Crop insurance is purchased by agricultural producers, including farmers, ranchers, and others to protect themselves against the losses.

The losses may be two kinds. They are:

- Damage of crops due to natural disasters. (Drought, Floods, Hail)

- The loss of revenue due to declines in the prices.

According to losses there are two general categories of crop insurance are:

- Crop Yield Insurance.

- Crop Revenue Insurance.

Basic Requirement that all farmers should adopt crop insurance:

- To stabilize farm income.

- To provide farmers financial support and insurance coverage during natural calamities, diseases and pests.

- To encourage farmers to implement progressive farming practices with better technology.

- To help farmers maintain flow of agricultural credit.

- To boost up agriculture.

What’s not under Crop Insurance?

Over the years, the list of things that are covered in crop insurance has evolved to benefit farmers. Depending on what policies that the farmer opts for, both the personal and property need of the farmer may be covered. Following is a list of what’s covered and what’s not under such policies:

- Loss or damage to the property of the insured farmer.

- Damage or loss caused due to fire or natural (including storm, flood, tornado, earthquake, cyclone etc.)

- Coverage for personal accident. This includes the insured farmer and the farmer’s family members.)

- Cover for loss of pump set.

- Cover for damage/loss of tractor.

- Cover for damage/loss caused by power failure.

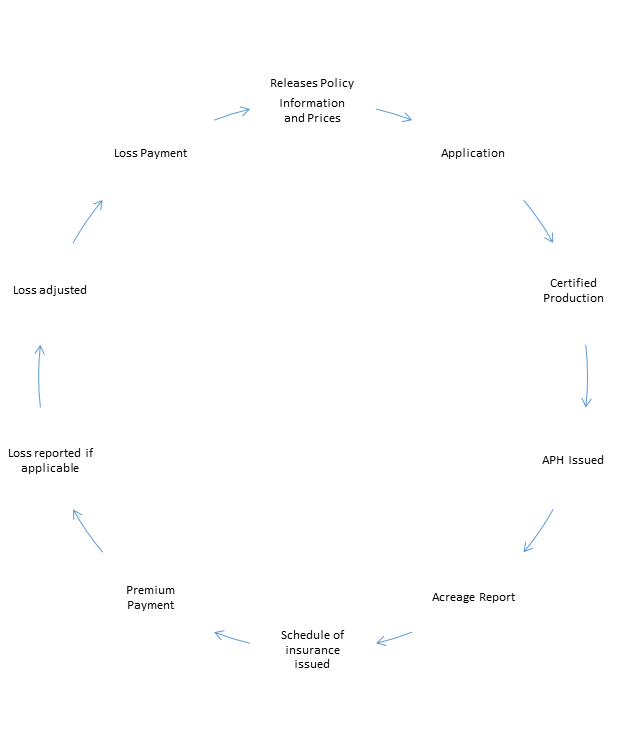

The crop insurance cycle:

Wow

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.bankbazaar.com/miscellaneous-insurance/crop-insurance.html