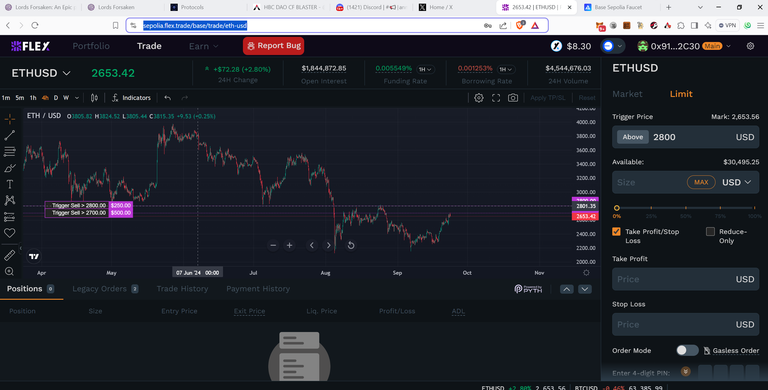

Flex Perps is launching soon with there TGE and there is currently a private sale going on which is the pre tge sale different from the seed sale that I participated in by a few things. The price per token will be higher than the seed sale but there will be no 6 month lock up like the seed sale units have. I would love if the units started out at 8 something which means I will have paid a hell of a lot less for my units than the initial price and as long as that holds and that plus the fees earned from staking and providing liquidity on aerodrome add up to more than the cost of my units ill be super happy as well as I also receive additional units via HMX staked units via a revenue share and I have yet to see what type of allocation comes out of that but it has not been officially announced just is in the sale docs as well as confirmed with both teams that the HMX stakers will get a allocation of the drop or units or profits some how via there staked units of HMX which are at all time lows. Depending on how well FDX does and the incentive plan for HMX stakers it could give the units price for HMX a nice boost and hopefully they set it up so its not a quick pump but a sustained thing where the FDX benefits are received over time incentivizing staking of HMX for longer terms in order to get FDX as well as daily fee income from the platform. There may also be a second layer zero airdrop that I have herd about for all the unclaimed tokens from the first airdrop and you must have been eligible for drop one to receive anything from drop 2 as well as i think meet other requirements which i beleive i have so i will be looking into that and hopefully claiming another allocation of zro and even 100 tokens is like 400 bucks plus so will be nice if I can finagle out another ZRO drop as well as get a good FDX allocation at that 8-9 dollar price when i paid probably a dollar a unit in the seed sale. I will not be participating in the TGE event sale as the token prices will be higher than I paid and will be getting a ample allocation from both sources but if interested check out the tge sale and it might be worth it especially if the prices are what seems to be indicted above but anything can happen so do your own research. I do not have a link for the the sale but im sure you can find it by searching flex perpetuals on google. Wish i did for the referral lol but figure people involved in these platforms could use the information. Also Radient stopped its arb extra allocations leaving the returns to be much less than they were before so I will be reevaluating my airdrop strategy where i use there platform to get kelp miles x3, eigen layer points then borrowed weth at a net of 1% or so after rewards and 3% gross swapped to eth bridged to linea to open up a gravitas vessel for the minimum amount required to do so in order to get additional lxp-l points toward that airdrop and deposited some of the borrowed grai in the stability pool on linea to get 3x gravitas points as well as lxp-l points then bridged grai to arbitrum as the goARB , oARB emissions are both live again giving out 21% approx in delayed arb options from a partial discount rate at a few weeks to 100% discount for 40 week lock up. On dolomite you also collect dolomite minerals which is dolomites point system that could later on be used for a airdrop of its own and you earn that in addition to the oARB and goARB drops that you earn weekly for holding any of the specified assets on dolomite. I will be looking into BTC layer 2s for airdrops as well to get in earlyish on those as well as continue to focus on arbitrum for my main holdings and start of my airdrop strategies as they seem to have some of the easiest ways to compound points for multiple airdrops using arbitrum and other protocols by bridging from arb to say linea by borrowing against kelp dao eth or other retaking protocols on platforms like radient which i believe the replaced the additional arb drops with rdnt weekly airdrops for DLP lockers which you need to provide 5% of your deposits in DLP to get the boosted yields in rdnt otherwise the yields are very unattractive. Right now I have kelp dao eth deposits getting the kelp miles 3x plus eigen layer points, rdnt drops and borrowing weth getting drops of rdnt as well as deposits only of usdc in the yearn riz vault for cash earning 10-20% depending and ZRO earning 1-2% in ZRO plus another 10-20% in drops of rdnt. The only thing about rdnt is it needs to be locked up for 3 months either in dlp or rdnt vesting before it can be cashed out so you need to delay your payouts for a little bit which could be a good thing as rdnt is low relative to previous prices and as they continue to expand may start to increase and if they increase you