We all use our national currencies but few people understand what they actually represent. The system is made complex by design so it is hard to understand. And if one looks into how it works it is so ridiculous that people will not believe it anymore or think they did not understand correctly because this simply cannot be true.

Lets start with the generation of money. The state issues bonds, wanting money and promising to pay back more in the future. These bonds can be deposited at the central bank as a security in order to gain the actualy money. That money is then used to pay the state for the issued bonds. In essence money is generated via debt. There is always more debt in existence then there is money.

But it does not stop there. The banks can create money on their own. When a bank has a certain amount of money, they can lend that money out. This lending is controlled by the fractional reserve banks have to keep according to the law. So when I give the bank 100$ my account says 100$. But without changing that number the bank can lend out 90$ to another person. Now we have 190$ in circulation, where 100$ are physical notes and 90$ are digital money created by the bank. This maybe does not sound too bad. But now when these 90$ find their way back to the bank, the can lend a fraction of that out again. In total this cascades until the 100$ of physical dollars represent a digital money supply of 1000$.

That means that the bank can lend out my physical 100$ ten times! and collect interest rates on all of these lendings. It also means that when people go to the banks to get their money back there will not be enough money because the supply has been inflated by the banks. If a private persons start such a scheme and lend money that they dont own, stabilised only by a growing userbase, we call it a pyramid scheme, but for banks this is business as usual and it is tolerated by the state. Again all created money is based on debt.

What are the consequences of this monetary policy? First since all currency is rooted in debt it is necessary to create more money because there is no way to pay back the debts with the current money supply. The inflationary nature is hard coded into the system. Currently we are looking at an increase in monetary base of about 6% a year. This may not sound much but over only 12 years this is already doubling the money supply.

The inflation rates may be somewhat lower than these numbers, but that is caused by increased productivity. If the productivity increases with the money supply then the buying power is unchanged. But this does not matter as increased productivity should mean that you can buy more for your money.

Now if you privately save money and the money supply doubles, then that money has lost half its value. Where did that money go? Since increasing the money supply is a zero sum game, the value is now transfered to whoever is issuing that money. The banks and the government. So over just 12 years, they will take half of your money. Good luck saving for a pension in fiat currency.

It also affects future generations. The bonds issued by the state are secured to the potential taxation of future generations. The state is taking your pensions and selling the future of our children to hide the real costs of operating it via fake money and inflation.

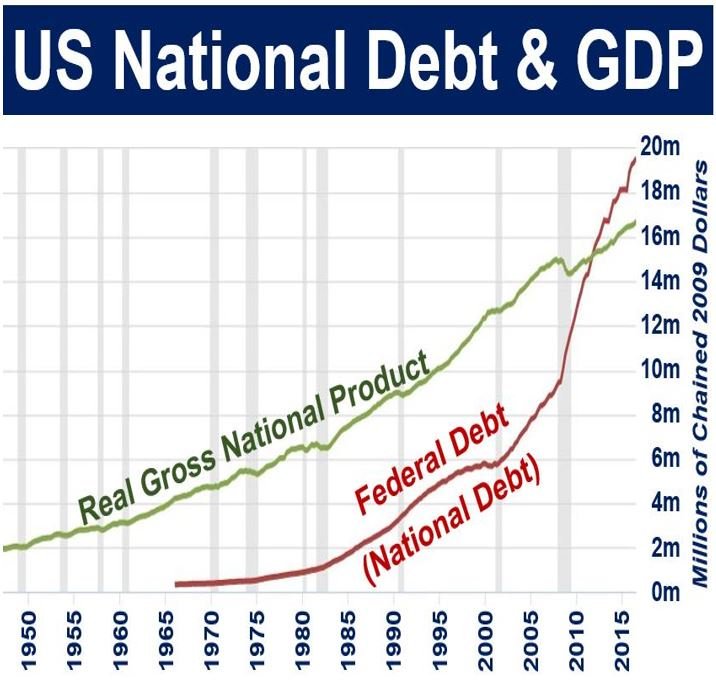

The national debt has reached about 20 trillion dollar, just repaying the interest takes 10% of the total annual tax income. And that in an era of low interest rates. It is clear that the system is coming close to not being able to handle this burden anymore and the interest rates have to be kept very low. So the only way the state can continue is by printing more money, keeping interest rates low and getting into more debt. But these schemes always fail. We dont know when the collapse is coming, but it certainly is coming.

Until then we keep living with the symptoms of this system. Low interest rates are a big work program, putting resources into not needed projects. Inflation is eating away our savings and salaries. How come after 50 years of amazing progress in science we still need to work 100% and at best both parents of the family. It is because the monetary system is contributing a big time to taking away our profits and funnelling them into the hands of the banks in a ponzi-like monetary system. A system of infinite debt requires infinite growth and we are trying our best to fight against the nature of this system like a hamster in a hamster wheel.

But the good news is that we do not have to play this game anymore. We can just opt out. Bitcoin and other distributed coins offer a very attractive alternative that protect us against the loss of our purchasing power. When the collapse comes you better have some crypto and it should better be in secure wallets.

Your posts are so underrated.

Thank you for your post. :) I have voted for you: 🎁! To call me just write @contentvoter in a comment.