Imagine life is a game (or a race), and the objective is to make the most money you can in your lifetime. Your adversaries are other people in the race as well. In other words, other people making money. Of course, this is not reality. But if it was, it might be helpful to know your rank or position in the race.

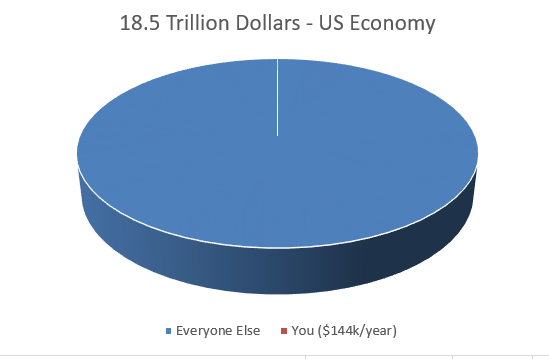

According to the Federal Reserve Economic Data, as of May 2017, there are 205 million people aged 15-64 in the United States. The BLS states as of May 2017, the labor force participation rate is 62.7 percent. This makes 128.5 million people aged 15-64 that are working in the United States. If we take the GDP of the United States, currently 18.57 Trillion dollars (World Bank, 2017), and divide that by the number of people aged 15-64 working, we get $144,513. We are not factoring in people 65 and older and people working part time are included.

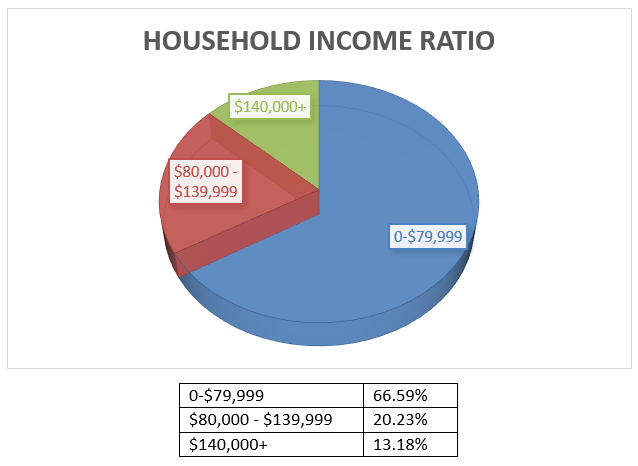

If everyone who was working got paid the same, we could each expect about $144,000 a year. According to Wikipedia, about 12% of households make that much or more a year. If you personally make that much a year, you are most likely in the top 10%. Life is not fair, and some people making an extraordinary amount of money skew the average. Therefore, it might be helpful to look at the median incomes as well.

The median personal income in the United States in 2014 was $30,960 and median household income is $59,039 as of 2017. (Wikipedia)

Now let's discuss your net worth. Net worth is calculated by adding up everything you own, assigning a dollar amount to it and then subtracting the liabilities (or debts) you owe. This is harder to caculate than incomes because some creative accounting can take place which could over value assets.

According to The Montley Fool, 2017, the median net worth of an American household is approximately $80,000, most of which is from equity in peoples' homes. While "total household weath equals $90.2 trillion" - Forbes, 2016.

If you have $80,000 or more in assets, little or no debt and are making well into the six figures, Congratulations! You are getting your fair share of the pie.

References

https://data.bls.gov/timeseries/LNS11300000

https://fred.stlouisfed.org/series/LFWA64TTUSM647S

https://en.wikipedia.org/wiki/Household_income_in_the_United_States

https://en.wikipedia.org/wiki/Financial_position_of_the_United_States

https://www.fool.com/retirement/2017/07/03/how-does-your-net-worth-compare-to-that-of-the-ave.aspx

https://www.forbes.com/sites/timworstall/2016/12/08/us-household-wealth-at-record-high-of-90-2-trillion-housing-and-stock-wealth-up/#7ff37dc26c24

Hi @adriangee, I see free competitive enrichment as just as important a liberty as the right to elementary means for survival - a philosophy that implies the necessary existence of a basic universal income, to put it briefly. To achieve this, we need, inter alia, a currency with a stable value relative to production of those elementary means. Without that we cannot resolve this conundrum of being a capitalist and a commie at the same time. But even without achieving a fair and equitable distribution of basic means, a currency like that can at the very least serve to secure the purchasing power of pensions. And I am working on a SmartCoin with that critical property. Should you be interested, there is an introduction to that on my blog. Thanks for the perspective underscored by your post! Regards.

Thanks for the post @clicketyclick. I don't believe in a socialist government but the income disparity is quite jarring.

Neither do I @adriangee.

Having been there, however, I know that in a theoretically free market society there is a poverty level below which all a person's energy and creativity is spent on survival and elevation beyond that becomes virtually impossible.

This is a serious flaw that breeds crime and enslavement. In a rich caveman environment everyone has equal access to resources and a fair distribution of opportunity to apply their talent to elevate their quality of life from rock bottom up. In modern urbanized society this is most certainly not the case.

Human-powered bureaucracies are doomed to fail by corruption sooner rather than later and tend to get bloated through laziness and other subtle forms of theft. So I agree, that is not the answer.

A decentralized mechanism that automatically distributes the minimum amount of power of purchase equivalent to the free means of survival available to every caveman is the answer.

This will provide a buffer from which all but the sickly can recover, earning an increase to their own quality of life by adding to that of others.

What I am working on is a decentralized currency with a value related to the cost of producing basic necessities that can be seen, on the one hand, as a first step in that direction, but that can also serve as functionally reliable means of trade in general.

this statistic "could each expect about $144,000 a year." really puts it into perspective how skewed it is

@marketanalysis, thank you for taking the time to read my post. Yes, it is quite jarring.