Pessimism appeared to be setting in the days running up to Monday 19 October.

Both the Dow Jones and the S&P 500 had lost more than 9% over the week by the time markets closed on Friday 16 October.

That loss had Asian investors playing catch-up when they opened for business on Monday.

And as more markets opened, that selling activity in Asia sparked more selling in Europe, leaving the US playing catch-up with the losses it had originally inspired.

By the end of the day, the Dow Jones had fallen by more than 20% and the UK's FTSE 100 by 11%.

It ended up as the steepest crash since 1929.

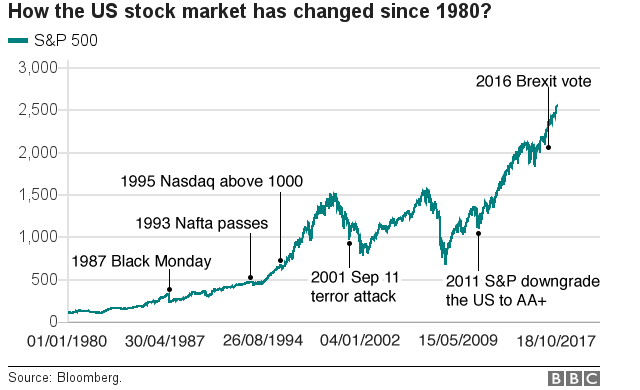

Dow chart

"Our mouths were wide open, our jaws were hitting the desk," says Peter Borish, who at the time was second in command at Tudor Investment Corp, a US hedge fund.

Tudor was one of the few firms to predict the crash and ended up turning a profit by innovative use of computer modelling.

"Fear always trumps greed and fear was at its maximum point then, so when people are fearful rationality goes out the door and they just start selling."

Nice Post @chetanthakur07 and a lot of informations....

Congratulations @chetanthakur07! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP