If you're interested in Bitcoin, Ethereum, etc. then you're probably tempted by ads with mining equipment or cloud mining contracts. Many of them promise you substantial passive income and a fast return of investment - usually under one year. Can it really be this easy? Here at WALCZAK.IT we experiment heavily with cryptocurrencies and we've also build our behemoth of a rig which mines three totally different coins at once. We've experienced firsthand that cryptocurrency mining is not trivial, nor is it passive or risk-free. Here are some cons you should consider before investing in it.

Profitability changes month by month

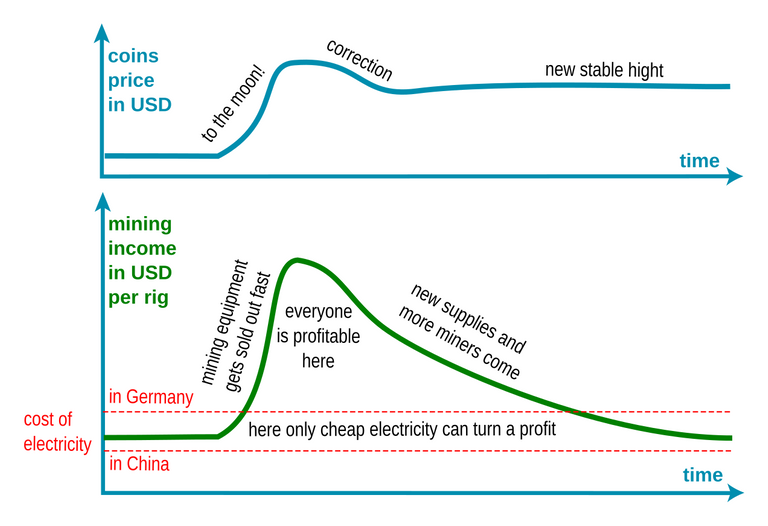

Most ROI calculations in ads look spectacular... but only in the most profitable months. They assume that all the aspects of cryptocurrency mining will stay constant during the year but the facts are as follows:

- You will get less coins each month out of your rig / contract - if it's profitable then new miners join and the cryptocurrencies network will increase the difficulty of its algorithm to adjust to the added computational power.

- Cryptocurrency prices are highly volatile - it may drop below your profitability level every day, it may also rise but this will give you just a temporary profits boost because this will attract more miners and rise the difficulty mentioned above.

A popular coin that experienced a rapid increase in price usually follows this patter when it comes to mining profitability - Ethereum being the prime example.

PS. These charts are of course very simplified trend lines. Stable in cryptocurrency means that the price has a weakly ±10% fluctuation. Going to the moon can mean even more then +50% per week.

Miners are in a constant arms race

Every now and then a new generation of GPU's or ASIC miners will be introduced to the market. When that happens your existing hardware may become obsolete fast. A new generation of hardware can often double or triple performance per Watt of electricity. The improvement is even more ground breaking if someone develops the first ASIC (application-specific integrated circuit) for a given cryptocurrency. Those can boost performance 100 times compared to CPU / GPU mining and therefore, in time, diminish income from older hardware to a fraction of their previous yeld. A good example of this was the recent D3 Antminer for the Dash cryptocurrency.

Improvement of preference was so great compared to previous mining solutions that the estimated return of investment was just 2 - 3 weeks. The first batches ware always sold out on the day of announcement. However only those who received them early made huge profits. As more D3s joined the network the difficulty rose exponentially and income per miner decreased. Two month after first people received their D3 miners the estimated ROI went up to a year... and this estimation presumes that nothing will change during that year but as you know by now... it will.

Cloud mining contracts sell you the risk

So now you know that mining is a risky business. Owners of bigger mining facilities knew that a long time ago and asked them self - how can we sacrifice some of our profits for stability? The answer is: sell hashing power in a long term contract instead of profiting directly from it. By buying a cloud mining contract you don't have to know how to construct, install or manage mining hardware but you still expose your self to the risks we mentioned above. You get a constant amount of computing power so when the cryptocurrencies mining difficulty rises you will get less coin. Besides there is also the chance that your mine will bankrupt mid contract and some of them already did.

So should I avoid mining all together?

If you're looking for passive income - avoid it. Just buying cryptocurrencies and holding them might be a better investment then mining but still, only do it if you have a good understanding of what you're getting yourself into. We offer some traning courses that might help you with that. Mining can be a great startup idea if you have the time to acquire the required know-how and you have access to either cheap equipment or cheep electricity. Installing one rig in your home or buying a cloud contract is probably not worth effort nor the risk.

Source: WALCZAK.IT Blog

Good job! Thanks to @vladimir-simovic you have planted 0.04 tree to save Abongphen Highland Forest in Cameroon. Help me to plant 1,000,000 trees and share my Steem Power to the others. Selfvoting is prohibited, but that should be the reason to spread the world to protect our precious environment. Check out profile of our conservation association @kedjom-keku and the founder/coordinator @martin.mikes to get more information about our conservation program. My current SP is 14276.19. Help me to plant more trees with your delegated SP.

Thanks a lot,

your @treeplanter

www.kedjom-keku.com

Good article :) I wanted to buy a D3 antminer but indeed the difficulty became so high so now I won't

Nice work, i do mining and you are correct

This is very true but I think those who invest on high end and top notch mining devices make appreciable profits.

Cloud contracts....... I hate them, u have to reinvest to prevent payout from dropping to zero as difficulty increases.

Keep it up.... And I like your rig, wish I had one, just for the fun of it

good shout @walczakit.. and excellent article and well explained.

nice rig btw !

Congratulations @walczakit! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPI have bult my own mining rig and have earned it back just within 3 months. First started with Ethereum and now switched to Electroneum. Find the right coins and join the right pools. At this moment i'm using https://etnpool.net for mining my ETN coins. Works fine and when ETN's value will increase the profit on my mining reward will even increase.

If you bought before the price of Ethereum and graphic cards piked then yes - it payed of fast. But still - as I stated in the article - if your counting for the price of the crypto to rise high it's much cheaper to just buy the coin.

It's worth it if you build a gpu rig or can get a first batch of new ASICs. Even at $0.10/kwr it's plenty profitable, assuming you know what to mine with what cards. You can also cycle out your gpus as the next gen approaches

No problems here, but I don't stick to a single "Coin".

I wish I read your article first.

I started off with a few cloud mining contracts.

Than went on to mine a single gpu, cpu

then built a rig.

and finally just brought direct from an exchange.

While I cannt say Im making a loss . If did this in the reverse order i would have made more money or if I just exchanged in the begining i would be even more profitable.

There are a few tactics though that will improve your return;

if a coin goes up in value fast 25% plus in a day then mining and exchange the coin for a top 20 coin will give you a good return. Currently ETC is a good example of this.

if a coin corrects(top 50 coins only) its a good time to buy and hold for 3 to 6 months at least.

If you are seeing a big rise in difficulty then its a good time to buy.

Also beware of pump and dumper! normally they will be talking up a coin but will except donations in the top 4 coins only.

Well hindsight is a b****h!

I've been buying bitcoin and ethereum via Coinbase, and then using Coinnseed to supplament that with small and automatic investiments. While it's not going to make me rich, I've decided I think that mining is not for me. Especially because I love my technology, and being unable to read print at all due to a visual impairment from birth, mining upon anything I own and care for would be a stupid thing for me to do. At least in my case; when a computer dies, I take them down hard; seems to take a part of me with it; the part of me that is attached to the device.