All cryptocurrencies are incredibly volatile, that is just a fact, however with the addition of POS one can minimize the volatility factor. Power consumption by the crypto community is a significant concern with not only private environmental groups but world governments as well. A 100% POS approach delegitimizes the core concept of decentralization. Hybrid coins (POW/POS) offer a compromise.

What Is A Hybrid

Hybrid coins such as Litecoin Plus (LCP), Peercoin (PPC), DigitalCash (DASH), and various other offerings present an alternative to strictly POW (Proof of Work) or POS (Proof of Stake) alone. Although POS coins may be considerably more environmentally friendly (reduced power consumption) they trade this benefit with the sacrifice of a decentralized system. POW/POS, on the other hand, offers a reasonable compromise.

Although this article is focused primarily toward Litecoin Plus (LCP), nonetheless it is the fundamental POW/POS structure that I am highlighting and my reasoning behind why the hybrid is arguably one of the best bets going at this time.

As mentioned in the talking points, something that requires minimal effort to make a case, the fact is that nearly every aspect of cryptocurrency is highly volatile. Those of us that choose to invest in the sector with high hopes of future financial gain, and the eventual long-term adoption of cryptocurrencies, fully understand this fact. My intent here is not to convince you that POW/POS coins can eliminate the volatility. It does, however, have the potential to help mitigate the volatility.

Looking For Stability Among Instability

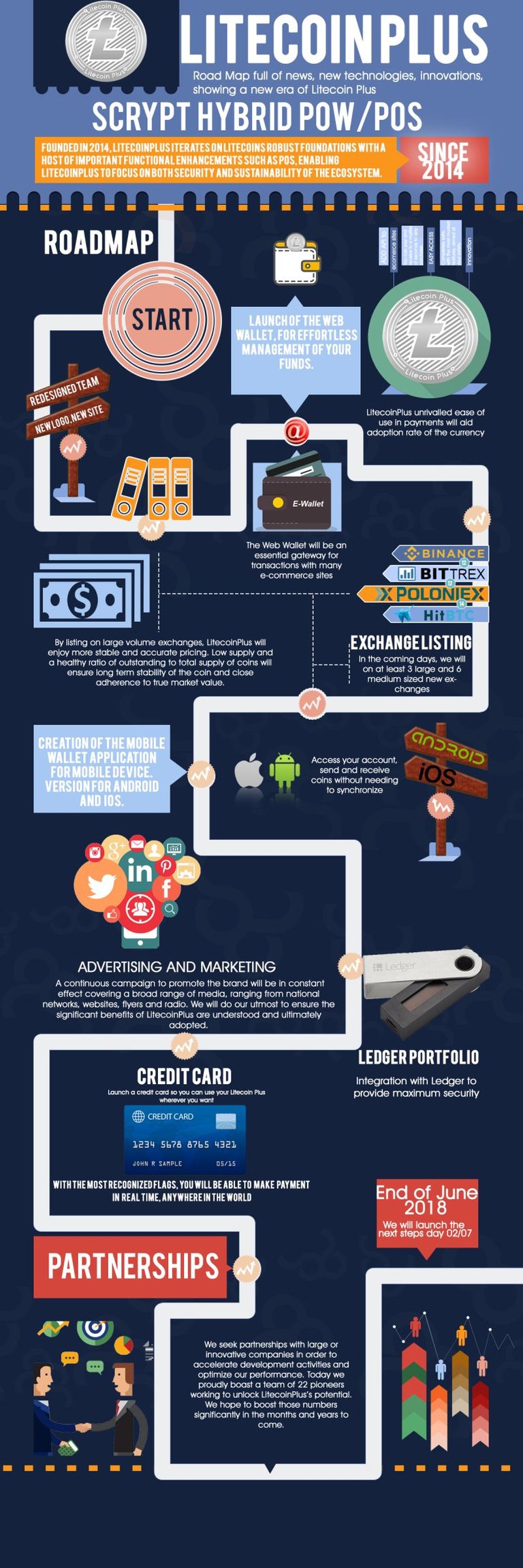

As noted earlier, this writing is intended to focus on one particular example coin, Litecoin Plus (LCP). I am attempting to draw attention to that coin for the following reasons:

