We have entered the age of digital currency. Bitcoin has gone from relative obscurity to being a household name. In May, the coin smashed its way through the $2,000 barrier like an angry bull in a china shop.

Bitcoin’s dominating presence tends to drown out its contenders. But there are actually quite a few digital currencies that investors should be paying attention to.

Out of these, a handful is poised for dynamic growth. We published this report to talk about one of the most promising: Litecoin.

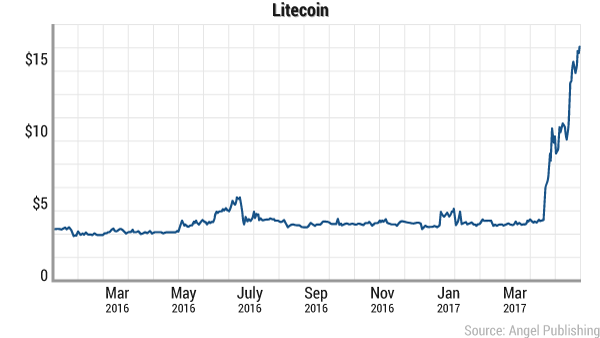

Over the past couple of months, Litecoin has skyrocketed alongside its digital currency peers.

It became the third currency investors could purchase on popular digital currency exchange, Coinbase. And now, a hyped up digital currency public has some questions.

- What is Litecoin?

- How is it better than Bitcoin?

- How do I invest?

Over the course of this report, we will answer those questions. It’s best to start at Litecoin’s humble beginnings.

What is Litecoin?

In October 2013, former Google engineer Charles Lee introduced the world to a new altcoin: Litecoin.

The coin was introduced as the “silver” to Bitcoin’s “gold,” with Lee promising the digital currency would fix many of Bitcoin’s problems.

Litecoin is currently the fifth biggest currency, with a market cap of $1,782,973,718 billion. This makes it one of Bitcoin’s most aggressive competitors. If you are evaluating the two currencies from the surface, they could be twins — sharing dozens of valuable characteristics.

Like Bitcoin, Litecoin was created to provide a peer-to-peer transaction system. It allows individuals to make payments or transactions anywhere in the world without incurring fees.

Litecoin also operates as a global currency, eliminating the need to adjust value if you are exchanging money internationally.

And, like Bitcoin, Litecoin is decentralized. There is no centralized authority, building, or headquarters. The currency flows freely on the internet.

This means it is far more secure than paper currency. And since no government can regulate it or overproduce it, Litecoin’s value rests in the hands of the people.

Like almost all digital currencies, Litecoin is produced through a process called “mining.”

Miners use computers to process Litecoin transactions, which are presented as algorithms the computers must solve.

When the computers solve the problems, more Litecoins are added to the network and the miners are rewarded with their shares.

There are a fixed amount of Litecoin in the world — the volume of Litecoin can never exceed $84 million. After we reach that point, the coin has the ability to be broken down into minute payments.

The mining process and the currency’s finite cap shield Litecoin against hyperinflation. It also allows the currency to regulate itself.

Every time a transaction is verified, the network becomes more secure.

It is clear that Bitcoin and Litecoin are similar in many ways, but they are also very different.

And it is from those differences that Litecoin gleans its value as a digital currency.

Why Litecoin is Unique

Bitcoin was the first digital currency in the world, and this has given it a leg up in the competition. But Bitcoin’s early arrival is also the source of many of its shortcomings.

Today the developers behind major digital currencies have identified Bitcoin’s weaknesses and altered their currencies to fix the issue.

This means that even though Bitcoin was the first technology to use certain technologies — specifically a groundbreaking network called blockchain — the currencies that followed may use that technology more efficiently.

The Better Blockchain

Blockchain technology is the foundation of all digital currencies. Envision it like this.

Every time a transaction or exchange happens in a digital currency network, that action is recorded in a “block.” Each of these blocks is attached to a slowly developing chain.

Anyone on the network has access to the information in the blockchain. This means that transactions are public knowledge, even if the users remain anonymous. This framework also makes digital currency very secure.

Litecoin actually uses this technology more efficiently than Bitcoin. The Litecoin blockchain generates a new block every 2.5 minutes. This is 7.5 minutes faster than Bitcoin can produce a block.

