There are some cryptocurrencies on the market today that are genuine and worth investing in while some are just outright frauds. All investors should come to this realization and hard fact. The main reason for this situation is the lack of a regulatory body that oversees production. Therefore, the amount that is issued is unregulated. In addition, cryptocurrencies are not valued based on materials like gold.

In fact, any kind of fraudulent transaction that is performed via conventional electronic money is only applicable to cryptocurrencies. Furthermore, most investors are paying less attention to the fine print due to the fast growth of major cryptocurrencies such as Ethereum, Bitcoin etc. The truth of the matter is that most individuals associate cryptocurrency with handsome profits. They do not care to find out the answers to fundamental questions like the identity of the currency, who created it and why was it created.

It has become increasingly challenging to set apart genuine projects from a fraudulent ICO. This is why investors are advised to keenly observe potential projects and diligently follow some simple rules that pertain to financial security.

It is prudent to begin by analyzing the white paper as it is undoubtedly the most vital document of an ICO as well as the product presentation that the authors suggest. Carefully analyze the facts and if a project’s geography is some distance away from where you are then it is not advisable to make such an investment.

Popular indicators of a potential ICO fraud*

It should be noted that the likelihood of a loss in the seemingly lucrative cryptocurrency business is much higher compared to a profit. This is why investors are urged to take their time in analyzing available information prior to taking the investment plunge.

The following are ten possible signs of an ICO fraud:

1/ Substandard white paper

White papers can be described as documents whose function is to describe an ICO. It justifies the need for a blockchain as well as a new cryptocurrency. A proper white paper should explain its purpose in a convincing manner. Other items that it should properly address are as follows:

•The necessity of making a new token.

•The technique it will employ in influencing consumers to utilize the new service, product, application or network.

•How the new service, product, application or network shall be implemented.

A white paper that fails to explain all of the above is not worth investing in as its reliability is questionable.

2/ Unknown team

Investors should be able to assess the employees of a company they intend to put their resources in. It is important for investors to have knowledge of the achievements, background, and skills of the employees. Their professions should be clear. Check their social media profiles to gather data on their past as well as their history with cryptocurrency. If the team has a wealth of experience in crypto, there is a huge possibility that they might have something fresh to offer. A team that lacks online data is not a good one and this should not be ignored.

3/ Promise of large and instant income

Readers should be aware of red flags such as huge discounts or big profits. These are major indicators of falsified projects that should not be invested in. It is common knowledge that it is impossible to predict fluctuations of cryptocurrency as erratically rises and falls. This is why it is suspicious for some ICOs to claim that they can earn you good money almost immediately. They have bad intentions of luring you in before they disappear with your hard-earned money.

4/ Non-existent community channels

An ICO that is reliable always invests in a website that shows the primary concepts that governs its operations. It should also have communication channels for individuals that follow the project e.g. Twitter accounts, chat rooms, email addresses. A good team is one that frequently updates its data so that their followers are abreast with projects developments and latest news. For organizers who allocate some funds to facilitate further development (on the basis of an established network), educational tasks and appropriate resources should be availed to developers. It is important for investors to determine how good these are and the ideal way is by contacting developers that can give an estimate of the ICO.

5/ Unavailable project results

It is essential for investors to know if a project is progressing or if the product has a working prototype/ POC/MVP. An ideal way by which a project can be tracked is by using GitHub that allows collaboration with the community and indicates the working code. A reliable ICO is one with a comprehensive roadmap of both past achievements and future goals. It gives investors a better understanding of how the team intends to implement its promises.

6/ No scheme to allocate tokens

A good ICO should indicate the money required to make the new application or product and also disclose tokens that the team will receive. Ideally, a project should receive some money as it grows in tandem with the company i.e. s certain work stages are completed. A team that receives significant funds prior to actual financing is never a good sign. What motivates a team to put in work is the timespan existing between progress of the project and coin issue. They should never be permitted to just cash in on a successful ICO. Important issues o confirm are:

•Whether the ICO has a limit or not (quantity of collected funds)

•The number of tokens being issued.

•The company’s plans with regard to further emissions.

Keep in mind that projects that ask you to bring a friend for payment are frauds.

7/ No uniqueness

A white paper might provide persuasive arguments that promote the creation of a new cryptocurrency and clearly give details of how it is going to be implemented. However, it fails to mention the existing alternatives. This is why investors should analyze the preciseness of all statements presented by the white paper. They should be keen on uniqueness/a new approach so that it is compared with coins that are in existence. The ideal way to predict a prospective ICO’s future is to compare the new offer to available ones. Therefore, a project should clearly show how different it is at providing a solution through persuasive arguments.

