Steemers!

Firstblood.io! If you missed my self-introductory blog last time, here is a

link to the post.It's @jasonmcz again form

The Beginning

24 hours ago I was browsing the through some of posts about the Steem Internal Market posted by @blakemiles84, quickly learned that some whales / early players who are making the market are doing wash trades against themselves.

The fuck is Wash Trade?

For those of you who don't understand the concept of a wash trade, here is a link to the wiki page explaining the definition of a wash trade and why it is illegal.

In short [wash trade] is a form of market manipulation in which an investor simultaneously sells and buys the same financial instruments. Why? For 3+1 reasons:

1. inflate the volume

2. commission fees rebate

3. ping an instrument price onto the tape to cheat on derivative product settlements.

4. some jurisdiction allows loss resulted from wash trades to be deducted from tax.

yeah but..

In this case, the wash trade had a purpose, which is to game the liquidity reward.

A reward totals 1,200 STEEM /hr or a dollar equivalent about $3720.00 /hr.

Last 24 hours

After reviewing all the archives on the topic of liquidity reward and internal market, I've decided to make market myself and see if I could take down those whales who are consistently getting those fat rewards.

some of those might think being a market maker needs a set up like this to watch the book, chart and signals..

But in reality, in this electronic trading world...Market making looks like this

You have elegant robots with just few dozen lines of code or a complicated system that has tens of thousands code and has the ability to learn from other peoples trades and its own mistakes.

Finding The APIs

post, I was able to set up something running really quickly with his steemit-python interface:Due to lack of documentation from Steemit official site about the internal exchange part forced me to look around for other solutions. Thanks to @Xeroc Fabian's

from pprint import pprint

from steemexchange import SteemExchange

class Config():

witness_url = "wss://this.piston.rocks/"

account = "xeroc"

# Either provide a cli-wallet RPC

wallet_host = "localhost"

wallet_port = 8092

# or the (active) private key for your account

wif = ""

steem = SteemExchange(Config)

pprint(steem.buy(10, "SBD", 100))

pprint(steem.sell(10, "SBD", 100))

pprint(steem.cancel("24432422"))

pprint(steem.returnTicker())

pprint(steem.return24Volume())

pprint(steem.returnOrderBook(2))

pprint(steem.ws.get_order_book(10, api="market_history"))

pprint(steem.returnTradeHistory())

pprint(steem.returnMarketHistoryBuckets())

pprint(steem.returnMarketHistory(300))

pprint(steem.get_lowest_ask())

pprint(steem.get_higest_bid())

pprint(steem.transfer(10, "SBD", "fabian", "foobar"))

Setting something up isn't hard but winning that liquidity reward is insanely hard especially when you have few people who are already extremely well established with their book. I transferred some ETH via blocktrades to convert into my initial liquidity capital (STEEM).

I was pretty confident that I was going to score all the liquidity points by providing the tightest spread in the market.

Then I was WRONG.

