Dear Steemians, the Crypto bear market took a toll on a lot of us and because of that, it might be a good idea to learn how to make a Budget Spreadsheet where we can quickly see our financial picture much more thoroughly, better plan for the future and save some fiat on the way.

It's January, you have worked through the previous year and made it: You have decided to manage a better track of your personal finance, but you are not sure where to begin.

Accounting software's, Sign Up services or Online Bank offerings for money management tends to be an expensive road to take from the get-go. Many people neglect what is probably the best choice of all. Microsoft Excel can help you to make a budget spreadsheet for yourself in a free and simple way.

Does the task seem intimidating to you or you never used a spreadsheet software before and not quite sure what it does or how to start using it?

Not to worry, using it to make a budget is simple thanks to the community. Someone has already done most of the job for you and here’s how to get started.

1) Pick Your Application

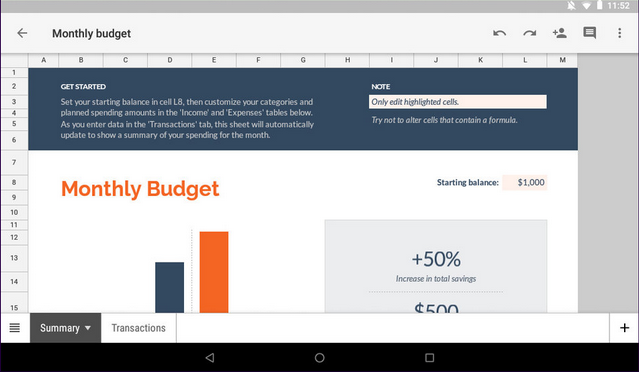

The first task would be to decide which platform are you going to use for creating and editing your budget spreadsheet file. Microsoft Excel has long been a central component of the Microsoft Office suite for Mac and Windows platforms. It comes in a subscription package or as a one time purchase. However, if you don't have it, you can pick up a free basic version of this software for Android or iOS

Some other examples of spreadsheet software are:

- Google Sheets for Android / iOS / web

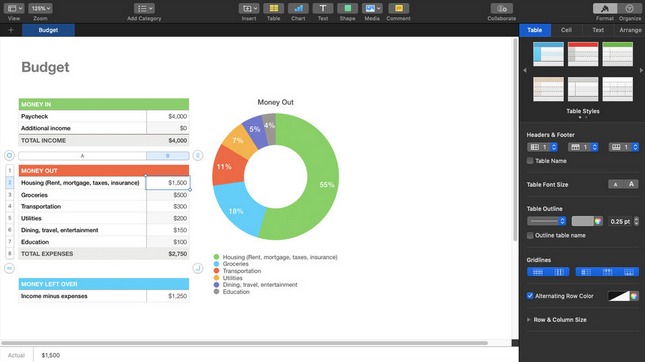

- Apple's Numbers for iOS / macOS / web

- Apache OpenOffice for Windows / Mac / Linux

- LibreOffice for Windows / Mac / Linux

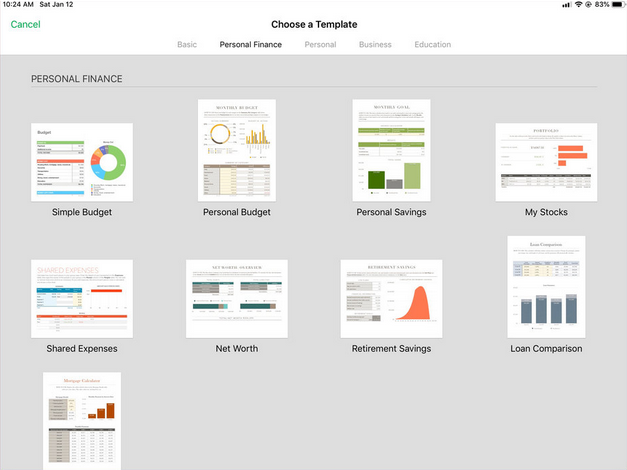

2) Pick a Template

Spreadsheet applications are around for over 40 years, providing developers plenty of time to make an intuitive platform for wide adoption.