will end up making out as they become eligible to redeem at higher prices but eventually you will always be redeeming some and then for 3 months after you stop redeeming as well. I may switch over to dolomite for some holdings like usdc and unwind my kelp eth position to deposit the kelp eth in there vault which gets 2-3% plus about 6 other airdrop point allocations as well. Maybe i will remove my gravitas vessel and utilize that weETH to swap to eth bridge to main net eth and use zero lend to participate in the btc restaking where you can get about 9 airdrop points in one deposit. Also the ZERO airdrop I am still waiting on the other half and recently ZERO has skyrocketed from lows up a few x deff wish i bought a few million when it was low now its about 4-5x off the low in a day or two so at least the 200000 zero im due from the drop will be worth closer to the original value of 200 dollars as its value was less than 50 before the increase. Something interesting must be happening but likely to see a crash down as there are many people that will use this to sell out once they can unlock there tokens as they have been having a problem letting people unlock there staked tokens so there are many people that are mad lol. I wont be committing anything to them now unless they resolve all the outstanding issues as i don't want my funds to be stuck if i say put a few grand to combine the 9x airdrop point option with part of my strategy to stack as many high quality airdrops as possible. Since the GRVT the i believe is supposed to be soon i may close my vessel down incase there is any volatility etc with others doing the same and keep my stability pools open earning 3x points and my dolomite deposit earning 3x points and the goARB and oARB drops. I think arb is undervalued and i want to accumulate as much as I can via airdrops so dolomite may get more of my assets now unless radiant is getting back there arb allocation or the rdnt weekly drops make up for the lost arb drops. If i can get a chance to buy arb at .4 that would be great i would probably start loading up. Will also be looking for ZK airdrops from dapps on the ZK ecosystem that receive a grant of zk and plan to distribute that to liquidity providers or supply and borrowers on lending platforms but I would prefer to use a different platform than reactor fusion until they get bigger and there incentives are not very good in zk so its not worth locking my tokens into a smaller platform with more risk without significant rewards in zk i would rather put it on pcs with the lps over x ranges and receive cake plus zk fees and either usdc or eth fees as well. If zros yields on Camelot or PCS go up again i may allocate some tokens to zro lps as well so i can take advantage of accumulating more cake as i believe long term cake will continue to exist and do well as it is a profitable protocol and the units are pretty low right now so might be able to stack up my cake bag which is pure profit as i had unrealized earnings from revenue shares that i never cashed out for a while when prices spiked way up which allowed me to pull my cost basis out and now my small cake stake for 4 years to get the max rev share is paid for and im accumulating again to wait for the next pump and might start to use them in the syrup pools to get new launchpad tokens which can be interesting and sometimes do a few x on launch then sell them into that likely dumping them on the fomo. Some times dumping is not the best move but more likely than not there will be pullbacks after a big run up so ive overall done better by just dumping into the fomo rather than hoping its one of the few that rocket. Did the same with the 500 bnb i staked for years before i sold into the massive pump from 40 to hundreds lol. The launchpool made me multiple times back my cost of those 500 bnb then the trade into the run up made me a good amount especially since my cost was like 5-6 bucks i think lol it was right before everything went bananas and shit coins turned into a few grand which at that time told me sell almost everything lol and turned out to be the right call for most of the coins like FTX ran up 50X deff sold that same with nexo similar concept there native token ran up to a few bucks from .1 so sold all of that for a nice 20K and FTX got lucky on and pocketed the gain at the top basically. Then things like algo which i bought in for .1, matic, ada, xrp all had there hey days sold out into the hype of those as well lol. Got lucky with a lot of holdings that were pretty small and some massive gains into the 2020-2021 bull run. The 17 bull run i had a few btc and a bunch of eth now i wish i would have just fucking held my multiple btc which my cost was like 3k per after the crash lol if i did that would have a lot more now