Legal marijuana has been having banner year after banner year since various states have legalized the sale and consumption of the plant and its derivatives starting back in 2012 within Colorado and Washington. It should be noted that the process of marijuana’s status as a demonized drug has been slipping for much longer than the past 4 years.

The first medical marijuana dispensary in the United States was in California back in 1996. As a business model, it’s hard to beat being a legal seller of pot, whether in a medical capacity or fully legalized manner. It’s common to see business owners and consultants cross-pollinating across state lines to be first in line to get licensed into new states as they pass legislation to legalize. But the green-rush to get into a successful marijuana business can be a headache because of some of the highly restrictive financial laws associated with running such an operation.

So, the question must be asked – is there a potential solution to this problem with Bitcoin?

Few of us could honestly complain about being too cash rich, right? Well, many of the owners of marijuana dispensaries have this exact problem. While fantasies about being surrounded by piles of green bills might seem appealing, there are several inherent problems with this.

Marijuana Is Legal within Certain States, Not the Entire United States

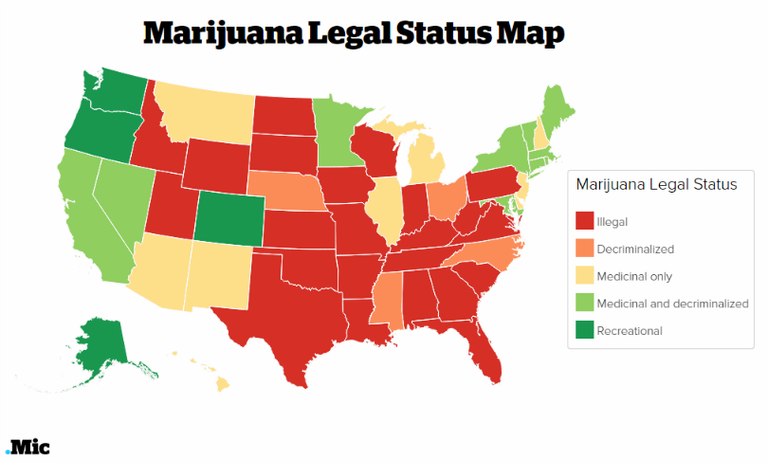

Marijuana had an almost revolutionary moment when people from certain states within the U.S. stood up collectively and declared that they weren’t going to be persecuted for the cultivation, sale and use of a plant that some believe to be not only not harmful, but beneficial. Regardless where these states stand on the subject of what place marijuana has in society, the fact remains that it is still very much illegal in the eyes of the Federal Government.

Sitting within the same scheduling class as heroin, ecstasy, and LSD, being caught with and prosecuted for being involved with marijuana in anyway can land you a major jail sentence and massive fines. Untold numbers of people in the U.S. have been locked away for years for being caught with small amount of marijuana on their persons. So, that’s quite a stark contrast between what’s happening within state limits and on a national level.

No Checks, No Cash Deposits and No Credit Card Transactions

For those who have never visited a marijuana dispensary, they can range from the atmosphere of a nightclub, to almost a sort of Persian tapestry showroom. The business and branding styles of dispensaries varies greatly and depends in large part on the owners and people working there. However, if you step into the back office room, you’ll notice something similar between virtually every dispensary. Besides computers which manage inventory and transactions and some video displays for CCTV, you’re likely to see a massive safe.

What lies behind the doors of that safe is cash – lots and lots of it. Due to the sheer illegality of marijuana under Federal law, dispensaries and any business directly associated with the production or sale of such products cannot write checks, deposit money into financial institutions and cannot accept credit card payments.

While you may have been to a dive bar, diner or food truck that was cash only, it’s likely that most businesses you use accept some form of electronic payment via Visa, MasterCard, Etc. However, you’ll never find that at any dispensaries. This causes a huge stockpile of cash in the operations of virtually every dispensary in business and causes big logistical headaches for the owners to manage that cash.

The Dangers of an All-Cash Business

In movie scenes where you see townie Boston thugs robbing a bank and somehow losing the cops in a car chase in a major U.S. city, it’s hard to imagine how actual bank robberies realistically happen anymore. It’s no secret how guarded banks are and at this point in time, it’s hardly worth the risk to anyone who isn’t completely desperate and on the run. However, cash-only businesses like marijuana dispensaries are a prime target for crime.

Many of these operations must be hyper vigilant just to keep internal employees honest and from skimming cash every chance they get. Never mind a brazen planned robbery on an unsuspecting dispensary which could lead to financial losses in the hundreds of thousands, if not millions, or even worse, injury or death of the business people.

The Time for Bitcoin Is Now

In an industry that’s slated to reach $6.7 Billion in total revenue within this year, there needs to be a solution to this cash-rich business problem being faced by dispensaries. It’s simply not safe or practical to be managing so much physical cash within a location that is a potential target for crime. Due to cash which is associated with marijuana sales not being eligible for circulation of any kind through financial institutions or through credit cards, Bitcoin is potentially a life-saving solution for the near-term and long term.

Bitcoin has no central authority, therefore there’s no immediate way for the government from a State or Federal level to intervene with dispensaries processing their transactions or cash through Bitcoin. While in theory, dispensary owners could take their mountains of cash to local Bitcoin ATM’s and after hours or even days finally deposit their cash into Bitcoins, a better solution would be for dispensary customers to purchase their products using Bitcoin. With this, as we’ve seen before in other industries, it’s going to largely be an educational challenge for dispensary owners and their customers.

Getting people on board to knowing how to securely purchase and store their Bitcoin and then use it transactionally is a challenge, but certainly a smaller one than figuring out how to safely move huge amounts of cash. While there’s always potential for the Federal Government to get involved somehow with attempted regulation and while the price of Bitcoin has potential to be volatile, the upsides to this solution seem to be too good to ignore.

As seen in cities around the world, Bitcoin supported commerce ecosystems are certainly possible, but it requires dispensaries to be bigger stewards in their communities and put efforts in that they probably didn’t need to before. Imagine a co-working space that was sponsored by a dispensary with a cafe, small restaurant, and a few Bitcoin ATM’s where people could go, congregate and help support a movement beyond their own medicinal interests into a radically different and better local economic system around Bitcoin.

I don't have any particular insights or first hand knowledge on this topic, but at first glance it seems dispensaries and bitcoins were a match made in heaven. But I doubt many businesses relish the idea of doubling-down on regulatory hassles, and banks are as averse to Bitcoin as they are to MJ legal regardless of its State legal status. Add to that the fact that Bitcoin kind of sucks for retail POS unless you are using a service that is centralized like Bitpay. Pretty sure they don't accept any dispensary's biz. When Bitcoin payment channels like Lightning Network are more than just an idea this might change, esp if they offer some privacy. I doubt any businesses want their competitors scoping out their financial positions on the public Bitcoin blockchain. Maybe a competing faster and more privacy based cryptocurrency like Dash or the upcoming Zcash will be more attractive. Like they say, it's all early days still.

POT coin is targeted specifically at the Marijuana industry.

Potcoin really small player. Steem dollars maybe? :-)