Bitcoin dipped under $6,000 and many littler advanced tokens tumbled as the current month's selloff in cryptographic forms of money hinted at few letting up.The biggest computerized cash fell as much as 6.2 percent to $5,887 starting at 3:07 p.m. in Hong Kong, the most reduced level since June, as indicated by Bloomberg composite estimating. Ether sank as much as 13 percent, while everything except three of the 100 greatest cryptographic forms of money followed by Coinmarketcap.com recorded decays in the course of recent hours.

The aggregate market capitalization of virtual monetary standards dropped to $192 billion from a pinnacle of about $835 billion in January, deleting a significant part of the increases seen amid the theoretical lunacy toward the finish of 2017.

"Most digital forms of money have been exaggerated for quite a while," said Samson Cut, boss procedure officer at blockchain engineer Blockstream Corp. "It's difficult to stick this proceed onward a specific factor, yet it feels like the inverse of a year ago when cash heaped in as individuals felt FOMO. Presently it's heaping out as they sense freeze." While digital forms of money mobilized in July on trusts that a Bitcoin-sponsored trade exchanged store would draw in new speculators, U.S. controllers still can't seem to approve different recommendations for such an item. The frustration has agreed with developing worry that business visionaries who raised crypto-designated stores by means of starting coin contributions are currently liquidating out of possessions, for example, Ether, the token for the Ethereum blockchain that is a prevalent stage for crypto ventures.

"The issue on everyone's mind in the market today is the gigantic shortcoming in Ethereum," Timothy Hat, CEO of CoinFi, a digital money information investigation organization, said in a telephone meet. "Bitcoin has held up generally well versus Ethereum. It's still very feeble versus the U.S. dollar." At the stature of Ether's rally a year ago, the advanced coin involved 32 percent of digital currency showcase capitalization, coming extremely close to Bitcoin's 39 percent. Ether currently makes up around 14 percent, while Bitcoin represents 54 percent in the wake of falling less rapidly than its littler companions, as indicated by Coinmarketcap.com.

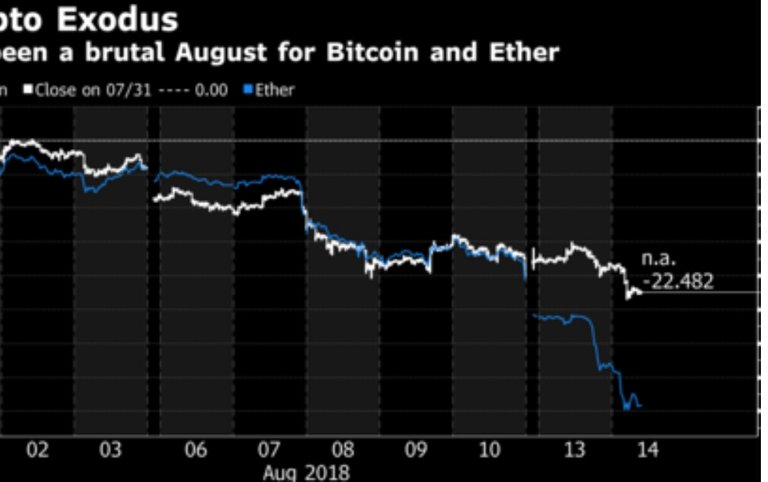

"ICOs that have collected a considerable measure of cash are truly feeling a great deal of torment" as their crypto possessions lose esteem, Hat said.Ether has tumbled 39 percent this month, while Bitcoin has dropped around 22 percent.It's far-fetched that ongoing worldwide market choppiness, powered by Turkey's money emergency, is affecting cryptographic forms of money, said James Quinn, head of business sectors at Kenetic, a blockchain organization with speculation and warning organizations.

"Connections verifiably have been to a great degree low amongst cryptographic forms of money and other resource classes," he said in a telephone meet from Hong Kong. "Which is one reason why there is enthusiasm for this space and why individuals need to make a portion in this space."

In any case, anybody anticipating that Bitcoin should give a safe house from choppiness in worldwide markets will have been frustrated. The digital money's slide against the dollar this month is nearly as large as the Turkish lira's 25 percent droop.

Sort: Trending