LTC is one of the more stable cryptocurrencies.

Flies somewhat under the radar as it is the little brother to Bitcoin. BTC gets most of the press attention and has much higher volatility due to all the attached drama. BTC has too many fork attempts and lack of consensus on best approach to evolve and enhance BTC capabilities.

As per my previous post from September 2017, there are many benefits of LTC compared to BTC.

The benefits include less drama in the innovation process, much faster transaction time, much lower transaction costs, and faster to market with necessary evolution and enhancements such as SegWit, Lightning network support and atomic swaps. And you can talk to and interact with Charlie Lee as the technical leader of Litecoin, which isn't possible with BTC. Satoshi still not identified.

In the previous post I did simple line fitting using the "tried and true" line it up by eye. Very scientific !! LOL

Let's get serious and go to the next level, with formal least squares linear regression.

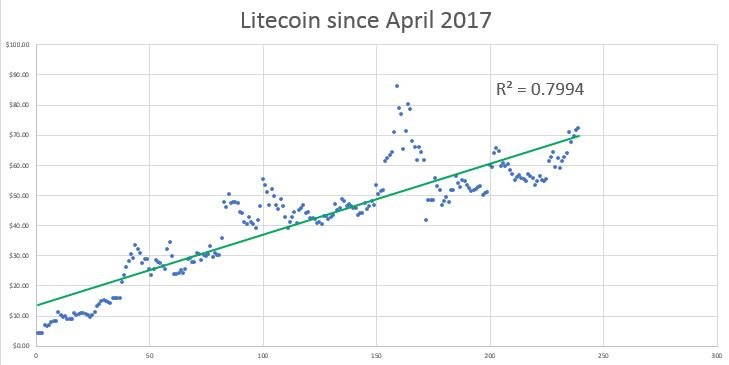

Chart below shows LTC price since April 2017, with linear regression for the trend line.

R^2 value means 80% of the variance is explained. Or, after conversion, 55% of the standard deviation is explained. Simple math, therefore 45% of the standard deviation remains unexplained by the current trend line.

Implication is the slow increase of price is 55% explained by nothing more than the passage of time. Every day LTC gets a little bit more valuable, as the trend is slightly positive on a daily basis on average.

45% of the trend line is explained by exogenous events, that are not modeled in the trend line. 45% of the trend line is positive news about LTC in terms of technical innovations coming on line, more merchants accepting LTC for payment, atomic swaps making BTC/LTC interchangeable at no cost to enable LTC for micropayments, and positive news about the crypto market in general.

LTC price has increased $60 in the most recent eight months in 2017. Extrapolating, with all the inherent dangers of that modeling approach, I am predicting using the trend line that LTC price will increase another $60 in the next eight months.

LTC price will be $130 by August 2018.

A more aggressive view than my previous post, which had LTC price at $80 by Q1'18.

For my money, the most certain place to get a >85% increase in the next eight months is LTC. From $70, adding $60 to get to $130, is approximately an 85% increase.

$70 to $130 in the next eight months is better than you will get from Apple stock, FB stock, Google stock, or Amazon stock.

Go Charlie Lee!

Go Litecoin!!

Go Lightning Network !!!

Go Atomic Swaps!!!!

Go LTC!!!!!

Upvotes, resteems, and insightful comments always welcomed.

No whining that my forecast is too conservative if you are just a fanboy without any evidence to explain your more optimistic guess.

DaveB

Love me some LTC. I just ordered some miners and I'm looking forward to seeing LTC run all the way to 300! It's going to be a slow climb to the top but slow and steady always wins the race.

Resteemed, Upvoted, Followed MUCH LOVE (>")>

You have changed my opinion of LTC after reading this. Thank you for your insight.

YIKES. I have slowly back away from my previous Awe of LTC. It has many good qualities. But in the end is still just a copy of BTC with a few enhancements.

I think LTC will do well, but will never make it to the top of the heap.

Long term, 2 years out, consider ADA or EOS or ETH as more probable top of heap coins

Haha, could be... definitely see ETH up there--maybe surpassing BTC, just bc it seems to have so many more applications!! While BTC still seems to want to stay under the radar, so to speak (which is understandable, of course..) They are just two seemingly very different projects. BTC is more "currency" while ETH is more.. all kinds of stuff. I am not too fmailiar with ADA, I just read about the Daedelus... very cool... a Dapp wallet; Haven't seen that yet. logs into Binance

simple linear regression analysis...isn't .

math is hard.

I just put raw data into Excel, XY Scatterplot, and trendline using simple linear regression.

Five minutes at most.

good luck

Whatever the math is, if Bitcoin keeps on rising, grand old altcoins will continue to fly as well in 2018. Money sucking magnets.

Simple summary. Probably true.

Hi Dave,

A novel idea indeed with the usage of Linear regression for a Price Forecast. I 've seen that being used in research papers more often and never in real world use cases, probably because of the many flaws in forecasting.

For example, residuals and its corresponding plot could give us an idea of the fit better. R squared still suffers from the problems of spurious regression. An F test could help better in explaining the vailidity of the coefficients.

