In every significant precious metals bull market since the 1970s the white metal or silver has led the way. The gold to silver ratio has always been a good barometer for the direction of the precious metals. The ratio translates into how many troy ounces of silver are needed to buy one troy ounce of gold. Historically going back centuries the ratio usually averaged around 16 to 1 but in the 20th century with the creation of the Federal Reserve System and the emergence of fiat money and the abandonment of sound money this ratio has been a lot higher and averaged 47 to 1 according to golddealer.com.

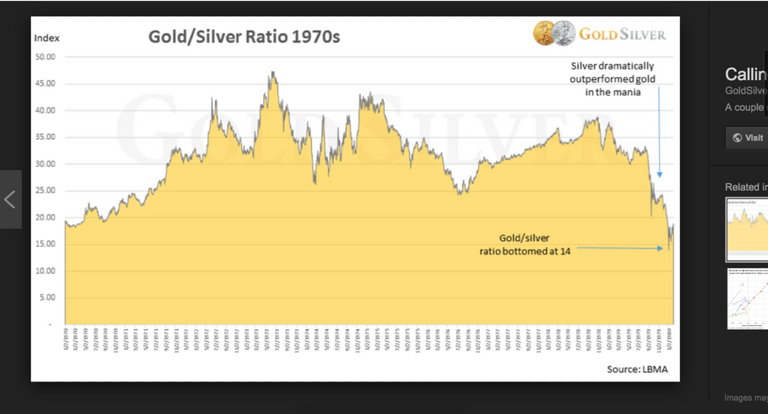

In the great bull market of the 1970s that ran up to January of 1980 we saw the gold to silver ratio drop from around 45 in 1973 to 14 to 1 at the end of the bull market in 1980 as the Hunt brothers cornered the silver market and drove the price of silver to $50 per troy ounce.

More recently during the bull run in the precious metals from the low at the end of 2008 when gold and silver rallied from their respective lows of $680 and $8.46 to their eventual highs of $1921 and $50.00 in 2011 the ratio again saw a big drop from a high of 84 in October of 2010 to a low of 32 in April of 2011.

So why do I think silver could be ready to lead the precious metals market higher? The technical outlook for silver is starting to improve as you can see by the charts below. The first chart is a daily chart going back to the beginning of 2016 and you will note that at present silver has broken out of the upper boundary a pennant formation. Technical analysis is never a perfect science and this breakout could fail but it does not mean we should not take note of it. The second chart is the same chart but it is zoomed in so you can see the clear breakout.

For the last year the gold to silver ratio has been in an upward trend and it has gone from around 68 to almost 80 and that, in my opinion, is why the precious metals have not been able to mount any significant rallies despite the fact that we made a low at the end of 2015 in gold and silver. Late last year the ratio tested the 74/75 area but was unable to break below that level and earlier in January of this year it almost touched the 80 level. So the next key support for the ratio will be 76.5 and after that the area around 74 to 75.

In conclusion we need to see the silver price out perform the gold price going forward if are going see a major rally in the precious metals sector. Today was a start in that trend as silver rallied about 1.5% and gold about 0.6%.

Very nice analysis, I tend to agree with you' this could be the turn around we’ve all been waiting for, fingers crossed,

Yes let's hope so.

Great info, maneco64. Historically when the G2S ratio gets this out of wack it can mean that gold's little brother silver will lead the way. Let's see what happens!

Yes I agree. Let's hope silver is ready to wake up!

Personally I hope it stays low. This allows me to stack more while it is cheap. I'm rolling crypto profits into silver and need a little more time to build my stack.

Silver has been cheap for a very long time and you had plenty of opportunities to stack up. If you miss out, it would not be because it went higher too soon but rather because you were greedy.

Greedy? I only have so much disposable income. But with my crypto investments paying off that allows me to stack more than I previously could. How exactly does that make me greedy?

Why aren't selling now and buying silver now? Just saying.

I am steadily rolling btc profits into silver. But I would prefer the market stay as is for a while.

I think precious metals are artificially suppressed and it seems the emerging crypto markets are exacerbating it. Which is fine for me. I plan to use crypto to invest in more tangible assets such as gold silver and property (if I'm lucky)

Risk to reward and greed can affect the outcome. We are all greedy to some extent. If you end up with too little silver because you took too much of a risk, then too much greed can be at fault. Either way best of luck, with all of that. It's a balancing act. Some of us have been holding on to PMs for a long time now and it can't happen too soon for us.

I certainly hope silver starts to move. We really need to see a decisive break of the range that they've been in before we know we're in rally mode.

Nice analysis.

The Global Markets are out of balance - the correction seems to be coming late.

Will it be a Bang? Or a sharp descent? Or can they push the money around forever?

When I got into silver, I noticed YouTubers talking about "crash" and "silver spike" 6 years earlier ... and now we are around a decade, and the magnitude of debt & derivatives is enourmous!!