Good morning traders! Grab a coffee and let's dive right into the markets and news!

I have talked about some over-the-counter liquidity providers, who usually like to stay in, not to say shadows, but out of the spotlight, here in this post Have more funds than the average guy? Check out these guys.

Image credz financialtribune.com

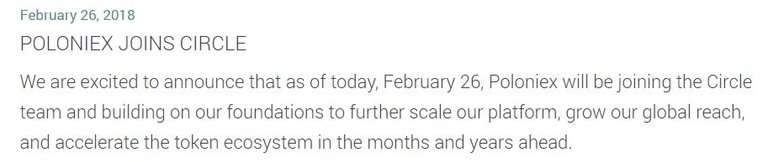

Now Circle takes a bold move and announced on Monday, that it has bought Poloniex, the cryptocurrency exchange that was founded in 2014. Similar announcement came out from the Poloniex team, as well, with promises, that the Circle team will immediately step on the train and start working with Poloniex to technical solutions and customer support, to start growing their operation.

One can hope that the entrance of Circle also further enhances the professionalism of the exchange, bringing their skills and connections to the table. Until now, Circle Trade, the Goldman Sachs-backed venture, only allowed bigger investors to play in their sandbox, but along with their acquisition of Poloniex, they are also planning to launch Circle Invest app, that is geared towards the small retail trader and investor.

A few questions still remain in the air - whether Goldman Sachs is now actively trying to grow their market share in the cryptocurrency business and whether this move will have bigger influences on the other leading exchnages, remains to be seen. One thing is for certain - big players are now actively taking part of the cryptocurrency revolution.

Read the original article on fortune.com

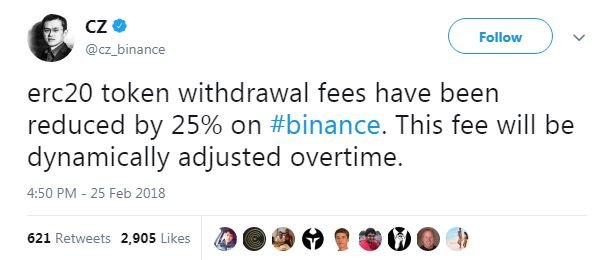

Binance slashes all ERC20 compliant token withdrawal fees by 25%. Zhao Changpeng, the CEO of Binance, tweeted on Sunday, that the fee has been reduced and will be dynamically adjusted in the future. What exactly is the dynamic adjustment, remains a mystery to me, for now.

cz_binance via Twitter

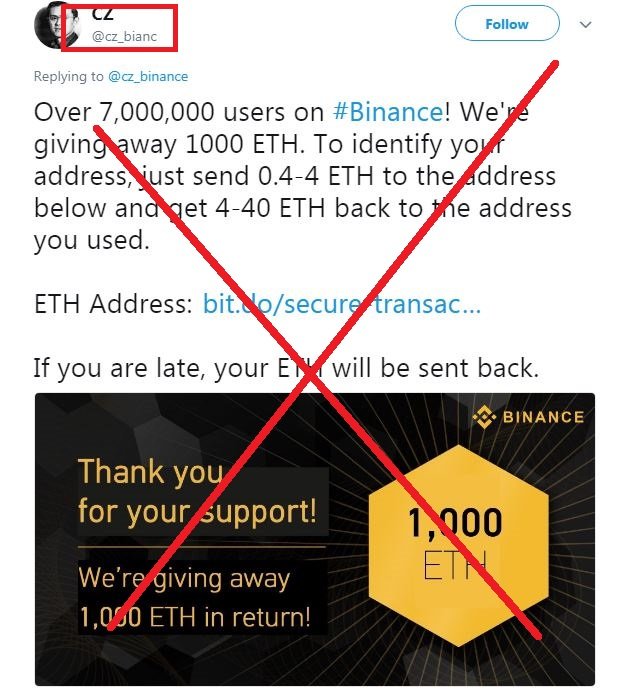

A word of warning when following the crypto VIP-s on Twitter. The scammers and bots have taken over the tweets comment sections and promise various ETH and Litecoin giveaway, claiming that if you send them a small amount, they will return it tenfold, for the first 100 users, to celebrate some milestone and stuff. So don't let greed and promise of easy money to blind you and your emotions and try to keep a level head.

Example of scam:

We have talked about scams before and not going into this extensively at this time, just a quick note to always be vigilant when it comes to your hard-earned and precious cryptos.

Too young or too pre-occupied with other things to truly understand cryptocurrencies and Bitcoin? Not a problem, Andrew Courey has got you covered. An 11-year old player from Massachusetts has produced a Bitcoin guide for kids.