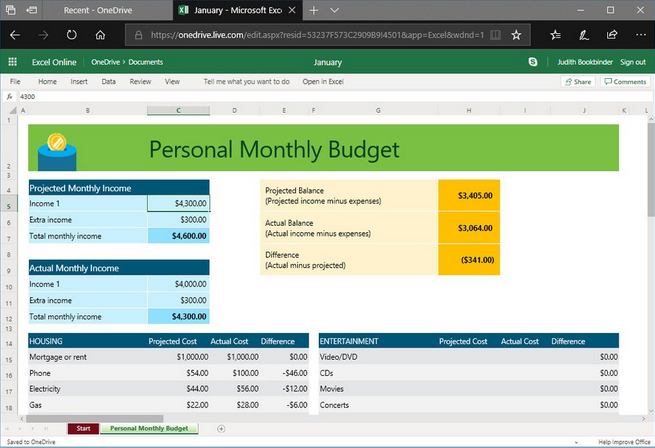

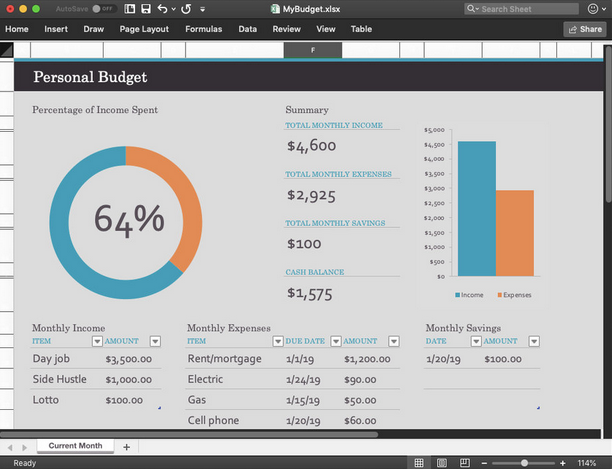

Many of these platforms have a version of "Personal Budget" template with many different spending categories, dashboard design, and various functions already implemented for you, why not to take advantage of them? All you have to do is type over the sample values with your own numbers and the application does the math.

Open your application of choice and find the "Template" or "Project" gallery. Here you can search and pick a template that best suits your requirements, like "Monthly Home Budget" for example.

In a situation when you can't find a template that matches your needs, you can make a quick search online and find plenty of other downloadable templates for free. Selection over at BudgetsAreSexy.com and The Measure of a Plan are a great example where you can find free budget templates for different needs which are compatible with Microsoft Excel and Google Sheets. In case you still didn't find a template, I would encourage you to search for Online video tutorials and software guides to guide you through building your own custom budget spreadsheet.

3) Enter Your Information

The following step would be to gather all you pay stubs, bills, statements and any other documents that show how much you made or spent that month.

These numbers need to be entered into appropriate cells on the spreadsheet. Beside your salary, your pay stub should show the money taken out for various taxes, retirement savings, and health insurance. Add all your monthly expenses to see the clear picture, don't cheat yourself. Phone bills, credit card, and power bills along with car loans, gas, insurance, rent and mortgage costs, gym expenses, restaurant dining; and shopping spree...everything.

4) Review Your Results

Once you entered all your numbers into appropriate cells, there are two main things to review:

- First, review the line-by-line accounting of your monthly finances

- Second, most templates will present you with added totals in your columns for income and expenses, so you can see your cash flow in action. Additionally, many templates even include charts to help you better visualize your condition.

5) Keep Going or Move Up to a Specialized App

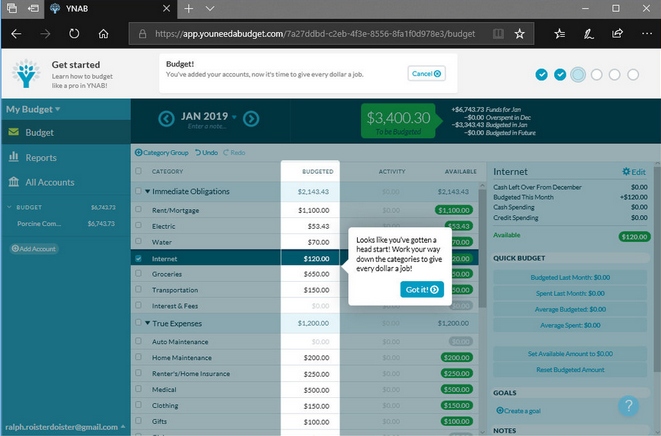

If recording your monthly budget on a simple spreadsheet inspires you to keep tracking it over the years and taking more control over it, it is then the time to consider subscribing to a dedicated platform with additional benefits of seeing spending trends, providing financial coaching and offering tips along with your journey.

Some platforms worth mentioning are:

No doubt, being diligent and updating your chosen budgeting tool takes time and effort, but it pays off. Just think of it as a map to follow the money.

This post has received a 11.75 % upvote from @boomerang.

@exgap purchased a 17.96% vote from @promobot on this post.

*If you disagree with the reward or content of this post you can purchase a reversal of this vote by using our curation interface http://promovotes.com

You got a 1.21% upvote from @minnowvotes courtesy of @exgap!

Congratulations @exgap! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!