Hello Steemit Friends:

Today I would like to share with techniques and information on improving and reaching a higher credit score within 1 year. This assumes you currently have no credit history or any existing delinquencies. In the US (and even other countries) credit is everything. It gives you the power and flexibility to make small and large purchases, allows you to get loans at more favorable interest rates, cheaper insurance, and even a new cellular plan. It is an aspect that can affect every part of your life.

Why would you want to improve your credit?

Today, most large purchases and even some small purchases require some level of credit history in order to qualify. Without an adequate amount of credit, you will find making purchases or even small things like getting a cell phone plan will be more complicated. Below are just some examples you may face if you do not have an established credit history:

Cell Phone Carriers will generally run a credit check to determine what plans and number of lines you qualify for. If you have no credit history or a questionable credit history, a deposit may be necessary in order for you to secure a plan.

Renting and apartment may require you to provide additional months deposit as well as a security deposit if you do not have an adequate credit history.

Without an established credit history, taking out a loan may be more of a challenge and would require you to provide additional documentation in order to get approved. In most cases, establishments will not approve you or even charge you a higher interest rate.

Why am I writing this post?

Many people don't realize the value of good credit until they need it and don't have it. You may even know about how credit works, but it never hurts to refresh your memory to keep yourself in check. Since Steemit has a variety of people of all ages, Im hoping this will also help our young steemians who are just starting to establish their own credit and avoid making mistakes that I made when I started

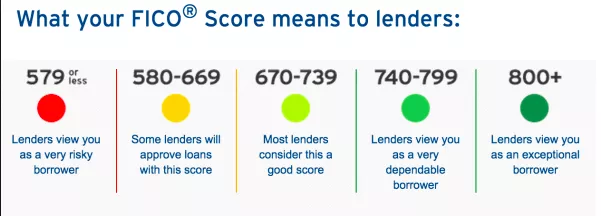

I myself did not realize how credit worked until it was too late and I had already destroyed my credit history. Over the course of 7+ years I clawed myself back to an 800+ credit rating and essentially started again from scratch to get to where I am now.

What you should know

Good credit can help you get loans — like a home mortgage or a car loan at lower interest rates. It can also help you get approved for an apartment or cell phone plan without hefty deposits, as well as avoid utility deposits, and get you lower insurance premiums.

Aside from credit-building, credit cards have many other perks. Many cards offer cash or travel rewards which you can use at anytime to save you money. They can also offer you purchase protection, price protection, extended warranty, rental car insurance and even allow you to spread out your payments for purchases over a longer period of time at no interest at all.

How to establish (or in my case - re-establish) your credit history

Typically your initial credit card application may be rejected if you have no previous credit history. If you have a bank account with regular deposits and a balance you can ask your personal banker to help by submitting a recommendation on your behalf stating that you would like to begin establishing your credit. Generally Banks are happy to help you with this, especially if you are a good standing customer.

If you do not have a bank account, you should look into opening one (I know most of us don't trust the banking system, which is why a majority of us support cryptocurrencies.) A bank account is not very difficult to establish and usually only takes a few requirements.

The second option is to find a credit card or institution that is geared towards people who are interested in establishing their credit (typically you will start with a lower credit limit) such as Capital One. In most cases Capital One has a higher chance of approving new credit user applications. It was the first credit card I received when i was young and it was the first credit card I was approved for when re-establishing my credit. There is also the option to apply for a secured credit card, however I would not recommend that and only use that option as the last resort.

Once approved, you may notice that your credit limit will be low - especially for first time or recovering credit applicants. Your credit limit will probably be around 500 USD. As you begin using your credit card for purchases, I would recommend paying the entire balance off on time on or before the due date. As you build your history you will begin to receive other credit card applications.

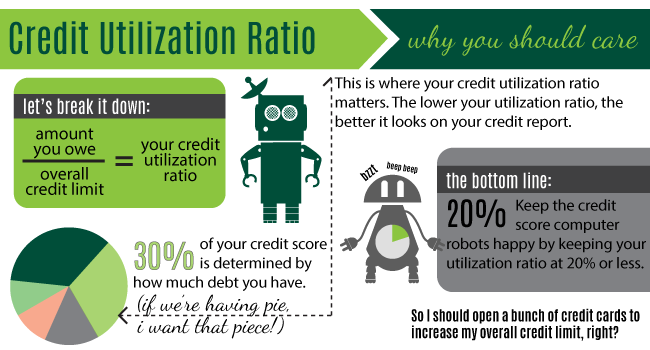

You will want to watch your utilization. This is a calculation of the amount of credit you have vs the amount of credit you have used. You generally want to keep your utilization low - typically below 20-30% as it is a factor in calculating your overall credit rating.

As you start getting more credit card requests and applications you may want to consider applying for additional credit cards. You may think it is bad to have more credit cards, but it actually is quite the opposite. The reason being that having more credit cards allows you to have a higher overall balance reducing your overall utilization. Keep in mind though that applying for too many credit cards in a short period of time will have an adverse effect on your credit rating, so apply for only a couple.