same with eth i sold that before the big run up and ended up buying back later for some of the gains but mostly mine came from alt coins that time. This time im more into btc and eth plus setting them up to get airdrops along the way and profit from the drops like dividends while adjusting various hedges to keep leveraged positions in check. Also looking at p2a games to get there native tokens as well as assets for little to no cost in dollars and get into the games for free or very low cost to build up my decks and assets like Lords Forsaken anyone who has been taking part in the alpha tests and now beta tests and does well have received rewards that can buy a small deck to start playing with plus cards that will give a advantage gold foil promos when earning as well as in the beta test packs are now being given out and this is the last chance to get in before the game goes live then there will be no more pack give aways like this and you might need to spend a little money to earn significant rewards as you will still be able to earn from free to play for very low cost barrier to entry which is like splinterlands back in the day so to me the p2a campaign for lfs is a no brainer takes a bit of time to complete but not that much and you help out finding bugs etc in return you get the assets to play with and some special promos that so far I have earned 5 gold foil promo cards which will enhance my earnings alot and make my deck start out with a edge and 3100 faith approx 50 dollars in the in game currency im going to use for packs and the beta test i expect to get at least 5 packs but am shooting for top 3 again as i finished first last time and second the time before that and fifth the second play test bc i had no idea it was ending lol could have finished higher. If i can get 1-3 in the beta test ill get another either 1`- 3 gold foil promos and 6 packs to add onto the 10 packs i believe my faith will buy me for at total of 16 packs with 5 cards each and then assuming i get first again ill get 8 gold foil promo cards which are all very strong cards in the game and are must haves which wil let me earn much more from my deck that i earned. As i earn i will add additional assets to the deck building it from scratch with no money but a time investment to see how big i can build it and how much i can earn from it. Once the rental markets are live i will likely rent out my gold foils or some of them to people that dont have them or cant get them yet and make a passive return as well off of extra copies and the rent income i will take out of the game and put in the lp pool faith/weth on lynex to earn returns from that and all the fees from people transacting and purchasing packs as well as people buying and selling faith once it is being rewarded each win in game. The fees will likely provide a nice stream of cash flow as well and that will be in oLYNX which can be cashed out or used to bribe the lp for higher rewards so your deposits would get more and more fees enhancing the earnings over time. I would also like to eventually start a fund that receives its initial capital from delegations on HIVE which will be used to invest in say the usdc-dec lp for SPL for a while as well as eventually take over my land plots but also be a play to air drop gaming fund that goes after various games that are airdropping assets like this and the gaming assets would be owned by the fund which would be controlled by a DAO that has both general partners and limited partners where the general partners actively participate in the funds operations and the limited partners get to vote on various decisions put forth by the general partners. In order to keep the fund able to do things fast the limited partners will not need to be consulted on all matters and the lp votes are to decide where the community stands and likely the gp group will vote to do the same thing but does not have to. Any earnings will be subject to a split that first pays out GP partners a certain percentage relative to the effort put in then the fund will split the earnings x% GP and y% LP partners until all capital from the delegations and curation is returned. The delegations will be used to delegate to various passive income sources on HIVE such as having a balance in HBD, HIVE power to upvote delegators posts as well as use the author rewards to build a perpetual fund that only pays out its earnings and only 50% of them so that it can grow over time creating a larger and larger distribution to both gp and lp dao unit holders which will act like a endowment for the dao. The endowment funds would be invested in various stable coin protocols including aqualis so we can take advantage of there unique lending and borrowing protocol and also accumulate AQL to stake and earn more platform