Over the past 9 years the equities bull market has been front and center in the news with good reason. This has created an environment where commodities have never been cheaper relative to equities. Although the stock market continues to achieve new highs seemingly weekly, the commodities trading floor is rather dull.

"Typically wild price swings, massive upcycles, exciting resource discoveries and extreme weather events all playing into things, there’s usually never a dull day in the sector,” writes Visual Capitalist’s Jeff Desjardins. “That being said, it’s hard to remember a more lackluster period for commodities than in the last couple of years.”

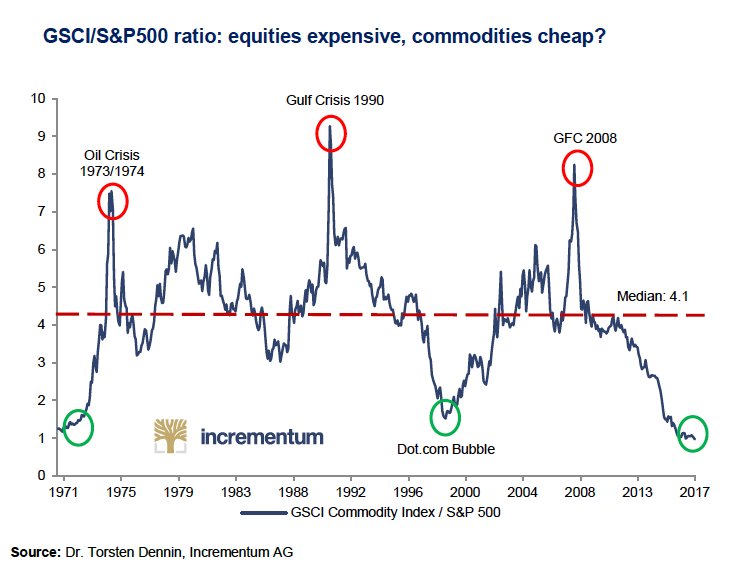

This chart from Incrementum AG suggests the turn of tide is near for commodities. And in reality, how low can they really go?

What's interesting about this chart, as shown above, is the divergence reaching historic levels due in part to a 200%-plus move in the S&P 500. For comparison the Goldman Sachs Commodity Index saw a 31% decline over the same period.

The market saw similar happenings in the early 1970s and leading up to the dot-com bubble in the early 2000's. In both of those scenarios stocks began to crumble.

This all begs a great question, will it be different this time? Or is history due to repeat itself?

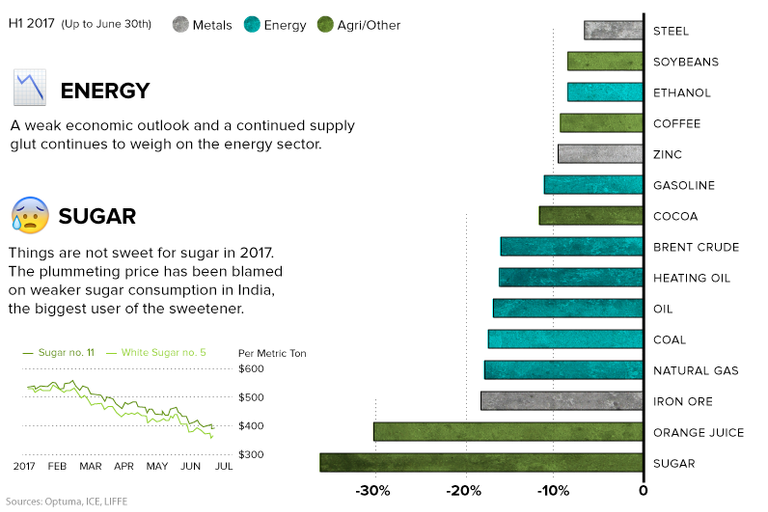

It has been a rough year overall for commodities with many such as oil, sugar, iron and natural gas suffering double digit losses YTD. Ouch.

For commodities traders, times have been rough but at least it has found a bottom. Luckily for commodity bulls there hasn't been a better opportunity in the last 10 years to jump in.

Personally, I have benefited from the equities bull market but everyone knows it is due for a correction in the coming years. Meaning commodities are bound for a rebound soon.