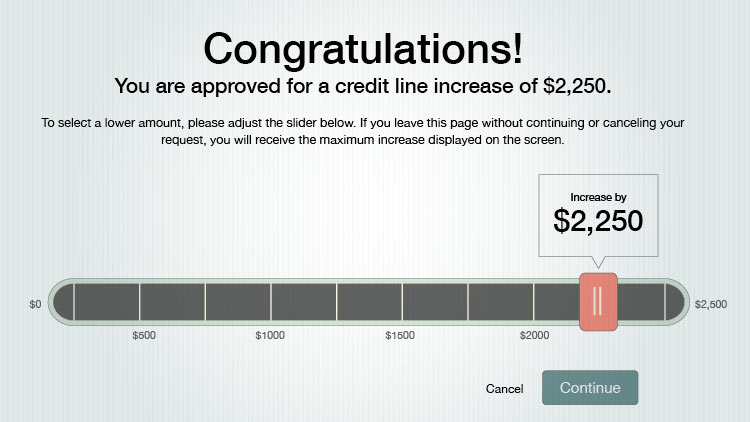

About every 6 months - especially with Capital One, I requested a credit increase. With a good credit history, they will typically double your existing limit. It also does not impact your credit because a soft credit pull is done, vs some other cards which do a hard credit pull which negatively impacts your credit temporarily. The second and third credit card I applied for was the Chase Freedom and the AMEX Everyday card (roughly 6 months after the Capital One Credit card and after 1 credit increase from $500 to $1500). My Chase Freedom card came with a $1500 credit limit and my AMEX card came with a $5000 credit limit. This increased my overall credit balance to $8000 dollars allowing me more spending power without impacting my utilization.

This is where I need to remind everyone that you shouldn't spend what you don't have or can afford to pay off. Credit cards come with a lot of temptation and one can easily get caught in the buy now pay later scheme , which is what banks rely on when it comes to credit. If you aren't careful, you may find that you have spent more then you have when the bill due date rolls around.

I continued to use my credit cards and pay the balance in full on or before the due dates and as the time to request a credit increase rolled around again, this is where I added another strategy. I decided to pit each establishment against once another. Chase performs a hard credit check on credit increase requests, so I waited for them to automatically increase my credit, which they did to match my AMEX credit limit at $5000. I called Capital One to request a credit increase, however this time I added that my other credit cards gave me a higher limit and that wanted to use my Capital One as my primary credit card and requested more then just double the credit limit. Because of my usage history, they increased my limit to $10,000. I then called AMEX and said the same thing and they increased my limit to $15,000. This increased my overall credit balance to $30,000 and as a result, by the end of the year had a credit score of around 720.

I continued to follow the same process every 6 months until today where my credit score is now at 800+. Incidentally I have also added a couple more credit cards and 1 small low interest loan to help drive further improvement.

Please Follow, Upvote, Comment, and Resteem if you found this helpful and enjoyable and let me know what you think in the comments below

Image Sources: [1] [2] [3] [4] [5] [6] [7] [8] [9] [10] [11]

As a broke student with loans I am reading the post like this right now

I was in the same boat one time. I also racked up a good amount of credit card debt as a student. Good Luck!!

I love the toon btw - so perfect for this!

This post received a 3.1% upvote from @randowhale thanks to @cloh76! For more information, click here!

It is good to know that there are steps one can take to increase his credit score however, I would like to know how one can also mess up his or credit score. I am particularly happy about your warning about spending beyond what one can afford to pay back. Great post indeed!!!

Great Idea for a follow up post. Having experience in both establishing credit, messing up my credit, and re-establishing it, I think it would be a great follow up post!

I will be watching out for it.

Good post. Keep on sharing.

Thanks for the feedback. I definitely will!

Refreshing to see post in here that is not about cryptocurrency :).

Credit and credit scoring is need fascinating, I recently came across some of the different services that help you check your credit for free, Credit Karma in the US and companies like ClearScore and Aire in the UK. Looks like you put a lot of thought and work into this post. Thank you.

Thanks. Yep those are good resources. You can also use Credit Journey, Nerd Wallet, or request a free credit report annually. Most Banks also have there own tool when you login as well that refreshes every 7 days.

Thanks for the support!

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by cloh76 from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, and someguy123. The goal is to help Steemit grow by supporting Minnows and creating a social network. Please find us in the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you like what we're doing please upvote this comment so we can continue to build the community account that's supporting all members.

This post has received a 7.87 % upvote from @booster thanks to: @worldtraveler.

Credit is a horrible and wicked system, pay cash.

It is. Too bad it's so difficult to live without it. Hopefully Crypto will change the system

You are right, it is difficult to live without it. It took me awhile to get free from the credit system. I do believe cryptos will change the world.

You should write a post on that Im sure many people would like to free themselves from the credit system :)

Congratulations @cloh76! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!