revenue as well as get airdropped more AQL by providing stables in the liquidity. The stable liquidity will be used to borrow against which is one of the unique things AQL can do and the freed up liquidity can be used to farm various airdrops by stacking them carefully so that the fund gets the most bang for the buck out of each dollar for airdrop points and direct drops. Also any post that delegators post will be copied to steem and other protocols to extract rewards back to the main fund from other blockchain social media platforms like steem, publish ox, d bank etc and platforms on other chains as well that offer a similar rewards for content. The fund will stretch delegators posts over many platforms earning more for them by retaining all of the extra earnings in the endowment and those earnings will be seen through direct cash flow distributions in kind so there is less of a tax impact if people choose to or have to report taxes. All info for taxes will be the sole responsibility of the individual and information will be provided related to the various sources of income and information needed to prepare tax returns if needed. The lps will be considered independent contractors at first who delegate there hp for LP units in the fund at a set amount per unit. All the details still need to be worked out but even if im the only member im going to start it my self and just start with me owning 100% and maybe wait until there is some performance and assets owned by the DAO then go and start the campaign to raise capital once we have some earnings from some p2a games as well as other airdrop set ups for liquidity provision all set up. Then there will already be value to the units and they will be easily priced for the delegate to earn equity campaigns. One game we will be focusing on is Splinterlands though as said before the dec-usdc lp which generates dec and usdc at about 50% apr and will be the most liquid way as well as stable way to participate in returns, also we will stake sps and acquire it when it dips in order to rent out for DEC which can go to feed the usdc-dec lp. Once the stake in those things is large enough to distribute some and also use some to buy cards we will look at buying cards or packs that are seeminly undervalued like cards that are trading at there burn value but still offer good rental returns bc they offer relativly low risk rental income as they can always be burned for x dec. Land will be also looked at and people with contributions of delegated cards for land will get units in the fund by delegating cards that produce returns on land for the fund and the income produced will go mostly to the delegators capital account in the fund with a percentage going to the treasury for as long as they delegate the assets. There will be a minimum lockup where people must commit to x weeks or months of delegation in order to receive units and the longer the lock up the more units received in % terms per value of assets locked up and the value to the fund of the assets will be determined by there cash flow provided as the fund does not own these assets only the cash flow received from them. Will be interesting to go through and make a detailed white paper for this type of fund and start with hive but if there is no interest then maybe ill start on a different platform depending on where there is interest. There are a lot of funds on HIVE that do not necessarily offer great returns or are dependent way to much on hive or one thing and that is definitely one thing I don't want to happen to this idea if it comes to fruition. HIVE and games on hive will be part of the fund so that the fund can have ample diversification and not get hemmed in by HIVEs performance as i want it to be so that not one investment is more than 10% of the funds/clubs portfolio. It will also be likely that when i am ready the gp partner units will be the first capital raise via delegation and content creation rewards from hive and various platforms then once the gp team is established and all the protocol's are in order for the DAO then the lp units can be added which may even be revenue share units only and after a certain period of time with a multiplier on capital added to the fund be paid off and once paid out there multiplier from x% then the cash flow reverts back to the GP units as the revenue share is more like non recourse debt which may make it much easier for the club for regulations as the revenue share units could even be raised using a crowdfunding platform for daos etc there are plenty of them around just need to have a good idea and have that idea spelled out nice and clear unlike this post with all my random thoughts lol.

This post is just a collection of random thoughts and might not all make sense and need some fine tuning lol.