My Personal Net Worth Report For Q2 2018

Well, the market has had it's ups and downs this year, but it really hasn't gone anywhere. This has really muted my growth compared to last year. Still I look for sectors to invest in, even if I do believe that we are near a top.

I mean, what am I going to do with the money? I am certainly not going to go out and spend it on fancy things. However, the family and I did just get back from a trip visiting my brother in Alaska, which cost in the realm of $3,000. Rental cars are expensive there! During my last trip there, before kids, I just went out and bought a cheap old truck off of craigslist. I figured that my brother could resell it and we could split the proceeds and still come out ahead of the damn rental prices.

That is one example of how my mindset is different than most people. I mean how many would do that? But it is because I have a big goal - to become financially independent. And the only way to achieve that is to have a different mindset than 99% of the population. Becoming financially independent is an enormous goal needs to underline how you look at the world and the decisions you make.

When you commit to saving a major portion of your household income each year, you’re choosing to live in a way that’s likely significantly different than how you were raised and also significantly different than how the vast majority of Americans live.

You have to think a little differently and the only way to do that is to cultivate a different mindset.

Over the last few years, I’ve spent a lot of time cultivating that mindset. At first unintentionally, and then with a powerful focus. I’ve read mountains of books and hundreds of hours of video on self-improvement and personal finance.

This is how I have managed to go from a net worth of $81,000 at the start of 2015 to where I am today just 3 1/2 years later.

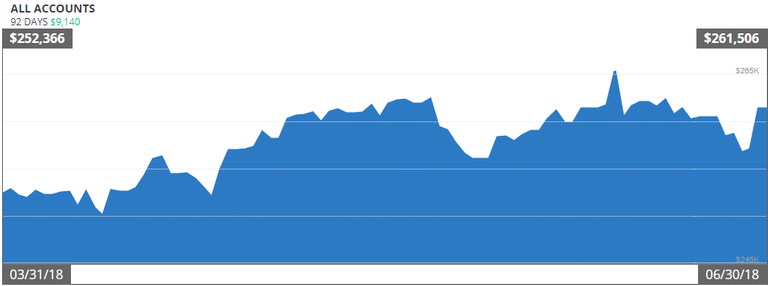

Ok, enough preaching, on to the 2nd quarter results. I ended Q1 2018 with a net worth of $252,366.

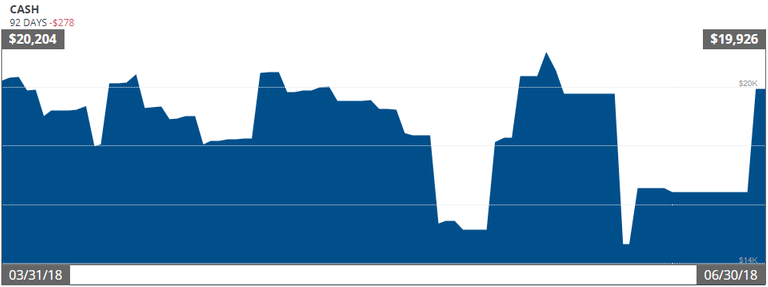

CASH

Starting $20,204 Ending $19,926 [-$278]

Cash levels were maintained in the $20k area. Nothing too exciting here, but I would like to bulk up this area as am I getting closer to early retirement.

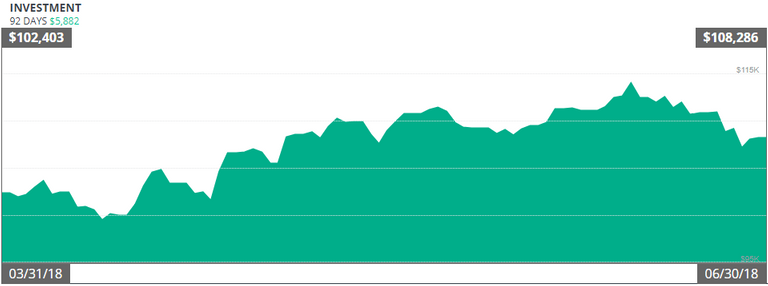

INVESTMENTS

Starting $102,403 Ending $108,286 [+$5,882]

With the changes in the tax law, I did some calculations and found out that I am able to change my contributions through work and end up paying no taxes. This has to do with the changes to the standard deduction. So yeah, I am paying no income tax anymore - pretty sweet. Anything that was going towards income tax is now going towards my retirement account so that my paychecks remain the same.

Since my adjusted gross income was so low, the savings are only in the $80 per month area. I'll take it though!