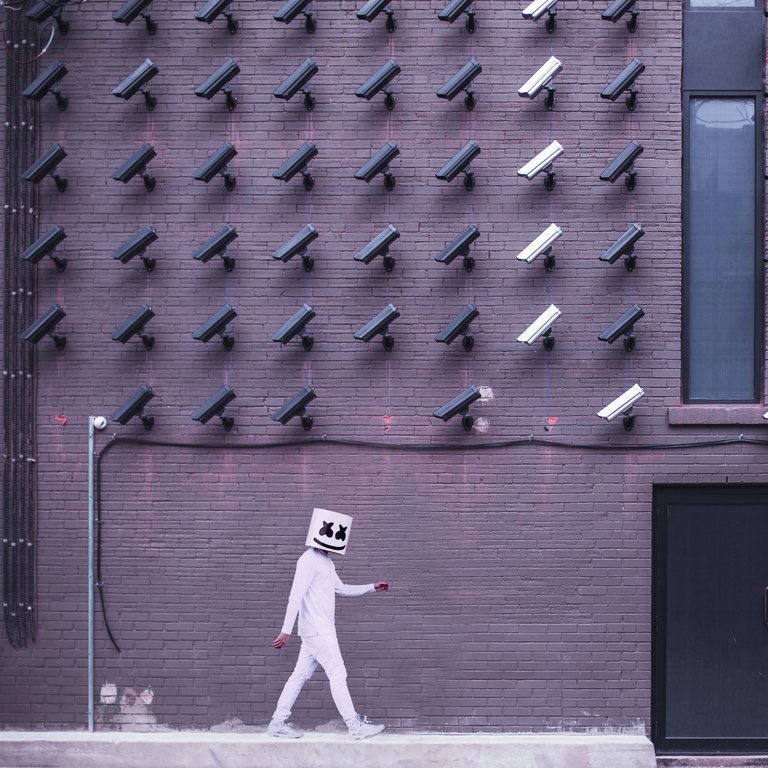

8/ Big marketing campaign and Multi-level marketing

pexels

Projects, whereby many tokens are used for marketing, are never good. Analyze every document and be extra keen on parts that have the acronym MLM. Multi-level marketing is a popular scheme known for its fraudulent ways. These companies create pyramids and place themselves at the apex. Easy incomings attract new participants, usually, this is in form or referral bonuses. All that is required of them is a small deposit in form of cryptocurrency. Participants get income that is from other people’s initial deposits. Look out for MLM structures such as OneCoin.

9/ Lack of investor rights

White papers that lack information on both reimbursement opportunities and investor protection are suspicious. Many ICO projects appeal mainly through their names as well as those of prominent celebrities. A good project should have many contacts as well as legal information. This information should be easy to comprehend and the description should be detailed.

10/ Missing registry

The main purpose of ICOs is to earn profits for authors and investors hence its popularity. However, most people never think of the timely registration of an ICO because they exploit laxity in the implementation of this regulation in numerous countries. Success of a project is dependent on the country of choice, Great Britain, Australia and USA are good.

Conclusion

People who have decided to invest in ICOs should do so carefully, this is because there are many unskilled scammers who take advantage of investors via cheap developments and cheating words. In addition, know how to identify fraudulent schemes that are very sophisticated. Who knows, you might just invest in a new cryptocurrency that is good for both yourself and humanity as a whole.

Buy and sell cryptocurrency on Binance

Previous posts that may be of interest to you:

When you bought or invest in crypto !

Faster, Lighter, Highly Scalable and Unique !? this is IOTA !

This is Eos! And this is some reasons that can let us to Invest In!

From App Store to DApps Store !

Ripple’s plan for XRP was always to have a cryptocurrency that would be safe, useful and fast for institutional transfers !

Why EOS is going to be the TRUMP TOWER !

To support me!

Delegate steem power or donate steem to @simobnr

Donate other cryptos to :

IOTA: UKLNL9KXJKIIKPGDYS9AUGUKDOKPNAZ9THYSXAKFYEVURGO9CQI9XGPMPHUBOTXDDGGEWHQG9LYSIBIFWKXBITNNGB

Ethereum: 0x63a65a8f8e850e58d941afe55df4c213295befcd

Bitcoin: 1EVbgEB2hRYoJjWckzDSXNHtAmQEPdRnHC

Litecoin: LXM1o2mvUmSMCS1a9z8X91JGGZ4os1crps

All the best!

simo

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Please conduct your own thorough research before investing in any cryptocurrency.

Well done post.

A better topic for it is "How to spot a Cryptocurrencies ico's fraud !?" or "Signs of a Cryptocurrencies ico's fraud"

You got a 33.26% upvote from @luckyvotes courtesy of @fersher!

You got a 57.14% upvote from @sleeplesswhale courtesy of @fersher!

I wish I sold back in December.

I wish I sold back in December.

I just wish people would do more research before investing more than they're comfortable losing. Then we wouldn't have these massive price swings. Instability can be great for trading though.

You got a 21.30% upvote from @postpromoter courtesy of @simobnr!

Want to promote your posts too? Check out the Steem Bot Tracker websitevote for @yabapmatt for witness! for more info. If you would like to support the development of @postpromoter and the bot tracker please

Good for you for helping spread ico fraud awareness.

yes quite true about ICOs, you never know, but its too bad as many are true sincere projects

La investigación previa es muy muy importante, sobre todo si se trata de algo nuevo o poco conocido.

90% of the ico's coming are scams only 10% are trusted

Thanks! I didn't think blockchains could be scams in an way by how they run, this was very easy to read and understand!

I will definitely come back to the article as someone who instinctively invests and buys things.

I think every beginner should read your post before he takes part in an ICO. Your point with the unknown team is especially important, as you can not investigate if the people behind the ICO will scam you or not. Knowing the team makes the ICO trustful - at least a bit.

You got a 15.49% upvote from @upme thanks to @simobnr! Send at least 3 SBD or 3 STEEM to get upvote for next round. Delegate STEEM POWER and start earning 100% daily payouts ( no commission ).

Correct. Most of the ICO’s are scam. The main reason Facebook banned crypto related ads in general is because of these ICO’s offering 200% return and high bonuses. Enough is enough, most of the people scammed are people who couldn’t afford to lose that money but got fooled.

Very nice bro

It's better check the team first and their credibility before engaging to any ICO. We know how filthy it can get because the percentage of fraud is much larger then those o legit. I hope this could change though in the future that all ICO's can be successful.