Valuation Strategies for Cryptocurrencies (Introduction)

Since they began trading publicly, cryptocurrencies have been notoriously difficult to value. Much of the valuation has been speculative with volume, business adoption, or merchant acceptance being the most commonly cited metrics. However, given the high levels of volatility in the market, it's clear that there isn't broad alignment on valuation metrics.

Well, time to add a new metric to the books - commits! Cryptomiso recently released its ranking of cryptocurrencies based on GitHub commits, and the chatter has begun on what that means.

First, what is a commit?

Per GitHub: "A commit, or revision" is an individual change to a file (or set of files). It's like when you save a file, except with Git, every time you save it creates a unique ID (a.k.a. the "SHA" or "hash") that allows you to keep record of what changes were made when and by who."

...but what does that mean in English?

In short, the higher the commits, the more the developer team is changing and editing the code. One could argue that a coin with strong, long term potential should have more commits, while a coin that is either stabilized or has declining potential should have less commits.

For example, as pointed out in a recent Merkle artcile, Dogecoin has almost 0 commits - suggesting low long-term potential.

...so...can we actually use commits as a valuation indicator?

This is where it gets tricky. For starters, we don't have enough data right now to draw any sort of correlation. Second, market cap is driven by a lot of other things right now - volume, market sentiment, economic conditions, etc. If we were confident that market prices were driven by a defined set of valuation principles, we could draw more of a correlation, but it's clear that the data is really noisy right now. Finally, we have no way of telling the quality of a commit - it could be a complex recode or just changing a single letter - so volume is not the best indicator of true development potential.

...but if I wanted to try?

If you REALLY wanted to try, you'd want to look for:

- coins with a high commit number and;

- a below average market cap $ per commit

Assuming you believe in the business case of the platform, this would suggest that the developer team is dedicated to building and improving the platform and that the market hasn't quite realized the "full potential" yet. As the platform stabilizes, one could see the market cap $ per commit trending back towards the average, as the price rises and the number of commits declines.

So without further ado...

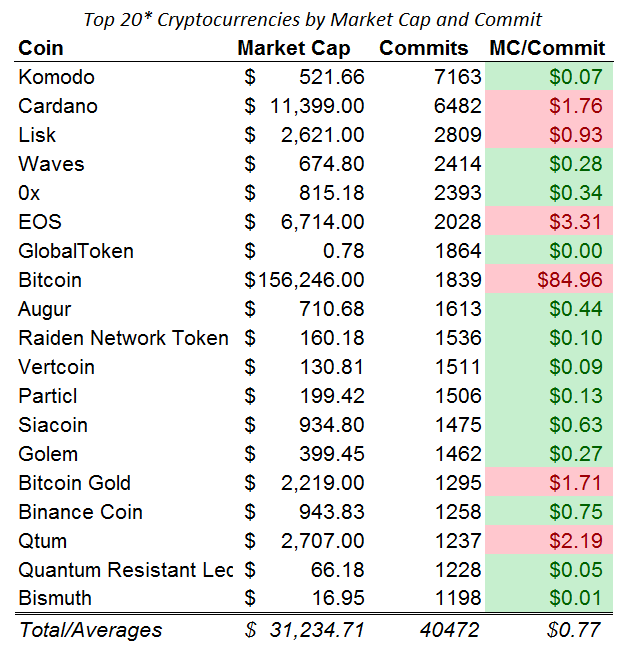

I ran a quick analysis of the top 20 coins by commit* and their market cap, based on data from Cryptomiso and Coinmarketcap as of 2/1/2018. The greens suggest a market cap $ / commit below average and therefore could signal potential long term, investment opportunities. The reds suggest, in contrast, a stable coin and platform (e.g., Bitcoin) with potentially less runway for growth.

So you bought Komodo then?

Nope, not yet. For me, this has only led me to start exploring Komodo in greater detail. But in the world of crypto, a little focusing can only help!

In the coming weeks, I plan to explain other high-level valuation strategies being used in the market so please stay tuned!

*Note: Certain coins with 0 market cap were excluded; Bitcoin was excluded for average calculation purposes; Commits calculated from 2/17 - 1/18;

Disclaimer: This is only my opinion and is not a recommendation for a certain investment action or strategy.

Insightful analysis! Didn't know what a commit was until now. Do you have stats on steem and bts MC/commits? Would be interesting to see how they stack up against the rest.

Thanks @dirkboy41! Looking to build out a more robust database - they don't rank in the top 20 notably but doesn't mean there isn't some activity. Stay tuned!

Excellent post. Something worth exploring for sure.

Any edge we can get in trading is exploitable. I am looking into correlations between Google search data and Currency price.

Thanks and agreed! I've long held a hypothesis that google search data has some directional value in predicting prices. Would love to see what you find

Nice way to look at it, I am curious if you came up with this idea or heard about it?

Thanks - I'd seen people mention commits but I haven't seen a market cap/commits analysis, which on its face seems like it could be directionally helpful. Not sure it's the right way to look at it yet but crypto is in a great place where we have some opportunity to explore and exploit strategies

Totally agree with your perspective on this. I am definitely going to pay more attention to the commits.

Idk about prices, but this is the first thing that I look at in ICOs. When there's not daily activity on github then I seriously question wtf they are doing.

Agreed, all the whitepapers in the world are meaningless if the team is just sitting on their hands

You got a 17.70% upvote from @minnowvotes courtesy of @bigtx31!

50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP Don't delegate so much that you have less than 50SP left on your account.This post has received a 27.94% upvote from @msp-bidbot thanks to: @bigtx31. Delegate SP to this public bot and get paid daily:

Thank you bigtx31 for making a transfer to me for an upvote of 1.23% on this post!

funds growth projects for Steem like our top 25 posts on Steem!Half of your bid goes to @budgets which

The other half helps holders of Steem power earn about 60% APR on a delegation to me!

For help, will you please visit https://jerrybanfield.com/contact/ because I check my discord server daily?

To learn more about Steem, will you please use http://steem.guide/ because this URL forwards to my most recently updated complete Steem tutorial?

Thank you bigtx31 for making a transfer to me for an upvote of 0.80% on this post!

funds growth projects for Steem like our top 25 posts on Steem!Half of your bid goes to @budgets which

The other half helps holders of Steem power earn about 60% APR on a delegation to me!

For help, will you please visit https://jerrybanfield.com/contact/ because I check my discord server daily?

To learn more about Steem, will you please use http://steem.guide/ because this URL forwards to my most recently updated complete Steem tutorial?

Hello, we are Project Araneobit - money transfer system based on the blockchain. The Commission for money transfer is set independently.

You can invest money