bank account and corporation without ever having to step foot in Estonia.

This is very useful. Why?

Let me explain.

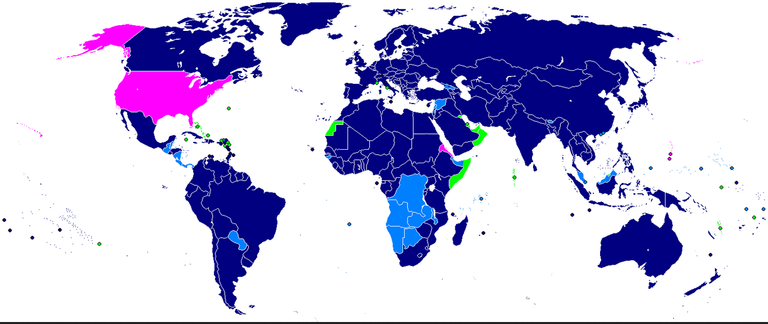

Most countries don't allow someone to open a bank account remotely due to compliance issues from global government agencies like OECD. The same organization that supposedly promotes the economic and social well being when its own employees don't pay any income tax.

Allowing entrepreneurs to open a bank account remotely, will provide us with the ability to use "Countries -As-A- Service". In other words, just how you shop around for the best software online, we can shop around for the best countries to incorporate a business.

As Global Renegade's, we can pick an choose where we want to invest, bank and do business. No longer need to be under the influence of "one" government. We GO where we are treated best. Under certain circumstances Estonia checks off a lot of the boxes. Here's why:

Estonian Business Taxes

There is NO income tax. Only on the distributions, if any, at a rate of 20%.

This makes it particularly interesting for a holding companies where dividends are flowed through the active business into the holding company, and if the holding company does not distribute to shareholder and only invests in projects, the holding company will never pay any income tax.

For startups were the founders want to re-invest their profits back into the business without paying any income tax.

A retirement strategy where distributions are only realized later in life.

For online entrepreneurs who are digital nomads or for people that are resident in territorial tax based countries. (More on this below)

What Else to Know About Doing Business in Estonia?

Estonia is part of the EEA, which means you can take advantage of great payment processing rates. Estonia also has great banks that are far more liquid than most banks around the world! A low cost high skill tech community (not very plentiful though). low bureaucracy. And a tie breaker clause in the tax treaty with several countries, making the company tax resident for sure in Estonia rather than Canada, for instance.

What the heck? tie breaker?

Yes! If you live in a country where your taxed on your world-wide income then being a resident of that country and starting a online business in Estonia with no employees is pointless for tax purposes. As your business will most likely be considered a business in your home country. There are certain regulations and criteria your Estonian business needs to follow in order to have it as a legitimate business operation in Estonia for the eyes of regulators in your home country. Typically, what I have seen is that you need a minimum of 4 employees in that country and have most of your clients located in a jurisdiction outside your home country. If you have an online business this can be done much simply.

However, if you are resident of a country with a territory tax system, where the country only taxes you on your local income this tie-breaker may be very interesting. Also if your a digital nomad who only spends a few weeks in one country, allowing you to be a non-resident in no particular country. (Could be done in theory, but becoming harder to do!).

Your much better off having a base and incorporate a business in a location that is not currently black listed (i.e. Panama is not seen with high regard). Estonia on the other hand is fully compliant and white listed. If your income is generated exclusively from crypto then this entirely different situation and could very well be the future for a lot of people. Then if this is case you wont really need a business bank, but until then Estonia is a great option.

Let's face it, governments use our money to spend on wars, brainwash our children in public schools and use on countless useless social programs. Keeping more of your money makes sense no matter what. This Estonian e-residency is a step in the right direction, especially for online entrepreneurs.

It's time we make a difference and stop supporting corrupt governments and instead promote governments around the world that taking steps to make life easier and fruitful for us and not the establishment!

i've had my e-residency card for a while now, i have yet to use it to it's full potential but i wanted to get in early before it went up to 100 euros so i got it at the 50 euro level. i'm keen to setup a business there for sure, i just don't have the funds to make the leap just yet! working on it!

Well Estonia is a pretty cheap place to incorporate a business! Good luck.