Precious metals are generally a very unloved asset class, which is understandable because over the years they haven't exactly yielded amazing returns compared to the stock market or cryptocurrencies (mostly due to manipulation in the metals markets though). But here are a few reasons why you should actually consider buying metals or mining stocks.

1. Inflation is Kicking In and the US Dollar Keeps Weakening

Wednesday's inflation report came in higher than expected. This made precious metals spike because high inflation is directly linked to higher metals prices (higher prices for the stock market too). Inflation is going to keep getting worse and the fed isn't going to care to stop it. Money supply has quintupled in the last 10 years! This theoretically means that the prices of everything in general should increase by a factor of 5. This won't happen overnight but it is certainly kicking in.

Foreign countries are starting to ditch the US Dollar as their reserve currency for international purchases and are starting to use their own currency instead. A lot of this unused currency is going to make its way back into the US which will cause even more inflation and devaluation of the US Dollar. The USD is currently near a 3 year low. Looking at the chart below, you will see that the dollar has been on a steady decline since December of 2016. I anticipate that this decline is going to continue because that's where the fundamentals are pointing to in my opinion. All of this inflation is a positive for precious metals.

2. Growing Demand For Metals and a Low Supply

Countries like China and Russia are buying up Gold in large amounts, as well as a few other smaller countries that see the true value of it. Also, over half of the silver that is produced is used for industrial purposes. The same goes for platinum...a high percentage of production is used up for industrial purposes.

For silver, the silver supply was in deficit by about 147 million ounces in 2016. For platinum, according to this years quarterly report, they are expecting a 275,000 oz deficit this year caused by an increase in demand for jewelry and industrial usage.

3. There Will Always Be Value

Unlike the risks associated with investing in certain stocks or cryptocurrencies, precious metals will always have a base value and demand so you will never actually lose a huge portion of your money (assuming you buy at current prices). Gold can never go to $0 per ounce and neither can silver/platinum/palladium etc.

4. The Stock Market Will Crash/Have a Major Correction

As I've said in one of my other posts:

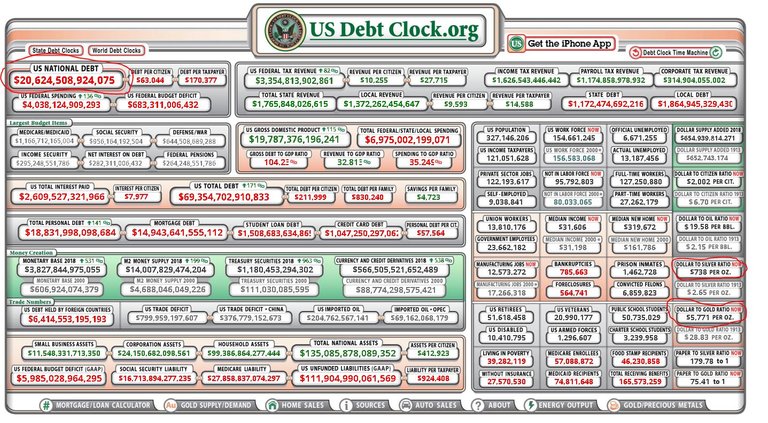

Metals are a flight to safety as well so they will shield you against any massive drops in the stock/crypto market. When the market crashes, metals will most likely rise and outperform stocks (they may drop in the initial market crash). The US has a terrible debt problem. As you can see below, there is 20 trillion in debt and the dollar to silver ratio is $738 per oz. That is much more than the current price of silver which is around $17.

The Stock market has risen to bubble levels over the past few years because the Fed keeps artificially raising the market value. While this can keep continuing for a while, eventually the market will come down hard. Money velocity is near historic lows which means that the economy is not actually booming at all; we are in fact entering a recessionary period. Recessions are always positive for precious metals. Here is a quote from an article talking about Gold.

If it were to ever reach its TRUE value (which could happen in an economic collapse) it would be well over $5000 per ounce, just like the dollar to gold ratio in the picture shown above. Also, the dollar to silver ratio is over $700 per ounce, just take that in...

The Q Ratio and Why it's Important

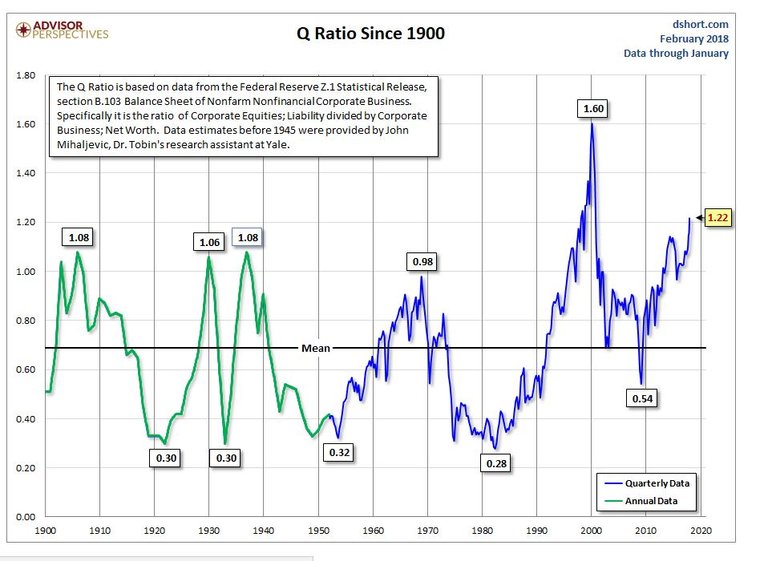

Essentially the Q Ratio is a calculation for taking all the value of every stock on the stock market, and comparing it to how much it costs to replace all the assets of those stocks. Any time that the Q Ratio is near a valuation of 1 (or higher) it is a bad sign for the market. Take a look at this chart below of the Q Ratio.

Currently the Q Ratio is at 1.22! That is insanely overvalued. The only time it was ever higher was just before the dot com crash. But as you can see from the historical chart, every time it has passed a valuation of 1, the market crashed soon after and the ratio went to undervalued levels near 0.30. For us to be at 1.22 right now is a big tell in the overvaluation of the stock market right now.

I do however believe that the stock market isn't done going higher just yet, as the markets are being manipulated by greater powers, but it will come down eventually.

5. Silver to Gold Ratio

The Silver to Gold Ratio is currently around 80. This means it takes about 80 ounces of silver to buy one ounce of gold. Historically, the ratio is somewhere around 40. If the ratio corrects to historic values (which it should), silver will outperform gold, making it more undervalued than gold at this current moment. So perhaps silver is the most undervalued precious metal?

6. Platinum vs Gold

Platinum is 30x rarer than gold and is historically 2x more expensive than gold. Currently, it is actually $350 cheaper per ounce! According to just those statistics, and the fact that platinum is also somewhat viewed as a safe haven, it is even more undervalued than gold. I anticipate that it will outperform gold in the coming years to make its way closer to historical pricing in relation to gold.

In conclusion, you should definitely consider adding precious metals to your portfolio, as they are currently undervalued (especially silver). If you REALLY believe in precious metals and want even bigger gains, another option would be to buy precious metals mining stocks. They almost always follow the metals markets, just in a more leveraged fashion. Be careful not to pick a bad company though, look through their fundamentals!

This is not financial advice, just opinion. Thanks for reading!

A nice update from you boss ..... Keep thrilling us with the news across the globe..... Re-upvote

Thanks boss!

You are welcome!... It good to view this awesome post!... Up vote me please

Congratulations @dre-investments! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

1 Year on Steemit

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @dre-investments! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!