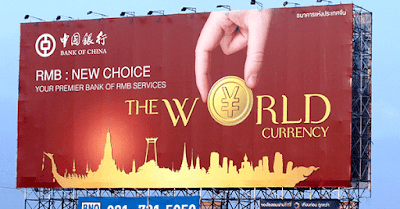

Nearly all the elements are finally in place to put to rest America's dominance over the world's unipolar reserve currency, and to end the Petrodollar agreement that has ruled global finance for the past 44 years.

Last weekend officials from China's energy exchange announced they were ready to introduce a new oil contract that would not only compete with the world's two primary ones out of London and Chicago, but it would also be denominated in the Yuan currency and available to be converted for gold should customers desire.

This ground breaking announcement however was just the start of what was to emerge from the BRICS coalition during their annual meeting in Xiamen, China.

In addition to China's new gambit to wrest control over oil markets from the West, Russia's President Vladimir Putin made a strong speech that it was finally time to end the world's reliance on a singular reserve currency.

And then, Putin delivers the clincher; “Russia shares the BRICS countries’ concerns over the unfairness of the global financial and economic architecture, which does not give due regard to the growing weight of the emerging economies. We are ready to work together with our partners to promote international financial regulation reforms and to overcome the excessive domination of the limited number of reserve currencies.”

Yet at the same time that the BRICS are seemingly ready to offer the rest of the world an alternative to the long-standing dominance of dollar hegemony, the global financial system is undergoing a change of its own as the rise blockchain technology is forcing governments to rush in to determine how it can and will be used in their own economies. And this appears to have also been taken into account during last week's forum as the BRICS have agreed to undertake the creation of a cryptocurrency that will be tied in with China's new gold backed oil contract.

While the US Dollar remains the most popular global trading and reserve currency, this is rapidly changing. A BRICS backed cryptocurrency may be both the proverbial ‘Dollar buster’ as well as a ‘sanctions buster’.

In May of this year, China and Russia agreed to begin a process of trade in local currencies. Turkey and Iran have also begun steps to break away from the Dollar.

Even more recently, China announced that is plans to allow for oil trading in Yuan which will be convertible to gold at the Shanghai and Hong Kong international gold exchanges.

The creation of a BRICS cryptocurrency could potentially retain the flexibility of current cryptocurrencies with the additional benefit of being backed by the leaders of a large economic-trading union which would give traders confidence in such a currency that many existing cryptos such as Bitcoin are lacking.

It is not certain what the exchange rate of a would-be BRICSCoin would be, but there is every chance that it could be based on a derivative of what is known as Special drawing rights (XDR) a current means of exchange which pools the values of the US Dollar, British Pound, Japanese Yen and the Euro.

A possible variation which would set the initial exchange rates of a BRICSCoin could be a combination of a gold backed Chinese Yuan, Russian Rouble, Indian Rupee, South African Rand and Brazilian Real. – Global Research

The final piece of the puzzle to end the Petrodollar and dollar hegemony may inevitably come from Saudi Arabia, who 44 years ago was the primary signatory to allowing the U.S. to continue in its role as keeper of the global reserve currency following their removing gold from backing the dollar in 1971. And belief that they will be willing to turn Eastward and ditch the United States is more a pragmatic one than political, because as of today China is Saudi Arabia's biggest customer and they are in no position to lose that revenue stream in the midst of their own financial collapse.

It appears more than ever that the BRICS nations chose well the timing of their gambit to finally put to rest the four decades old Petrodollar system, and there is very little that Washington can do about it besides rattle their sabers in the realm of diplomatic rhetoric. And with their closest allies in Europe too reliant upon both Russia and China to show too strong a stance against the ongoing change, Washington has very few options and very little time to decide whether to join with the BRICS in the emerging new financial order, or fight against it and relegate themselves to being isolated from the rest of the world.