Via Amazon

Apparently Andrew, the author of the book started looking for investment opportunities to reach his first $20 million by the age of 14 (!) and did some digging on Bitcoin as well. Unfortunately Bitcoin, due to it's volatility, was not suitable for his growth plan and Andrew's father, Jeff Couray propesed he put down all his gained kknowledge about Bitcoin in a book instead. And so, "Early Bird Gets The Bitcoin: The Ultimate Guide To Everything About Bitcoin" was given birth to.

The book itself is available for Kindle and also on paperback, should you want to prepare your kids or not so tech-savvy relatives fr their first $20 million as well.

Hit the Amazon store to get your hands on the book Amazon.

Original article via livebitcoinnews.com

Check out Chainbb, an alternative frontend for STEEM network. If you like forum style, that's the platform for you.

Title image from pixabay

Are you looking for Minnowbooster, Buildteam or Steemvoter support? Or are you looking to grow on Steemit or just chat? Check out Minnowbooster Discord Chat via the link below.

BuildTeam

Great questions @furious-one re GS. I've tried to view these type of transactions purely from a strategic/legitimacy perspective as most others cover the other angels. As you nicely noted "big players are now actively taking part of the cryptocurrency revolution.", it appears that GS jumped in with both feet. This acquisition further supports many thoughts by my colleagues and I that Wall Street has been playing both sides of the crypto "trade", just like the old days of otc stocks or more akin to the Junk Bonds back in the 80's to mid-90's. Slam the asset class you want to get involved in, buy cheap and go long, establish strategic positions and then formally support the asset class through M&A, cap markets, market making (legitimacy/liquidity), research/analysis (recommendations) and long term investors (individuals/ investor funds). We have heard that certain proprietary trading desks at both Wall Street firms and hedge funds have been accumulating crypto positions. With this acquisition, GS is clearly supportive and indirectly involved (due to regulatory issues, they should not have directly ownership now, etc.). This is yet another step towards greater legitimacy and acceptability. Lets now see what JPM, CB and the others to counter GS jumping in.

Meanwhile just the day before the acquisition on Jan 25th, as typical oin Wall Street, Goldman's Senior Strategist for Global Investment Research released a video about the Bitcoin "bubble".

https://www.facebook.com/goldmansachs/videos/10155852419177247/

I self upvoted to push up my comment higher for your thoughts.

Thank you, you summarized all nicely. I am fairly sure that Wall Street whales have been in cryptos for a while and playing both sides, like they have done in other markets. And as the cryptocurrencies get more regulated, they have more and more "legit" and direct ways of raking in the profits from these markets.

So true and inline with your comments on more reg, more legit..... I have heard (and you likely have as well) that Circle has briefed the SEC that they will begin the process of registering Poloniex as a new entity with the SEC and FINRA as a B-D and in turn as a licensed ATS. They will be the first. In tern the SEC was favorable and indicated that they would not pursue any enforcement actions for prior activity. This may be the template going forward.

Huh, thanks, i hadn't heard of that yet. Appreciate it.

looks like competion is gearing up in the crypto markets, binance is trying to get more clients and at the same time been wary of Poloniex been bought by a big corperation, this is good for us and also bad if Goldman Sachs uses poloniex to distabilize the coin market, maybe they are seeing a crypto future and they dont want to be left behind, this move will trigger other big players to join in the crypto space, things are about to change for the good as more money starts to pour in the crypto markets

It seems to me that binance is getting ahead of its competition unlike coinbase which is nice! Also now that poloniex is bought by a company this big will we see some good changes? will poliniex be viable once again? only time will tell

Who knows, maybe it will become the "big boys exchange" :D

I dont mind this one bit! All we want is new players into the game the ones with the big pockets i might say!

wow! will probably grab the book for my kid :)

"Good morning traders! Grab a coffee and let's dive right into the markets and news!"

Best Good Morning anyone has ever wished me apparently. Haha

Thank you heaps for the interesting news. I feel that if any business is able to get in early to the cryptocurrency frenzy they will be able to be very successful in the future. Great post!

great post. interesting news and succes for you...

Thanks for share this interesting news dear @furious-one

it was just a matter of time. Won't be surprised if NASDAQ and other major exchange follows suit now that market makers like Goldman Sachs are damn right clear on cryptos.

Your article is rich and very informative. Thanks a lot.

check out holochain. seems legit

https://steemit.com/cryptocurreny/@philander5up/3ny4s6ot

Coins mentioned in post:

Disclaimer: I am just a bot trying to be helpful.