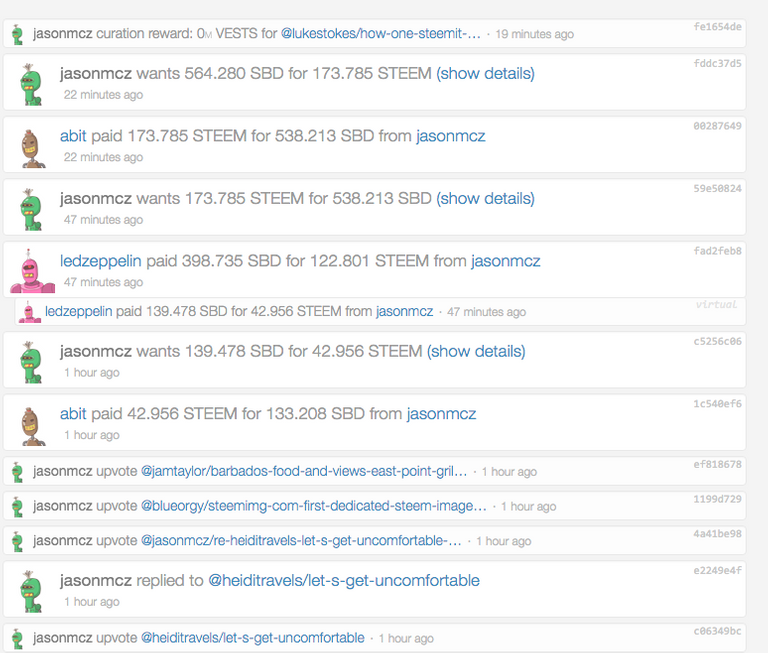

Algo_Bid: 3.239 x Algo_Ask: 3.2410000000000003 Thanks to those well documented API. I was able to set up my robot and consistently provide a spread as low as $0.002, however providing the tightest spread doesn't mean anything and certainly doesn't earn me anything to the liquidity reward.

But why is that?

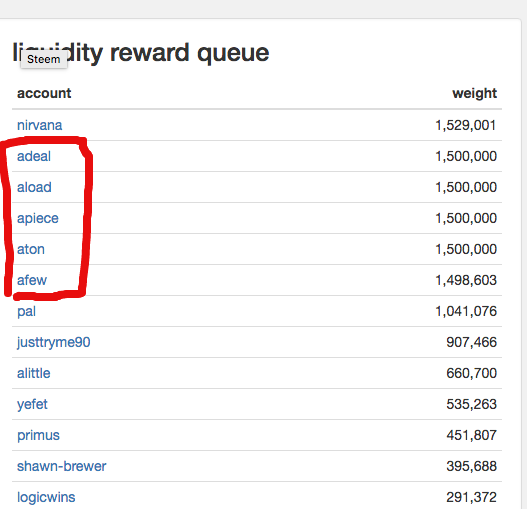

The 'A****' & Nirvana/Ledzeppelin/thebeatles/thewho Clan

adeal, abit, alittle, aload, apiece, aton, afew -- the 'A' clan is controlled most likely (my speculation) by one person

Nirvana, theBeatles, the Ledzeppelin/thebeatles/thewho accounts are probably controlled by the same person as well

It's strange and interesting at the same time to witness how the 'A' clan and the Nirvana clan were adjusting their trading strategies after the change to liquidity reward calculation in the last implementation.

[Now Liquidity Points are only applied to those open orders remains on the book for more than 30 minutes]

Now instead of wash trading every couple minute, they will place big wide orders on the order book with a huge spread. We that know with that $0.15 - 0.20 cents -- it is quite discouraging to people who want just to trade and with the less trades happening at the spread they are providing.

They were able to utilize multiple accounts to wash trade every 30 minutes to take out the very liquidity they put on the book themselves.

AHHHHH... THAT'S WHY I HAVE NO LIQUIDITY POINTS.

Cuz my tight orders were eaten by them before they could hit the 30 minute mark, and it seems like the last thing they'd be concerned about is to provide orders with tight spread. Isn't this counter-intuitive in the way that encourages liquidity reward takers to place their bid/ask away from BBO?

The Change of My Strategy

Knowing I have no chance to compete with whales on that fat check given by the network even tho the liquidity that I provide is obviously tighter than theirs. I've decided to change my strategy entirely. Instead of providing tightest liquidly on the market, I wrote a Robot that detects A clan and Nivara's orders.

Robot will scan the orderbook and identify where the whales are and then place my orders one level above or below them so in order for them to wash trade they will have to eat the orderbook up from me first, but this time with bigger cost.

Now I am collecting few bucks on each trade they make! but HELLO??? Why are they collecting 1200.00 STEEM when I am real MM who's ACTUALLY providing order flow on top of the orderbook

The Conclusion

I am not saying this is not doing its job but rather it's counter productive from making a liquid market for STEEM community. There is a reason why some exchanges let market makers compete on the order flow and get rebate (solely) on liquidity takers fees. Just my two cents.To be honest, as someone who has been prop trading for past 8 years on equities, derivatives and cryptos (on exchange) this strange structured liquidity reward thing is completely a new animal. I've never seen anything like this -- especially the part that all orders have to be on the book for ( 1minute before) 30 minutes. Perhaps @jl777 is right on his comments earlier or perhaps I just fail to see the bigger picture this time.

