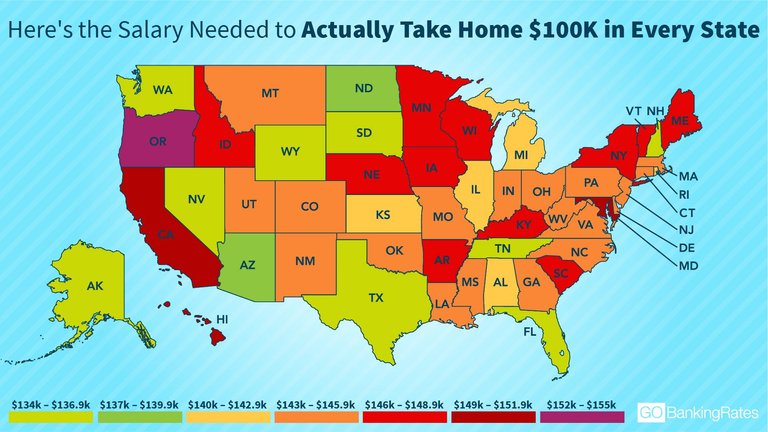

For many American workers, earning a six-figure income is an impressive milestone. But it might not mean as much after accounting for state and local taxes, particularly in places like New York, California and Maryland.

To see how much you really need to take home $100,000, personal finance site GOBankingRates determined the exact salary, weighing federal, state and local taxes plus withholdings. (With the Tax Cuts and Jobs Act, now is also a good time to take a look at your tax withholding at work.)

In Oregon, that comes out to $152,810. Since the Beaver State doesn't have a sales tax, high income taxes make up the difference.

Alternatively, residents of Nevada and New Hampshire need only to earn $134,629 on paper to take home $100,000 — that's largely because those states have no income tax on wages and salaries. (New Hampshire does tax income from dividends and interest but Nevada is one of seven states with no personal income taxes on wages, earnings or investment income.)

Article written by Jessica Dickler https://www.cnbc.com/2018/03/20/how-much-you-really-need-to-earn-to-take-home-six-figures.html

https://www.cnbc.com/2018/03/20/how-much-you-really-need-to-earn-to-take-home-six-figures.html

Thanks for the info. Never knew that the tax system is different in various state in America. In Australia that is controlled by the Federal Government and it's all one rule for all the states. If ever considering living in America then Nevada is the state to be.

No wonder I got much less paycheck since I moved from FL to CO.

Some other states have the same lower tax rate as Nevada, eg Florida, New Hampshire, Texas, Tennessee,Washington state ...etc....hope your Australia tax rate is lower than us in US. If so, I will be happy to move there...

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.cnbc.com/2018/03/20/how-much-you-really-need-to-earn-to-take-home-six-figures.html

I couldn't believe how much taxes we are paying...

How much is the tax for gains on forex?

Here in Italy it is 26%

that is a lot in italy.

here it depends. we called it capital gain tax

Taxpayers in the 10 and 15 percent tax brackets pay no tax , taxpayers in the 25-, 28-, 33-, or 35- percent pay a 15 percent rate . For those in the top 39.6 percent bracket for ordinary income, the rate is 20 percent.

Here 26% fix, indipendent from other incomes.

Losses are still recoverable for some following years