Most supporters of Austrian economic theory will attest that gold and silver are the best commodities upon which to establish a sound and honest monetary system. Quite simply, both metals are scarce, and both require significant investments of time and capital to extricate them from the ground. For this reason, silver and gold have prevailed for many centuries as a superior medium for preserving wealth and protecting purchasing-power. Additionally, virtually all great empires have expanded their territories and conquered others by employing silver or gold money, or by issuing currency that was tethered to a verifiable supply of it.

Although the end date of the so-called “gold standard” is debatable, it was the case until 1971 that foreign governments could exchange $35 US dollars for an ounce of gold at the US Treasury “window.” It was also the case that all dimes, quarters, half-dollars and dollars were struck in silver, of 90% purity until 1964 in the United States, and of 80% purity until 1967 in Canada. Unfortunately, most people do not remember that gold and silver was “money” during the nifty fifty's or the swinging sixties, and that it was upon a bed of precious metal that western governments restored their bankrupt and broken economies following World War 2.

Following the Nixon “shock” on August 4th, 1971, and the abandonment of US dollar convertibility to gold, the creation and distribution of virtually all money has been the exclusive domain of private banks, who create and issue credit in exchange for promises, from individuals, business owners, and governments, big and small. These promises, bonds and notes, are ledgered by the bank and recognized as an asset. The borrower in turn receives dollars (credit) and is responsible for returning both the dollars and the interest on those dollars.

These mechanics of employing credit and debt as money, and allowing the bankers to control its supply exclusively, always work for awhile as the supply expands (inflates), causing wonderful booms of prosperity. Unfortunately, these “usurious” debt-money systems always end in tears as the money supply contracts (deflates), often due to the rising interest rates and increased debt servicing costs causing bubbles to burst. Many learned statesman and Austrian economic students have warned over the dangers of debt-based money, including a former Prime Minister of Canada, who stated the following:

“Once a nation parts with the control of its currency and credit, it matters not who makes that nation's laws. Usury, once in control, will wreck any nation. Until the control of the issue of currency and credit is restored to government and recognized as its most conspicuous and sacred responsibility, all talk of the sovereignty of Parliament and of democracy is idle and futile”. “(W.L. McKenzie King, 1935)

So, it is the case today that usurious debt-money has caused the bankruptcy of all Western nations, including Canada, as the servicing of yesterdays 'rented' money requires more and more borrowing. According to Paul Hellyer (a former Canadian MP and Minister of Defense), from 1974–1975 to 2010, Canadian taxpayers have paid one trillion in interest on the federal debt to private lenders, and in 2011, alone, Canadian taxpayers paid these same private lenders an estimated $37.7 billion to service the federal debt—over $103 million each and every day of the year!

http://qualicuminstitute.ca/federal-debt/

Cryptocurrencies like Bitcoin were born out of a need for solutions to address this problem of centralized and unregulated money creation. Everyday, more and more people are identifying with blockchain technology that limits the currency's supply, and ensures that exchanges are transparent and verifiable, and that these exchanges are enabled without the need for a banker, a bureaucrat, or broker of any kind.

This article however is the subject of a new cryptocurrency project, one birthed from the desires of a like-minded community seeking a solution to the existing monetary blueprint. This new project will attempt to marry the tested and true monetary properties of silver bullion with cutting edge cryptographic technology, with a goal to restore sound silver money to the financial system.

Introducing LODE – A Plan for Cryptographic Silver!

LODE inspires us to imagine a future where physical weights and measures of pure silver are restored to the global economic system as a superior and sound form of money.