@jasonmcz I'd been wondering about all this. I'm so glad you shared this info with us. Thank you! We need more helpful posts like this one. Keep up the good work!

I proposed a solution, but it got very little love. Ironically the only whale that up voted it is the one getting a majority of the liquidity incentives (abit). LOL... https://steemit.com/sip/@coinhoarder/steem-proposal-abolishing-liquidity-incentives-and-reverting-the-funds-to-provide-actual-autonomous-liquidity

Really glad to see this stuff getting attention.

To me, the whales who rule the waters need to be really, really careful. If they try to get too much out of the goose that lays the golden eggs, they'll kill it. This entire beta experiment relies on the perception of fairness. People are here because they believe it represents a peaceful revolution towards more freedom, in so many ways from expression to monetary policy. What we're seeing so far is discouraging to many as great content is missed and other content receives insane rewards. If the economics and exponential growth kick in so that no one can win unless the top of the food chain decrees it... well, that's not going to be good long term. The market maker part is just one side of it.

Thanks for talking about it.

Well said @lukestokes, I think most cryptocurrencies/projects always come down to the perception of freedom and representation of something that's different which is why the community has its own unspoken rules such as no pre-mining, no pre-distribution of tokens and etc. Whales accumulating liquidity reward by not even providing tight liquidity is something that would hurt the ecosystem in the long term especially for late-comers to come to realization that how 1% holds 99% of the STEEM (exaggeration here but you guys get my idea).

The lack of manipulation for this particular cryptocurrency being a social promotion environment with this platform is critical to the success long-term.

I followed along with the whole article, but that dog pic at the end - those hypnotic doggie eyes - I just can't stop staring at them.

Now what were we talking about?

Awesome writeup, @jasonmcz

Learned a lot on this one. Thanks for the shout-out too. I only noticed those transactions because of @roelandp's stream website.

Lines of convergence :)

My pleasure man! It was your post that got me into market making at first place.

You know this site is still in beta. I'm sure getting these things solved is not simple.

Glad people are trying and battling with these guys. I think much bett than solving the issues via legal avenues is to build mechanics that can't be gamed.

Thank you for the entertaining post, explanations and your efforts.

I noticed the same thing a few days ago and tried a similar test manually, and got nothing. I posted about it and asked if I should have gotten any rewards, my post was ignored by the ones that could answer, even though they were answering my other questions.

It is pretty obvious the people coding this seem to be the ones making all the hourly profit. If there are already 6 bots permanently at the top of the cue for rewards, that reinforces the idea. Regular steemit users and windows miners cannot even place orders on the market right now, only linux miners and linux developers can. If it wasn't for those 2 developers sharing info with you, that info never would have never even made it out to the public.

Perhaps you should focus an article on the illegal wash trade part, maybe that will get some attention.

"Perhaps you should focus an article on the illegal wash trade part, maybe that will get some attention. "

yep agreed!

Great post, I'm uber jealous of your trading desk setup! I'm fascinated by these sort of closer looks at how these markets work behind the scenes, thank you for sharing details and code :)

Thank you mate! Gonna do another one soon!

This why I appreciate steemit, where else would find a self-critical analytical honest post, that ultimaletly helps improve its own system?

my pleasure guys!

I am correct on this

now i am being attacked by abit: https://steemit.com/hack/@jl777/i-am-being-attacked-on-liquidity-provider-points

Sure. You can attack back, then I'll have to enlarge the spread, then you'll earn spread from me.. happy end.

you have far more capital than all the others combined and with 16+ accounts at the top of the the list, any stalemate in points will just get you automatically the hourly rewards

but I guess it is clear that your position is that anything within the rules is acceptable behavior, regardless of impact to the community. Thanks for clarifying that. I had mistaken you for someone who cared about the long term success of STEEM

Be strong!Don't give up, @jasonmcz. I hope you'll beat those whales!