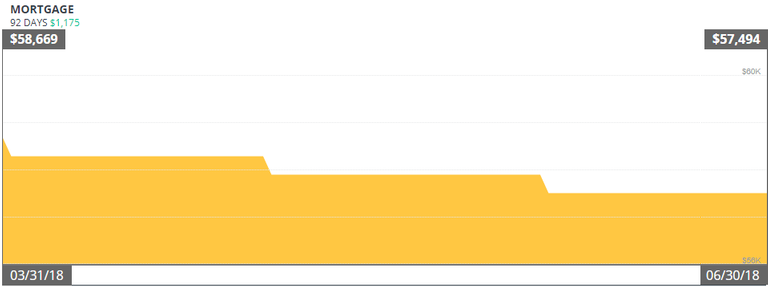

MORTGAGE

Starting $58,669 Ending $57,494 [+$1,175]

This mortgage is my only debt. Feels good to have only a small mortgage, but it will feel better when I owe the bank nothing.

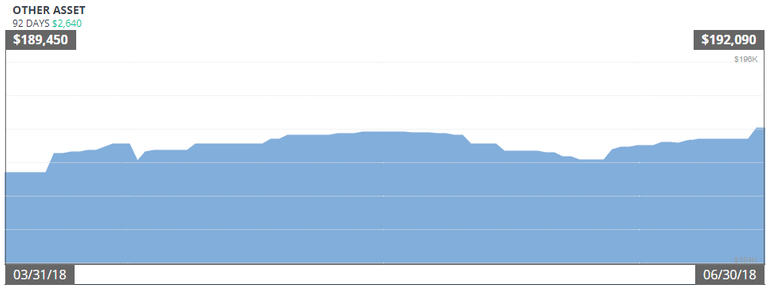

ASSETS

Starting $189,450 Ending $192,090 [+$2,640]

This isn't ALL my other assets as that would be crazy. This is three cars and a house.

Even though I am up $2,640 this quarter, I am still down for the year. Just like the rest of the markets (crypto and stock).

All together this comes out to a net worth of $261,506!

A TOTAL QUARTERLY INCREASE OF $9,140!

For reference, here are the previous quarter net worth increase results:

Q1 2018: $6,987

Q4 2017: $17,822

Q3 2017: $19,096

Q2 2017: $18,513

Q1 2017: $16,671

As you can see, this is about half the rate from this time last year. It is just so hard fighting against a market that doesn't cooperate. Still, I managed to eek out a slight increase over the previous quarter.

This quarter I increased my net worth by an average $3,046 per month, or just a few cents under $100 per day.

If you like my graphs here, I get them because I use Personal Capital. If you want to sign up, use this link and we will both get $20!

Could you give more specific detail on the "tax change at work" or what information you used to figure this out?

I suspect I'm too far into the 15% bracket to go to 0%, but I guess I owe it to myself to look into it.

I used a few calculators that are for the new tax laws. I drop a large amount into tax advantaged retirement accounts through work and am married with two kids.

Basically, with the amount I put into retirement accounts each month I had already overpaid my tax bill this year. So I stopped it.

There is also no longer a 15% bracket this year, there is a 10%, 12%, and then 22% etc. The standard deduction is now $12k each for the wife and I.

Link? (Probably useful to others) My wife usually does the taxes, I knew about the deduction change, but didn't specifically look more. I have three kids and house probably in similar boat to you, though I'm getting hammered with taxes living in New York state. Thankfully not in socialist New York City.

https://apps.irs.gov/app/withholdingcalculator/

Hey @getonthetrain, this is very insight full! I should up my game in tracking my finances! Do you have some tools that you use, maybe some scripts or Excell sheets that you are willing to share? I mean just the tools, not your personal data used within the tools :)

Oh, I just use Personal Capital.

If you want to check them out use this link and get $20 for signing up: https://share.personalcapital.com/x/djD4z6

Very interesting post.

Thanks, workin

Onward and upward my friend! These posts always remind me to run my net worth for the quarter...I have a feeling it may be a sideways-ish one.

Yeah, but things are looking up! :D

Hi your article is very good.

i want to translate it and share your idea with people around me.

am from China, Beijing.

hope can get your early response discuss about this.

Thank you so much for your sharing.

Uh, if you want to, sure.

Yes, appreciate your sharing, thanks for doing this.

Congratulations for your effective net worth and for sure your hard work, critical thinking and thinking differently is playing an effective role in this journey.

And i hope and wish that you will going to retire before you want to and i want to wish more effective returns for you, because when we do hard work then we deserve effective returns because there are many sacrifices we do to strive.

And good to hear about your tiny mortgage and i hope that it will be cleared soon because it's better to stay away from the debt trap of banks. 🙂