Introduction

Bitcoin ($BTC) certainly is the GodFather of all cryptocurrencies and it has the first-to-market advantage that is undeniably very strong with the masses.

Certainly, when you flick on Bloomberg or CNBC, the first thing you will hear covered on the news would be the multiple ATHs that $BTC is hitting and how epic the price has been skyrocketing causing people to have Fear of Missing Out (FOMO). $BTC is everywhere and it is most probably the first and primary cryptocurrency that a new crypto investor would place his money in.

$BTC is definitely one of my TOP picks for 2018 moving forward.

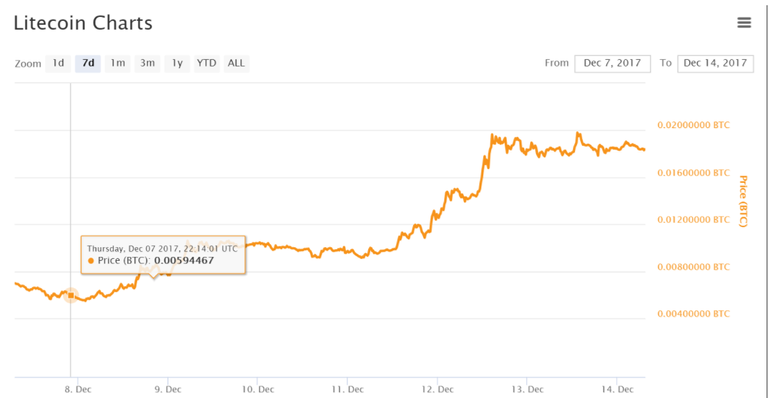

Litecoin ($LTC) has recently surprised the market with its (almost) 4x value increase against the $BTC. This is been an increase that has been a long time coming for the crypto community and I strongly believe that $LTC will continue to outperform $BTC in 2018.

These are my reasons behind my strong beliefs.

1. Litecoin is Much Faster than Bitcoin

$LTC Blockchain has a maximum capacity of 56 transactions per second (tps) with other major players like $BTC having 7 tps and $ETH 15 tps.

Compared to $BTC's Block time, $LTC generates network blocks 4 times as fast on the network, taking an average of 2.5 minutes for this process to complete as compared to the average of 10 mins block time on the $BTC blockchain.

This means $LTC blockchain not only is able to handle more transactions but it also takes faster to confirm on the blockchain as well! Let's not even start to go down to talk about cost of transactions where $BTC costs have been skyrocketing and being dropped by Merchants as a form of payment.

This has been made more apparent with the recent congestions on both the $BTC (due to increasing mainstream popularly as a mode of investment) and $ETH (due to a recent spike in traffic caused by cryptokitties app) blockchain while $LTC blockchain was still able to handlepeak volume and ATH

traffic with ease.

Would you want to be faced with a congestion problem moving your $BTC from your Ledger Nano S to an exchange during a ATH price when volume typically peaks? Suddenly the store of value $BTC is not as liquid as it seems.

2. Litecoin has WAY more Upside than Bitcoin

$LTC and $BTC both have a specific coin limit and an amount awarded for discovering blocks during the mining process. The total limit for $BTC is 21 million coins, and $LTC has a limit of 84 million coins (4X as compared to $BTC). Once the cryptocurrencies reach these coin limits, no newer currency is released into the system.

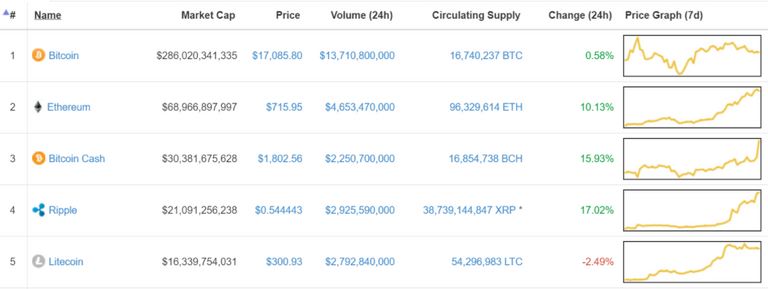

$BTC is 17 times the Market Cap size as compared to $LTC. While $BTC is "probably" and "perhaps" a "better" store of value, there is no denying that $LTC has a better market use case for payments.

With $LTC being more liquid and easier/faster/cheaper to transact, why would the value of $LTC be lesser than $BTC? It should be somewhat parity if not more. $BTC is proving increasing to be a stumbling giant that needs to improve drastically (with Lightning Networks) in order to keep up with the times.

3. Litecoin is a fantastic way to hedge against Bitcoin

$BTC, no doubt, has a larger pool of developers. Each of them having their own personal agenda and their ideals on how to bring the cryptocurrency forward.

Consensus has never been a strong word to be associated with the group of $BTC developers. An example was their long drawn out debate for scaling the $BTC blockchain which lasted for 2 long years. A consensus was never reached even with the Bitcoin Core developers "winning" the debate, the Bitcoin Cash developers faction ended up forking the $BTC network and coming out with their own coin Bitcoin Cash whom initially also didn't have the consensus on the appropriate cryptocurrency ticker ($BCH or $BCC).

Roger Ver, the most vocal proponent of $BCH seems to focus on attacking $BTC more so that distinguishing $BCH as an individual product. He's trying to position $BCH as a better coin as compared to $BTC. Why do that when $BCH can just be itself and stay true to its own principle?

Certainly, there was a time when the market was almost swayed. when $BCH price suddenly rose from $400 up to $2000 over a span of 3-4 days. This really shocked the market into believing that there was a shift in miner and user preference to use $BCH "overnight". Money was being pumped out of $BTC and funneled into buying $BCH as market panicked and $BTC value dropped 1500 USD in value. However, the "flippening" did not materialize, yet.

$BCH will still stay consistently in the shadows of $BTC and $BTC will face the consistent threat of increasing Bitcoin forks coming out that will constantly challenge it in term of market adoption.

Let's not forget here, $LTC is the FIRST fork out of $BTC. I have to applaud Charlie Lee, founder of Litecoin, on not using Bitcoin's name boost the adoption on $LTC blockchain. One of the changes was that $LTC increased the number of coins in circulation by a factor of 4 making the value lighter. $LTC was also easier to transact. Most of the code that $LTC use is still very similar to $BTC's code.

$LTC is well-positioned at #5 in terms of market cap and it has been traditionally known to be a more stable organization that compared to $BTC. The value of $LTC has also experienced a steadier and more robust growth as compared to $BTC.

Conclusion

I believe these reasons are quite clear on why I position Litecoin as a better and more fluid investment as compared to Bitcoin. This should continue in 2018 until Bitcoin implements Lightning Network where there maybe some changes. But I am a holder of these coins and look forward to these 2 major players in the future!

LTC Donations: 33Q8FsaesMkQaXxPk1ZtyxcmGn55VboX9d

BTC Donations: 3BymqCeVec5spPPZX2cWcNf4e6baDpqKhW