June 12th, Xiaomi, which is about to be listed in Hong Kong, has recently submitted a listing application for China Depositary Receipts (CDR) to China Securities Regulatory Commission. According to market sources, Xiaomi’s earlier two listings There have been timetables for the plans.

Earlier it was reported that the sales of Xiaomi in Hong Kong and CDR accounted for 70% and 30% respectively. Yesterday, Bloomberg reported another version, referring to Xiaomi CDR's fundraising amount from the $3 billion that had been transmitted earlier. Up to 5 billion U.S. dollars (about 39 billion Hong Kong dollars), the same amount of funds raised in Hong Kong as 5 billion U.S. dollars (about 39 billion U.S. dollars).

If Xiaomi is listed on the mainland and Hong Kong on July 9 and 10 respectively, its public offering will be conducted from June 25 to 28 and will be priced on the 28th. If the later plans were to be listed in the two places on July 16 and 17 respectively, the public offerings will be postponed between June 29 and July 5, and will be priced on July 5.

In addition, many of Millet's A-round to F-round investors have participated in multiple rounds of investment, such as Morningside Capital, IDG Capital, Russia’s DST Group, and Qiming Ventures, which have investments in almost every round, and other major listings. Former investors such as GIC, Shunwei Capital, and All-Stars also involved financing from rounds A through E. Therefore, if Xiaomi fails to meet the deadline, most pre-IPO investors can exercise the right to redeem.

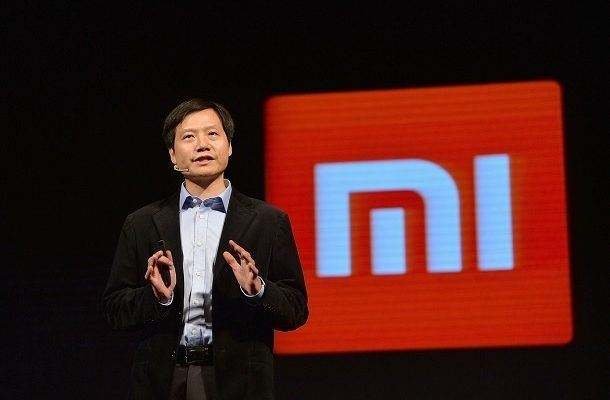

In addition, the above documents also revealed the latest developments of the company. In April, the board of directors issued a total of approximately 64 million shares of the company's shares to the executive chairman Lei Jun as “executive stock incentives,” paying up to RMB 9.83 billion, or approximately HK$ 12.23 billion. It is not uncommon for companies to pay dividends to shareholders before they are listed. However, it is rare for Xiao Mi to make "equity incentives" for Lei Jun alone.