Thank you for encouraging me on this hehe! I wasn't going to but earning a bit money here and there by ripping some of the whale's orders is fun too!

Glad that we have more traders like you! And I'm happy to share some of the rewards. Perhaps eventually we'll have a better liquidity rewarding system, but before it's put in place, we just have to guard the funds by taking them by ourselves.

By the way, as pointed out in this article, maker-taker schema won't work here. Any other ideas?

@abit! Hey buddy! Good to have you here on this thread. It'd be lovely you are happy to share some liquidity reward with your fellow. As for the maker-taker model, it was just an idea I was throwing around but it seems that article did explain some valid points regarding incentivizing liquidity providers. I am happy to bounce some idea with you and perhaps even @ Nirvana to see if we can have something smarter implemented by next fork.

P.S. Are you on slack?

I have a slack account, @abit, but not always online. If I'm not there, you can leave me a message.

Normally I don't approve of whale hunting but in this case I do!

@silentpower that's a good one!

love the twelve monitors 8]

@gekko, I actually have 3 monitors at home for my trading desk!

me too, i need more 8]

Invest my upvote well and buy them :)

Great post, it explain quite well how hard is the arbitrage in this markets, thank you for show us it with some deep

I am always down for the underdog to take out the whales!!

Thank you! Very interesting article!

Money fight!!

@jasonmcz I'm 99% certain that these micro wash-trades are happening on bittrex too. If you have a way to exploit it, I'd love to hear about it. I have a not bad amount of capital on there.

I am happy to take a look and do some investigation tomorrow. If you are on slack, feel free to message me anytime @jasonmcz, but normally I am in my own channel (http://tinyurl.com/hjpk6za) for my project.

I only understand bits and pieces of the above, but what I gather, it is just one person providing liquidity, and getting then rewards for it? If this is the case, isn't liquidity, liquidity? If someone makes a better "engine" and then has the rewards, it is still liquidity right? If the current rewarded makes a mistake, someone else will pick up the slack, or am I missing the point all together?

What do you think with the yobit

https://steemit.com/yobit/@toroiskandar/yobit-net

See it's already paying off!

Great article and yes, please keep competing. I love the "People think it looks like this but it actually looks like this small screen of code" bit. So True. My wife calls it, "The Matrix" because there's no fun pictures just lines of code.

Wow, your article sure shine a light on trading steem currency. Thanks for sharing!

Awesome post!

That is an insane setup, by the way!

Thank you, quite the "eye opener"!!

This shit is like chess on a whole nother level. Love it

Well said

Interesting article. I would like to point out it is important to never throw all of your eggs in one basket. Even if you believe something will be successful you always need a plan B. I think steemit is a great investment but if you are talking about your retirement plan, I would be careful. Cheers!

Thanks for contributing to steemit. Keep giving liquidity... This post will help you further ;)

Bravo man. It makes me mad to think I will never be able to earn a Liq.Reward. because of those whale gaming the system..... I'm glad you are not only shining a light on it but offering some insight as well... They seriously need to fix this or take the reward away completely.......

Informative

That is incredibly detailed and helpful. As someone who has never looked into how any of this is done I found your post very informative!

I hope people don't go running to their nearest federal/government regulators and complain about "illegal" wash trades or whatever. This is obviously an unregulated exchange and that is the whole point is it not? Something about it being "trustless", one of those weird Bitcoin terms where the whole thing takes care of itself without outside interference.

Only patients get the victory in a three-day all this bad weather will go away, and only those who sold their coin would remember this time as a nightmare,

I believe the plan is to eliminate the liquidity rewards soon (something I've been arguing for almost since they were introduced). If it turns out some form of liquidity reward is needed, it needs to be better thought out, and not so high.