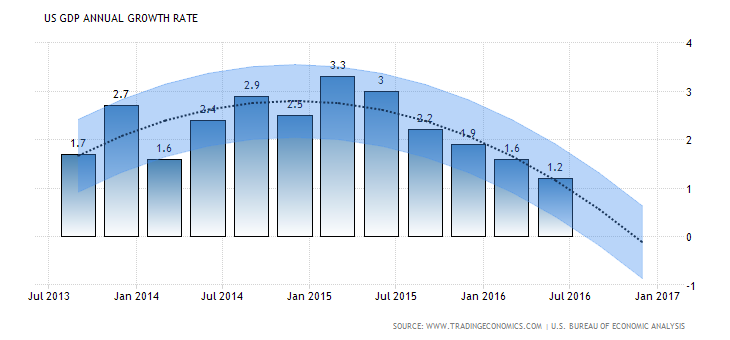

The last couple of years the Federal Reserve has been talking about raising rates and talking about the so called US economic recovery. Of course in reality the recovery has been anemic at best and the fact the fed funds rate has only increased a paltry 25 basis points.

So if everything is so great in the economy and the unemployment rate is so low why don't they just go ahead and raise interest rates. The truth is they cannot raise rates without causing a huge recession and blowing up the deficit, here is the proof.

You will notice on the chart the GDP stopped growing right around the time the Federal Reserve raised rates back in December of 2015 by 25 basis points. It was likely starting to slow before the rate hike, by keeping rates this low for so long reduced the effectiveness in terms of stimulating the economy. The U.S. economy is barely growing despite highly accommodative monetary policy from the Fed.

Chart number 2 shows the growth of debt accelerating especially after 2001 this was at a time when Alan Greenspan the Federal Reserve chairman starting playing around with low interest rates trying to spur the economy. Of course Ben Bernanke and Janet Yellen have doubled down and continued this radical monetary policy approach by keep rates at historically low levels. The low interest rates have fueled the largest debt bubble in history and it is only a matter of time when it will burst.

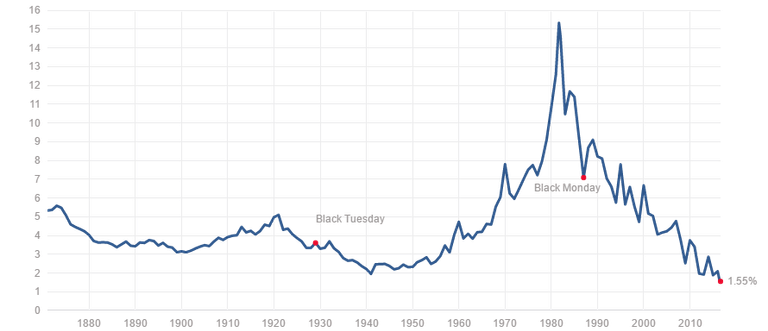

This is the interest expense on the debt, you will notice the amount of interest is starting to increase each year because the debt pile is growing. Not showing on the chart is 2016 which is expected to come in at $457 billion almost half a trillion dollars in interest alone. You can imagine if interest rates were normalized what the interest expense would be.

The last chart the interest rate on the 10 year treasury the actual mean on this note is 4.59% compared to the 1.55% we see today. If rates were to be normalized the yield on the 10 year would be about 3 times higher therefore interest expense would be 3 times higher as well. Essentially the interest expense would be about $1.4 trillion, when that happens the debt would explode higher and the government would have no choice but to cut spending drastically or raising taxes or both. Either way this will crash the economy, hence why the Federal Reserve cannot raise interest rates.

Despite the doom and gloom the fed does need to normalize interest rates in order to undue all the damage they have done over the years with their monetary experiment gone bad. It will bring about a great deal of economic pain however this needs to happen so the free market economy can fix all the mistakes of the Federal Reserve and the government mismanagement that has occurred over the years.

As a hedge and insurance against the fiat system Gold, Silver and Crypto are my choices. Good post.

I never used to pay much attention to precious metals and crypto however once I opened my eyes and saw what was going on I decided to divert half of my money away from the fiat system.

Good choice..keep stacking

The same problem exists in the uk and Europe is now facing negative rates, The U.K. rather than provide stimulus has gone for austerity which in turn fuels a lower wage economy so we are in a race to the bottom, stimulus if done in the right way keeps people in employment paying tax in as the economy improves you take the stimulus

Ila's back to pay the deficits , this is a total why the conservatives hate this policy and opt for sheer ausrity by crippling and finding any means to get money back from civic services does who are then put out of work drive the fuel for the deficit rising, the banks have walk away now they have been funded and are not putting the money into new business unless they get equity in your house, this is not business funding that they are doing its personnel loan secured in your house so it's win win, second it now costs a first time buyer upwards of 30.000 pounds to get a loan for a house so we now have people who will have to live with mum and dad well into their late 30s forget renting as this eats away at any extra money you could save. So hold on tight this ship is going down no matter what the captain says

nice post..gold is the safe haven..if you invest/trade, check out this gold mining 3x bull etf called NUGT

I agree gold is real money and will continue to increase in value while the money printing continues. NUGT has done well, I purchased a couple of gold stocks and done really well, I also own some physical gold.

raising interest rate will slowing down economic growht

Yes it will slow down economic growth, in fact the economy is barely growing with rates at all time lows. That is why raising interest rates would crash the economy. This scenario is unpleasant however keeping rates lower for longer will cause far more damage down the road. Of course the fed will not do this because they know what the consequences are.

Thanks for the visuals. I wonder how long the Fed will go before acknowledging they backed themselves into a corner with ineffective policy? It would be nice if they just admitted they had made a mistake, informed the public they were going to change course, and proceeded to raise rates (at least to levels commensurate with inflation). Yes, in the short-term markets would correct and economic numbers would probably continue to soften, but it would restore confidence in the system over time.

Hey great stuff. Ive been telling this my wife. I also just wrote this article about the aubject. Please checknit out and let me know what u think: https://steemit.com/politics/@knircky/steem-for-the-win-i-don-t-care-who-wins-the-white-house

The Fed should be the #1 issue in this country...

Great article, I have referenced you in one I am writing about a similar subject.

I would be honored if you would check it out: https://steemit.com/politics/@knircky/steem-for-the-win-i-don-t-care-who-wins-the-white-house-pt2

Thanks for the reference. I will check out you article and follow you as well. Thanks again.