With the main stream financial media talking up equities, the economy, and the "recovery," many are convinced that nothing can go wrong. Many are convinced, but some of us know that things aren't quite right in the investing community.

It's impossible to ignore the run up in stocks since the election of Donald Trump, and the retail investors are piling in. What's behind this? Optimism, pure and simple. Fundamentals, earnings, GDP, debt, employment and all other objective measures mean nothing to these markets.

What actual metrics should we use to determine fair value? Why do some experts think stocks are in a bubble and some experts see years of growth?

Earnings seem irrelevant these days and some companies (Tesla, Amazon etc.) have no profits, P/Es in the 100s, and valuations that are making the Tech Bubble valuations look reasonable. Debt is enormous. Commodities and retail stores are screaming recession. Real unemployment, labor force participation rates and wage growth are screaming depression.

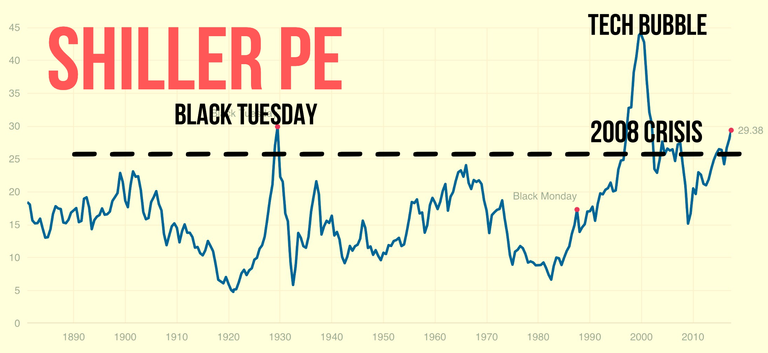

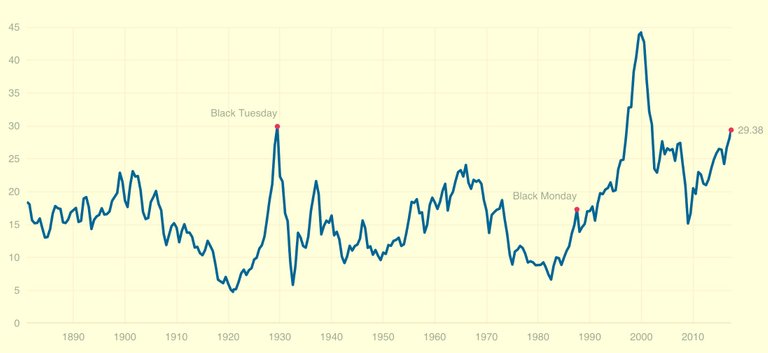

The first place I look for a broad view is the Shiller PE. (http://www.multpl.com/shiller-pe/). This ratio takes out some of the short term volatility and gives a birds eye view of history. Take a quick look at these charts:

The Shiller PE has only crept beyond a ratio of 25 in the last 137 years, only three times. Each time there was a global crisis waiting on the other side: the Great Depression, before the bursting of the Tech Bubble and the Financial Crisis of 2008. For 137 years of data to only show this number breached four times, this information should be chilling to investors as we are again approaching a 30 ratio.

These event were not merely corrections, not merely business cycles; these events were crisises on a global scale. What's coming around the corner? Nobody knows, and as @marketreport, Greg Mannarino says there is no use in speculating as to "when."

Just look at the last 140 years and decide for yourself whether or not we are ready for a major event.