1. A very reasonable rate of return. 15% APR on a stake.

2. Very dedicated and mature development team (67 commits in the past month alone).

3. Low final supply of coins @ 4 million total.

4. Designed to be an asset class (commodity) coin rather than one for daily commerce, focusing more on growth potential.

5. Relatively an unknown coin that was created initially as a POS coin.

6. Fast transfer times.

7. Very active mining presence meaning that the network does not freeze and blocks keep being solved to move things along.

I could list a few other reasons, but for now, that is more than enough. The POS aspect should probably be talked about first and foremost. There are daily questions in the Litecoin Plus Discord channel from those that have never had experience with either a hybrid coin or even a POS only coin, so possibly this can enlighten some that would otherwise have to search out this information.

It primarily works like this; You store your coins in your wallet on your home computer with the wallet online for staking to take place. While the wallet is online, it is working in the background (with minimal resources used) and as your coin balance matures it eventually is put up as a 'stake' which is assigned a given weight based on the size and age. This weight is compared to other staked coins and weights on the network at any given time, and eventually, you have generated coins from those staked. With the wallet online continuously your stake is more significant as well as your rewards.

Eventually, the coins used in the stake have to be refreshed and combined with the other coins in your wallets balance. At this time the procedure is completed by a semi-automated process called 'dusting.' Eventually, the process incorporates the option of fully automated dusting for those that wish to 'set and forget,' however regardless of which way you choose to manage your coin balance; the wallet must remain online and connected to the network for staking to take place.

Some online wallets offer to stake yet, for the most part, if a coin is in an online (web-based) wallet or exchange then you do not receive the staking rewards. It is therefore in your best interest to be the banker, which coincidentally happens to be one of the primary driving forces behind decentralization and the rise of cryptocurrency in the first place.

Development Team

Extremely active on the supporting Discord channel for Litecoin Plus you find the developers. They are always willing to help out on even with the minuscule problems (subjective of course) one might be having and display a significant amount of patience in the process.

Although new milestones, developments, partnerships, and other very positive releases are on the horizon, they tend to keep those details under wraps (and for a good reason). They do not hesitate, however, in announcing and ensuring that all are aware of new wallet versions and mandatory upgrades of which is crucial for network uniformity and accuracy.

General Specifications

Hashing Algorithm: Scrypt

Block Time: 30 seconds

PoW Reward: 1.75 LCP

PoS Reward: 15% LCP

Difficulty Retarget: 1 block

Current Supply: 1,509,916 LCP

Total Supply: 4,000,000 LCP

Approximate Time To Total Supply: 10 years

Total Coins Produced While POS Only Coin: 221,400

Get Them While The Getting Is Good

As it relates to mining LCP, right now is a somewhat pivotal time to be directing whatever spare scrypt hash power you can at the coin since it will soon (relative once again) be reducing in reward from 1.75 LCP to 1.25 LCP per block solved. As I write this the block count is at roughly 1,550,000 block height. At the 2,000,001 block-height level the reward reduces .5 LCP and then every 200,00 blocks after that, it will once again reduce by .5 LCP until reaching .5 LCP and staying at that level for the remainder of the 4,000,000 total blocks.

With a 30 second block time on a coin, you are only looking at less than 6 months before the block reduction. When it then reduces every 200,00 blocks we are only talking about roughly 70 days between reductions. To put that into perspective; If you owned only one L3+ ASIC miner and had it running at approximately 550 Mhs – it would net you around 2,083 LCP before the first block reduction, with difficulty maintaining close proximation to what it is today.