All in all, a very commendable effort! Good to read novel ideas and thoughts! Keep up the great work!

...this formula doesn't make any sense at all.

The scatterplot and trendline is directly out of Excel. So call Bill Gates if that is the equation causing you concern.

Following link tells you how to analyze and think about results.

https://people.duke.edu/~rnau/rsquared.htm

I'll accept more comments after you research some of the additional material referenced above

If you take a look at the max supply of 84,000,000 LTC there have to be and will be an exponential price development if the network grows in the same way. If you like to get a real trendline, you have to check the price with candle sticks and the average true range of define periods. Cheers

You list yourself as an engineer, but your analysis is BS. The trend fit line is based on "linear trend fit". There is no exponential component to the trend fit I did.

You could choose to do an exponential fit if you want, but that is not what you see in the analysis above.

I intentionally did not choose an exponential fit, since an exponentially increasing curve is not sustainable. I think the increase in price of LTC is sustainable, and it NOT increasing in exponential way.

R^2 is much lower when you try to fit exponentially. For the LTC data series.

The "real trend line" that you see on the chart is directly from Excel.

I don't believe you passed the engineering stats class. I frankly doubt you are an engineer based on your comment about "there will have to be an exponential price development".

That was exactly the point my post was proving is NOT needed.

Have a nice evening, cheers for Germany.

PS: by the way germany is full of engineers :)I will provide you one of my diploma. You can choose one either TU Vienna or TU Munich. Doesn't matter to me. But you forgot the phase if the network grows in the same way. That the reason why all crypthocurrencies moving upward if the supply is limited. That the same with the development of the microprocessor transistor, fell free to read https://en.wikipedia.org/wiki/Moore%27s_law

Moore's law applies to transistors on an IC doubling approximately every two years.

That has literally nothing to do with the price of crypto's.

A very interesting analysis and one I think would hold true except for the first part of your article. LTC is the little brother of BTC yet holds many advantages over the better know blockchain. Being a huge Charlie Lee fan, none of what you mention is a surprise. However, as little known as bitcoin is to the general public, litecoin is not even a work=d 99% of the people know. It flew under the radar completely.

LTC has been on a linear projection since April...that part is correct. However there was a huge jump in price shortly before that. We witnessed LTC go from $4 to start year to $90 at the July/August peak.

Using a price of $70, if your $130 is correct, that is an 85% return in the next 10 months...hardly something that anyone can argue with. That said, I believe your projections are too low. Do I have statistical analysis to back up what I am saying like you presented? No. However, I do have the knowledge that Wall Street is on its way and 2018 should see the entrance of a ton of cash from that cow. Therefore, while I still believe that BTC will get the lion's share of that money since it is the known coin (meaning it is an easier sell for brokers to their clients), I feel that many alt coins will get a lot of the spillover. LTC will be one at the top of that list.

The entire space is about to be lifted a great deal. I believe the crypto market cap by this time next year will be over $1T (actually I feel there is a good chance that BTC is worth more than $1T by the end of 2018 on its own) which gives a radical jump to the prices of most any legit coin. LTC will experience another exponential jump which will exceed your projections.

Thanks for the analysis. Having a high statistical chance of an 85% return in 10 months is not a bad thing.....even if that is the floor.

All good comments. Thanks for reading and time to reply.

The big wildcard in my opinion will be whether BTC can get transaction time and cost resolved in the next year? If not, then atomic swaps could end up making LTC much more relevant than today.

LTC could be used for all small daily transactions, with atomic swaps as a free exchange from BTC. BTC is the store of value, LTC is for daily spending.

Using other terms, LTC is fast money and BTC is slow money.

That could cause a big lift off for LTC price. This would take LTC price far higher than $130.

I agree with your conclusion completely.

Having a good chance of 85% return with LTC in eight months is close to once in a lifetime investment opportunity.

I find the entire scaling debate to be non relevant and, at this point, misdirection. It is also why I literally laugh at the BCH propaganda.

Wall Street does not care about block size or transmission speed. It cares about liquidity and ROI. The only one who really can offer that is BTC. For all their ills, there is one thing Wall Street can do and that is raise money.....lots of it. The technology side drove the show, we are about to see what happens when finance takes over.

As for your points specifically, you are right on. From a technical standpoint, I think LTC ends up right where Lee wanted it...as the faster more flexible chain to compliment BTC. In the end, as it stands now, neither can compete with the centralized system of Visa in terms of transactions per second. Even ETH, which gets a lot of attention is at 25 and might get up to 2500....Visa does what, hundreds of thousands. Now that isnt to say it wont be figured out...there area lot of smart people involved in this.

Slow money, fast money...great terminology. In the end, you are probably going to be correct. BTC will be used to buy boats, cars, and to have public documents (you will see smart contracts there at some point) such as tax records while LTC handles some of the smaller ones. The advantage to Atomic Swaps is that, ultimately, it will occur between any blockchain...so other coins could play into it.

I am bullish on both BTC and LTC...obviously bearish on BCH...and dont even think about BTG.

ltc is definitely the most stable form of crypto currency stable growth

Congratulations @davebrewer! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP