I have been in the insurance and financial services industry long enough to witness how changes in circumstances can have a tremendous impact on how we live our lives... that is why life insurance and investments should really be prioritized, I believe. Especially by parents like us.

RETIREMENT.

DEATH.

CRITICAL ILLNESS.

Forget about death. Have you even tought about how you will sustain medications if you were to be diagnosed with critical illness like cancer, heart attack, kidney failure, etc? The costs may be more than if you were just to die by accident and buried the next day right?

Just last month we had a client who all the while thought that her only ailment was "myoma". She had an operation and thought she'll be ok. However, before her follow up check up she noticed that she was struggling to speak which got worse as days passed by. Within a week's time, she came to know that she had BRAIN TUMOR! What are the odds? She did not have any symptoms. Or if there were, they were negligible. Great thing she has critical illness cover. She does not need to worry about the medication costs should she exhaust her medical insurance limits.

EDUCATION.

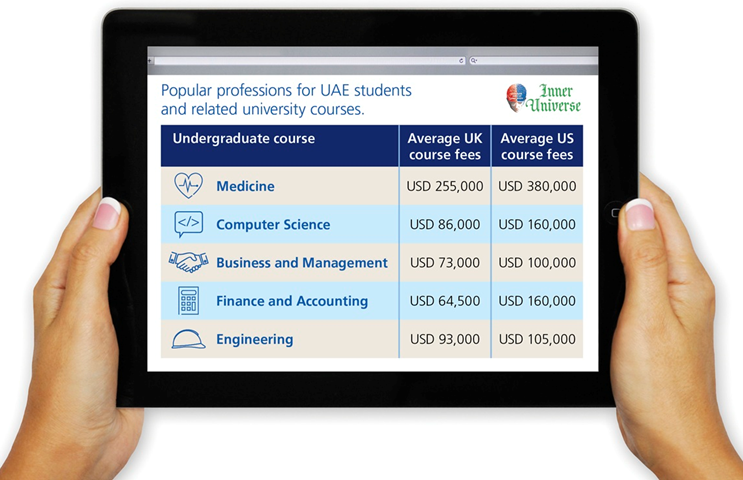

Did you know that you may spend up to USD 380,000 to send your child to US for university? That is on tuition fees alone!

Inner Universe also has a cost calculator which you can access here.

It is worth mentioning that this is only for the undergraduate courses. On average you may spend USD143,872 in tuition fees alone from pre-school to secondary years, leading to university.

Why am I even saying this? Because as a parent, up to where would you go just to give your child(ren) the best education?

We always say “Education is the only thing we can give our children which cannot be stolen away from them.” Hence no matter how hard, our parents strive to give us the best.

Knowing the advantages of good education, this is also what we would like our own children to get.

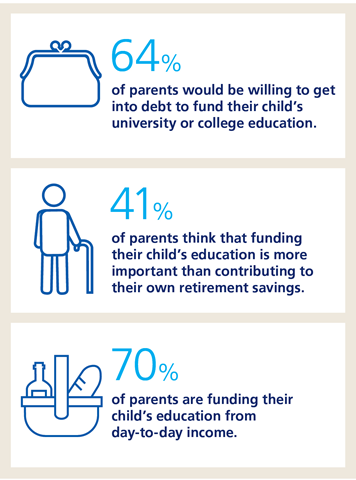

Zurich International Life's data at the right just shows that parents will do anything to send their children to school.

Wouldn't it feel better if we were to start planning early?

So why not save as early as you can?

If you were to read “The Richest Man of Babylon”, a book written by George S Clason , he shared there “7 Cures to a Lean Purse”.

1. Start thy purse to fattening.. Set aside 10% of your income.

"For each 10 coins I put in, to spend but nine."

2. Control thy expenditures. Differentiate needs from desires.

"Budget thy expenses that though mayest have coins for thy necessities, to pay for thy enjoyments and to gratify thy worthwhile desires without spending more than nine-tenths of thy earnings."

3. Make thy gold multiply. Invest, make your money work for you.

"Put each coin to laboring that it may reproduce its kind even as the flocks of the field and help bring to thee income, a stream of wealth that shall flow constantly into thy purse."

4. Guard thy treasure from loss. Carefully choose your investments. Speak to a financial adviser.

"Guard thy treasure from loss by investing only where thy principal is safe, where it may be relaimed if desirable and where thou will to fail to collect a fair rental. Consult with wise men. Let their wisdom protect thy treasure from unsafe investments."

5. Make of thy dwelling a profitable investment.

"Own thy own home."

6. Insure a future income. Plan and save for the upcoming days when you are no longer able to earn.

"Provide in advance for the needs of thy growing age and the protection of thy family."

7. Increase thy ability to earn. Seek for ways to improve yourself and your craft.

"Cultivate thy own powers, study and become wiser to become more skillful, so act as to respect thyself."

Savings, investments and insurance are facts that have been discussed even in ancient times and are still applicable in present age.

I am no financial expert, but have witnessed a lot of real-life circumstances to say that I am at least knowledgeable.

If you have savings and insurance, CONGRATULATIONS you are on the right path. If you have not yet started, then I hope from my post above I have tickled your minds a little bit. Now is not too late.

Image Sources: [1] [2] [3]

Other Sources: Zurich International Life - Helping you plan for your child's future

Credits to @elyaque for the followers and reputation badges, @merej99 for the Community Engagement Badge.

Want your own Homesteading, Gardening, Beekeepers, Woodworkers, Dads, Moms, Food Preservers, Preppers badge? Contact @daddykirbs

Page Dividers by @kristyglas

Yes, we're on the right path :-)

Me and my wife got life insurance from cocolife and hopefully an education insurance for our kid in the future.

Thank you for this post ma'am. Financial literacy is really important. I'll see if if I can read that book.

Congrats for that @rye05!...

I am also hoping we can start saving for their education soon. Right now what we have is only the life and CI cover. We are starting them on steem please check out @divinekids. I will start posting anything related to them through that account.

I wouldn't bother saving for a college education. Colleges will all but die within this generation.

Everyone has a college degree, so a college degree is worthless.

College doesn't teach any job useful skills, so a college degree is worthless.

It used to be that a college degree would more than pay for itself. Now college leaves people in more debt that they will never pay off, and can't discharge.

Everything you want to learn in college is now on UTube. So, if you just want the knowledge, have at it. For free.

The SJWs have taken over colleges. So, if you are a cis-white-male, you have to keep your head down. Don't talk to anyone. Avoid women completemente! If you do not you risk being thrown out of college.

So, unless your child wants to be an engineer or a scientist, college just isn't worth it anymore.

You have a point there, that is also why we also decided to pull our eldest out of regular school and start homeschooling instead. There are lots of practical knowledge not being learned in school. However if we'd like our child to become medical doctor for example, then we cannot teach them that in homeschool right.

Regarding people who end up burdened in debt, then that may be because of poor financial planning in addition to a lot of ther unforeseeable life circumstances

wow galing tlga ni mommy, bata pa lang inoopen na sa mga opportunities, good job, will do that to my daughter once na lumaki na sya ng konti hehe, followed them na

hehe... seizing the opportunities... anyways I am posting a lot which features them. nawala individuality ko. LOL. kaya dun ko ipopost sa @divinekids ang about sa kanila.

Ps: The book will be worth your time. It is really interesting how the investment basics could date way, way back and still be applicable in our present time.

I definitely need to work on my saving skills

That, or contact a financial advisor. The book I mentioned is great too!

Thanks for passing by @jeffjagoe!

Me too, I need to save for future purpose!

yes we do need to save for the rainy days! :D

Yeah you are right, it's good to save while you are still young, it's mathematically obvious! Great post!

Thanks, @asbonclz! Yes, insure yourself whilst you are young. That would cost you less. Save up early that you may save more for the long term. 😉

So true. We need to save not just for the future but for unseen circumstances. :)

Yeah... sabi nila rule of thumb is that you must have 10x your annual income... tas dapat you have an income buffer of 3x your monthly salary if in case you lose your job. Otherwise, "nga-nga"! haha

this is something worth upvoting @arrliinn thanks to this blog... I love this book that you mention the richest man in babylon as well...

Great eye opening post.

tip! post

Thanks @sneakgeekz...

I have read that book and it's great...!!!

Yes, very insightful and interesting right?

Yes, many of us are not legally competent, they live one day without thinking about the future. Thanks for the article.

We have to prepare for the unsure. The future is always unsure.

Great article, really got my brain working this afternoon. Appreciate the tips and it seems you are looking at the big picture, protecting your children while saving to provide them the best lives possible. And really isn't that what it's all about for parents?

I like to use crypto as not only an invinvestment for myself, but following the actions of many I respect in the crypto world including Trevon James, invest some money into coins for my children's future. Appreciate your article and looking forward to reading more of your content!

Thank you. That was the plan- to give my readers something to think about. 😉

Thanks for passing by

awesome post! thank you for this!

Welcome. I hope I was able to help with this article... 😉

Yes you did! More! :D

Interesting point. Recently the US news said that around 70% (or thereabouts) of Americans don't save. it's probably higher in the U.K. Don't know why this happens, maybe they don't understand that life is random!

Really alarming right? These countries however are more exposed to the knowledge on investments and insurances.

Talk about life insurance to Filipinos and they'd easily dismiss the topic. Either they're just skeptical or just plainly uninformed. Filipinos and other majority.

Hence I am compelled to make this post.

Thanks for reading @jvalentine!

Congratulations @arrliinn! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPHi @arrliinn! @sneakgeekz is sending you 0.1 SBD tip and @tipU upvote :)

:)

Check out the newest post from @sneakgeekz: Dji Mavic Pro Drone Beach Video Ogunquit Maine and follow if you like the content :)send tips with @tipU | earn interest in @tipU profit

Very nice post .... Congratulation bro

I'm actually planning too about getting an insurance because I know how important it is to have one. Thanks for reminding me! :)

Yes, that was the plan! 😉

An eye-opener. I think I need to focus on this which I often overlook.