Smart Money Vs. Dumb Money

An indicator that the uninformed investor doesn’t use is one they should. After a tumultuous decline in equity prices around the world, the average investor is wondering what gives. Historically, market volatility shows up around market tops. Millennial investors are not used to a lot of volatility, as we were raised in a time with unprecedented market intervention. Panic seems to set in and logic subsides. Inflexion points occur, and we may be there right now. An indicator that should be followed is the Smart Money Index and money flows of the S&P 500.

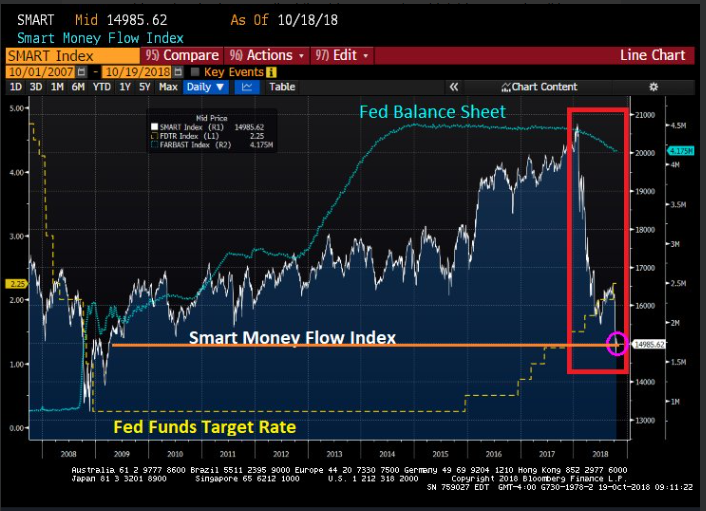

Smart Money Index

The Smart Money Index measures market sentiment and the flows of capital in and out of the market. As you can see, the beginning of the year brought about a major confidence shift. We’ve seen smart money selling to dumb money (retail investors) all year. When you look at the reduction in the Fed balance sheet, you can see the decline. When the supply of assets on the market is diluted, asset prices will fall, and the dumb money doesn’t pay attention to this.

Smart Money

It is no coincidence that higher interest rates have led to stock market volatility and a housing slowdown. New mortgage applications are at 20-year lows and every statistical measure in the housing market is down. Existing home sales are down 6 months in a row, as mortgage costs are increasing daily. If you look at the S&P 500, you can see 100 stocks above the 200-day moving average are nonexistent. Stock market gains are now gone for the year, and we are in correction mode.

Cheers,

Colin

To read more plase visit: http://thecurrencynomad.com/smart-money-vs-dumb-money/

Congratulations @cbenn! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard: