I don't know about you, but for me, there is no doubt that PEPSI is presenting one of the best times to buy its stock at a good price.

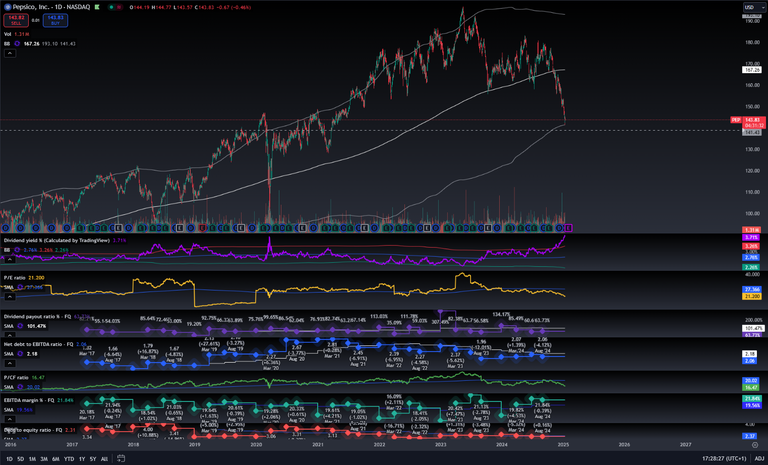

- Dividend Yield in ATH: 3.71%

- P/E ratio below its average

- Debt to EBITDA ratio decreasing

- P/CF below its average too

- EBITDA Margin increasing

From a technical point of view, it is touching the lower limit of the 1000-session Bollinger Band and on a known support in the chart.

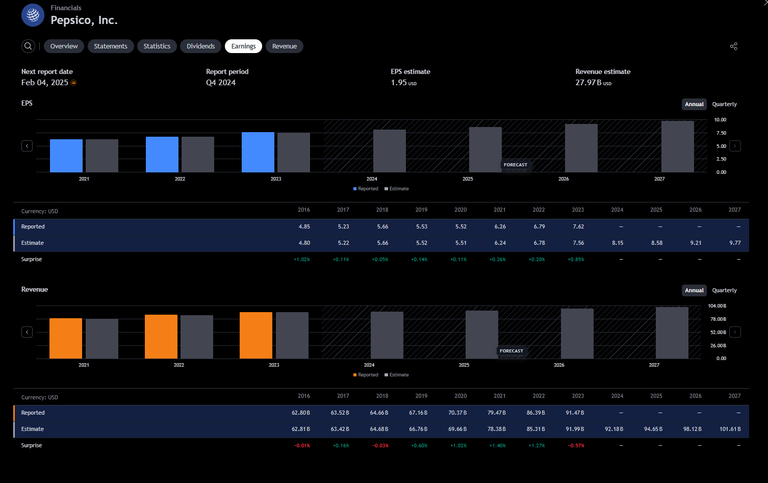

Taking into account the estimated future EPS, it seems that the situation is temporary:

For all those investors in DIVIDENDS, PEPSICO is a no-brainer IMO...always with the long-term point of view obviously.

Sure a good dividend grower. I am also tempted to open a Position but I slightly prefer Mondelez since its dividend growth is higher and the payout ratio lower. What do you think about this one, Eddie? I know they have a bigger exposure to high Cocoa prizes but they sell also other snacks and have strong brands too like Pepsi.

btw, I have set a limit order BUY for MDLZ at 55.31$, let's see if it plays out

Good luck! My first small MDLZ position is already bought. ☑️

I think MDLZ is also showing a good opportunity nowadays, it's a massive compounding machine too

Best would be to open a Position in Both. 😅

agree

Looks like a good buy.

I like to buy dividend stocks and sell calls out of the money on them too. I call them my triple winners appreciation, dividends and call option premiums. I will look at Pepsi, I have been out of the stock market for a year and now think I should take a look with fresh eyes.

PEPSI is a decent stock to hold. I don't think people will move away from Soda at all. The dividends add up over time though.

Dumb question, talking about pepsi the cola opponent?

Yes

Wishing best of luck to all.