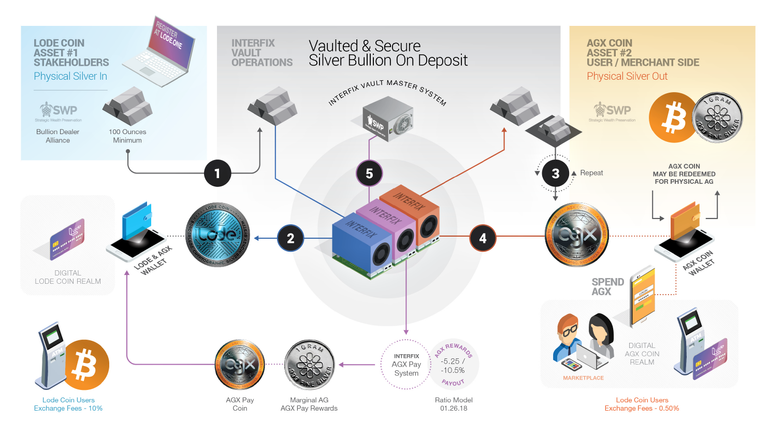

LODE is currently constructing blockchain architecture that will create and distribute two cryptographic tokens that will each represent a unique relationship to silver bullion. The two tokens, known as LODE Coin and AGX Coin, will underwrite each other by marrying the interests of silver investors with those of silver users and speculators. Somewhat like a conventional mining company, LODE Coins will represent an ownership stake in the project and a right to rewards. AGX Coins will represent a vaulted and verifiable one (1) gram weight and measure of silver bullion, and a right-of-exchange to the silver bullion at anytime, and from anywhere, via authorized dealers of silver and gold bullion products.

Both assets will be transparent and verifiable to all stakeholders at all times upon a public and secure distributed ledger and be controlled uniquely and individually by their respective owners using private encryption keys.

The LODE project is currently reserving LODE Coin positions for individuals and entities that contribute pure silver bullion to the LODE vaults. The current exchange rate is 1.85 grams per LODE Coin. Each gram of vaulted silver provides the LODE “INTERFIX” with an asset upon which to create a corresponding AGX Coin, which will be offered and sold at a prevailing retail margin. The revenues realized from AGX Coin distributions will then be utilized to acquire additional silver bullion in larger quantities, and at wholesale premiums. This additional silver bullion, now reserved, allows for further minting of more AGX coins and thus, the ability to purchase more silver, with the profits always retained for the LODE Community and its distributed ownership group of LODE coin owners.

In this model, the growing reserve of vaulted silver bullion always exceeds the number of AGX Coins outstanding. It is also the case that with each AGX Coin distribution, and subsequent wholesale purchases, the reserve of silver bullion controlled by the community will grow larger, and perhaps even large enough to cause issues for the entities distorting the 'true' silver price with paper contracts.

LODE INTERFIX ENGINE

The INTERFIX EXCHANGE is the “linking element” that synchronizes the total number of reserved physical grams of silver bullion controlled by the LODE Association (and LODE Coin owners) and the representative tokens that verify certain rights and claims against it. The INTERFIX functions in a synchronized, consistent, disciplined and transparent manner similar to the movements of a clock. The INTERFIX will only rotate as long as silver bullion is transacted from and/or to the vault. With each cycle of the INTERFIX, the reserved weight of silver bullion will grow beyond the number of AGX Coins outstanding. This marginal silver bullion will be utilized for the operational costs of the INTERFIX, and for flowing rewards (AGX Pay) to the LODE Coin holders.

This LODE Project is disruptive; it is not designed to follow a traditional financial model but rather, become its own monetary system. The goal is to restore sound money, money that can be weighed, and where the supply is verifiable and transparent, and transactions can flow around borders and bureaucrats. The LODE Project is a sound money movement made possible by the revolution of blockchain and the trust-less nature of the technology. After six months, the LODE community has grown to many thousands of contributors, and the silver reserves to many millions of grams.

I invite you to research the LODE project and consider becoming a member or contributor.

Contact the authors email below for more information.

Visit:

https://ag05.lode.one/

http://lode.live/

[email protected]

telegram@gcentral

There will be a lot of interesting!Hello! Good article! I'm interested in the them of ICO and crypto-currency, I'll subscribe to your channel. I hope you will also like my content and reviews of the most profitable bounties and ICO, subscribe to me https://steemit.com/@saiful993

Congratulations @w3s! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - Play-off for third result

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Congratulations @w3s! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!