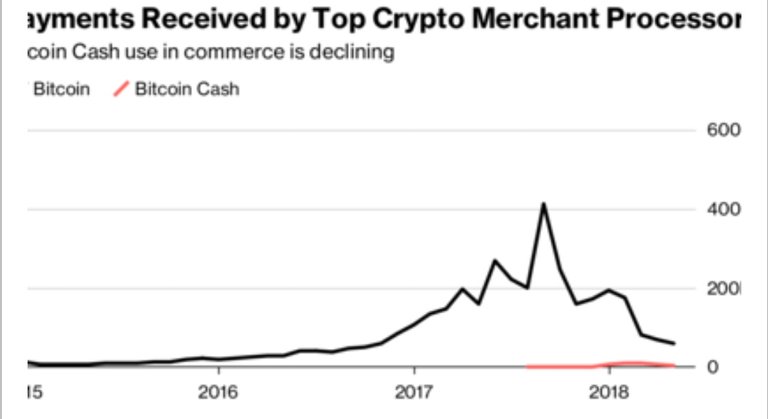

Roger Ver, the virtual money advocate frequently alluded to as Bitcoin Jesus, is thinking that its intense to win proselytes to the assumed second happening to the world's greatest cryptocurrency.The branch of the advanced coin, known as Bitcoin Money, is scarcely being utilized in trade, as indicated by blockchain investigation firm Chainalysis. An audit of installments gotten by the world's 17 biggest crypto trader preparing administrations, for example, BitPay, Coinify and GoCoin, found that Bitcoin Money installments drooped to $3.7 million in May from a high of $10.5 million in Spring. Bitcoin installments totaled $60 million in May, down from a pinnacle of $412 million in September.

The decays reflect the dive in the estimation of computerized money this year, with Bitcoin tumbling around 55 percent and Bitcoin Money smashing around 75 percent. In the wake of cresting in December, Bitcoin Money's market capitalization has dropped by around 85 percent to $9.4 billion. While it's as yet the fourth-biggest digital currency, the market top is under 10 percent of Bitcoin's, as indicated by information tracker CoinMarketCap.

"There are less clients of Bitcoin Money, less holders," Kim Grauer, senior financial specialist at Chainalysis, said in a telephone meet. Bitcoin Money split from Bitcoin a year back. Ver changed devotion to Bitcoin Money, put resources into it, and upgraded his Bitcoin.com site to center around the cryptographic money. Promoters of each have been exchanging spikes on Twitter, Reddit and different discussions from that point onward, and even occupied with the ongoing discussion over responsibility for. Ver didn't quickly react to a demand for comment.Adoption in trade has been low, mostly the aftereffect of concentrated proprietorship, Grauer said. Around 56 percent of Bitcoin Money is controlled by 67 wallets not situated on trades, as indicated by Chainalysis. Of those, two wallets hold somewhere in the range of 10,000 and 100,000 Bitcoin Money. What's more, odds are, the wealthiest holders are the ones sending a considerable measure of the movement to shipper administrations, Grauer said.Ver has stayed undaunted. He featured what number of exchanges Bitcoin Trade is doing out an Aug. 13 tweet, saying "the long haul cost of a cryptographic money is a component of its convenience as a cash."

Sort: Trending