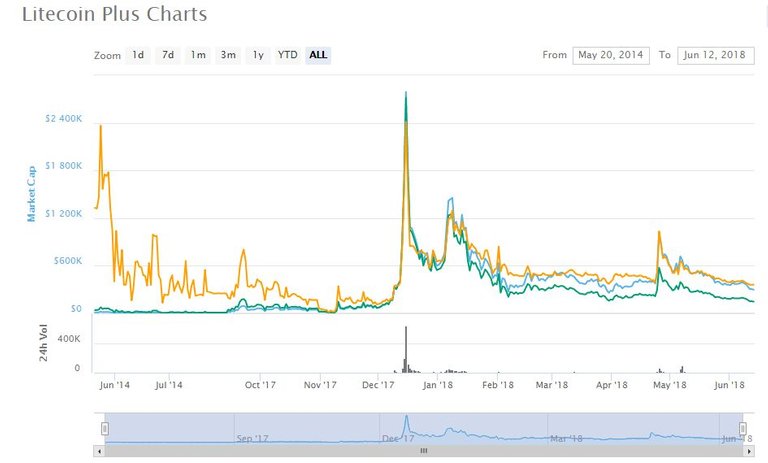

Now, none of this means anything if the price reduces to $0.01 per coin. However, one might want to consider a few things about the price of LCP in the recent past. One of which is the ATH (an all-time high) around $6.88 / LCP on December 14th of 2017 (yes it peaked for a brief moment at nearly $10.00). Massive profit-taking hit it pretty hard, and many holders made some money.

Even after the sell-off from weaker hands it landed on its feet at around $0.70 to $0.90 / LCP and fluctuated back and forth until another run in January to $1.80 / LCP where once again another yet smaller sell-off occurred and left the coin trading around $0.30 to $0.35 /LCP until February where the coin once again jumped back up to nearly $0.55 / LCP. It jumped again in April to nearly $0.72 / LCP and then realized one more jump up to about $0.55 / LCP in late May.

Currently, the price has been slowly declining but somehow maintaining its head above water at about the $0.25 / LCP level before this latest bear market that has affected nearly every currency listed with some coins falling as much as 13% to 23%. LCP is resting at $0.19 / LCP as I write this.

Why I mentioned that one might want to consider the price movement is simple. LCP was able to maintain some pretty good numbers even after experiencing all the sell-offs, and being predominately on a low volume trading exchange, Cryptopia. The news about the Cryptopia listing did occur in November to mid December time frame, and that may have very well been the stimuli to spike the price to that one ATH, however it is worth noting that it wasn't like some other coins that peaked to their ATH (yet not even nearly as significant a jump as LCP) based solely on the incoherent ramblings of John McAfee. Moreover, while it peaked very high, it has not yet found a niche at $0.03 / coin like others that espouse such technologically more magnificent coins, have a vast media presence, and a community that is willing to sacrifice they're first born to the all might altar of the developer.

Conclusion

It is impossible for me to know what might happen with Litecoin Plus (LCP) in the near or distant future. No one can know for sure. But if experience tells us anything it is this; A coin that offers a great long term investment potential, with little to no media coverage or advertising campaign, can chug right on along at above $0.10 / coin mark for any length of time while other coins that have invested thousands upon thousands of community donations that are claimed by them (and without disagreement by this writer) to be far more advanced than your typical 'alt coin', yet continues to remain below $0.03 / coin, more often than not, in my opinion speaks volumes about the maturity of the development team associated with LCP and the lack therof of the aformentioned.

I have made up my mind to continue mining Litecoin Plus (LCP) and reap the more significant rewards before the 500k block. I acknowledge that the price is going to do what it will. I expect in the coming months for a very well known exchange to list the coin, which has a much higher volume and could again spike the price.

I won't be selling this coin of which only 4,000,000 total coins are to be mined and instead continue to produce a dividend, year after year, by holding. The roadmap looks good. The team delivers on schedule for the most part. Moreover, I love to hear that repetitive 'cha=ching' every time I receive a deposit from my miners' work or from the stake the wallet produces.

Who knows, maybe you have time to look at a relatively unknown coin and come away with the same impression that I got.

*, Of course, I hold a position in LCP and as stated I intend to keep a position.

Please give me a follow and I will give you a follow in return!

Please also take a moment to read this post regarding bad behavior on Steemit.✅ @bittergreens, I gave you an upvote on your first post!