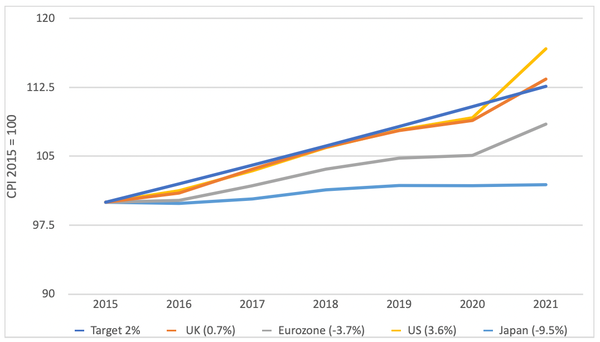

Inflation fears have been mounting. The UK annual rate hit 4.2% in October, the highest in a decade, and it’s a similar story in numerous other countries. This has been causing a lot of debate among central bankers about the best course of action. Some say this burst of inflation is transitory and will pass without any need for any intervention. Others worry that it is the start of a longer period of runaway prices, and argue that we should be raising interest rates and cutting back on “money printing” – also referred to as quantitative easing (QE), which most major economies including the UK have been doing in recent years. So far, the US Federal Reserve has started tapering its monthly QE at a fairly leisurely rate and there has been talk of rate rises on both sides of the Atlantic, but generally central banks have abstained from getting hawkish so far. But as the inflation numbers have risen and the pressure has increased, there is good reason to fear that they will put their reputations first and succumb. As far as I’m concerned, it would be exactly the wrong move. The case for the doves Inflation is like body temperature – it is not a cause but a symptom of underlying potential problems. So before prescribing any policy remedies, you first need to make the correct clinical assessment of what has caused this situation. The recent increase in inflation is not merely due to the central banks stimulating economies with QE and ultra-low interest rates. Had that been the case, inflation would have been going through the roof in the years after the global financial crisis of 2007-09, when these policies were introduced. It was not until economies reopened after the COVID lockdowns that inflation started to become an issue. There are two things to observe here. First, the situation is not as bad as some inflation fearmongers have been suggesting. In the years since the global financial crisis, it hasn’t been inflation but the risks of deflation that have been keeping central bankers in developed economies awake at night, particularly in Europe and Japan. There are numerous explanations for this deflationary period, including austerity, lack of public and private investment, low oil prices and globalisation, which helps to keep wages and other costs as low as possible. The chart below shows that inflation in the major economies since 2015 has been consistently below 2%, which is the rate that central banks want to achieve each year for stability. Inflation around the world since 2015

Even with the recent surge in inflation, the eurozone and Japan’s prices are respectively 3.7% and 9.5% lower what they would have been had they consistently followed an annual 2% inflation path. The UK is now just a little above the target path (by 0.7%), while the US is 3.6% higher – the only significant deviation in the other direction, but hardly catastrophic. One (good) cause of inflation is economic growth, and the US has enjoyed a particularly robust recovery after COVID, with 6% GDP growth expected for 2021. The fact that inflation is rising as a result of this growth is a cost worth every single cent. Second, the reason for the recent surge in inflation is not excessive monetary stimulus but a revival in global demand outstripping the ability of suppliers to cope (the so-called “disruption and bottleneck” of the supply chain), in conjunction with sharply increasing energy prices. When supply and demand get back into sync, price rises will stabilise again, since many of the deflationary factors of recent years are still likely to be true in future. This is why the likes of the Bank of England and European Central Bank are forecasting that inflation will ease next year. Even in the US, where inflation is seemingly highest, the expectation is that the recent increase will fade and that prices may even start to fall below the 2% trajectory.