This will appeal to merchants who want a faster transaction. Of course, in the world of Bitcoin, merchants can accept a payment immediately if they forgo security. But in a digital security world that is generally unregulated, throwing caution to the wind often ends badly.

With Litecoin, you get both security and speed.

And this speed just kicked up a notch.

On May 10th, Segregated Witness (SegWit) was activated in the Litecoin blockchain. SegWit is the process in which blocks in the blockchain are made smaller by extracting signature data from transactions.

This process allows Litecoin to process lightning fast payments.

The first of these payments happened on May 11th. Money was sent from Zurich to San Francisco in under a second.

But Litecoin is valuable for more than just its speed. It also has widespread consumer appeal.

A Love of Rounded Numbers

In the world of digital currency, the number of coins that can exist is finite. There can never be more than a certain amount of Bitcoins in the world — and the same applies to Litecoins. But the total amount of coins that can exist varies by digital currency.

This actually works in Litecoin’s favor. Litecoin will publish more coins on the market than Bitcoin. This will appeal to consumers.

A study by Dr. Judith Holdershaw, a senior lecturer at Massey University, concluded that 57% of retail shoppers opt for a product with a rounded price. Even more telling, 4% of those customers paid more just to round the price. The proof is in the pudding: People like to pay with full numbers.

This can explain our aversion to pocket change and lose bills.

Because there will be less Bitcoin in circulation, it will have to be broken down into decimals. That means you will be paying .002 BTC for a cup of coffee.

Since more Litecoin’s can be on the market than Bitcoin, it is more likely that people will be able to buy commodities with whole numbers.

The Battle of Algorithms

Outside of transaction speed and volume, there is another key difference between the two currencies: their algorithms.

For those of you completely new to digital currency, digital currencies are composed of code.

In the case of Bitcoin and Litecoin, those codes use two different algorithms.

Bitcoin uses the SHA-256 hashing algorithm, Litecoin uses a scrypt hashing algorithm.

Now, both of these algorithms are powerful. But over the years, the SHA-256 has made it more complex to get Bitcoin through the mining process. Bitcoin miners have to employ increasingly complex technology to extract a relatively small amount of Bitcoins.

Litecoin’s scrypt hashing algorithm makes it easier for miners to access the system.

This could cause a couple of things. First, it could encourage more novice miners to participate in the Litecoin system. This will help with widespread Litecoin usage since many users will be miners that never got a chance to mine Bitcoin.

Second, the simplicity of Litecoin mining could actually steal Bitcoin miners. It is true that Bitcoin is worth significantly more than Litecoin, but most Bitcoin mining is carried out by supercomputers. The algorithms have become too hard for everyday miners to crack.

This means that many miners tired of struggling over Bitcoin would transition over to Litecoin.

How to Invest

It is clear that Litecoin is going to be a powerful digital currency. Of course, it’s too early in the game to speculate on who will win the digital currency race.

In fact, there could be no winner. The future financial system could operate using dozens of digital currencies. And Litecoin is likely to be one of them.

Its days of riding on Bitcoin’s coattails are nearly over. The jump is coming.

We have already started to see this in the digital currency’s dramatic jumps this past month.

This means if you intend to buy Litecoin under $50 dollars, it is time to buy.

Luckily for investors, Litecoin is a fairly easy digital currency to purchase. Its popularity and appeal earned it a position on Coinbase, which remains the top digital currency exchange for novice investors.

The simplest way to buy is to go in and create an account. Once you have set up a username and password, you can plug in your banking information.

You can buy digital currency on Coinbase with a credit card, a bank account, or PayPal. This gives you complete freedom when it comes to purchasing the currency.

We wish you the best of luck in your investments.

Great read! I just upvoted you. Please do the same and follow.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.wealthdaily.com/resources/3-reasons-to-buy-litecoin/93

The rounding factor is kind of silly to bring up in a post about how LTC will explode in value. Because if it explodes in value like BTC then you will have to use fractions of LTC the same way. Even with more coins in circulation. Just an observation.

Good points in this blog. I was about to start a similair discussion. Buy low, sell high, it seems so simple but most investors still don't seem to get it :-) I found this great website: https://www.coincheckup.com This site is really helpful in my coin research. I don't know any other sites with so much indepth analysis. Go to: https://www.coincheckup.com/coins/Litecoin#analysis To see the: Litecoin Indepth analysis