Today we will talk about the basics of trading on the stock exchange.

This information will be useful for beginners who just want to start trading on the exchange. For mother traders, I will not say anything new.

Today and in the future we will consider the introduction and trade of crypto currency. But this information is also relevant for stocks, bonds, futures and so on.

So, as you know, there are three main types of investment, differing from each other by the terms of investment of the funds.

- Short-term investments - it is assumed that the funds will be invested for a period of up to one year

- Medium-term investments - from one to three years

- Long-term investments - the most capital, more than three years

People investing in this or that security, but here it is actual to say in the crypto currency, they are called investors

People trading on the exchange are called traders.

You should clearly understand that there is no "game" on the stock exchange. On the exchange, they trade and conduct transactions. You can play in the casino, in football, in computer games. At the exchange are traded!

All trade boils down to a very logical aspect - it bought cheaper, sold more.

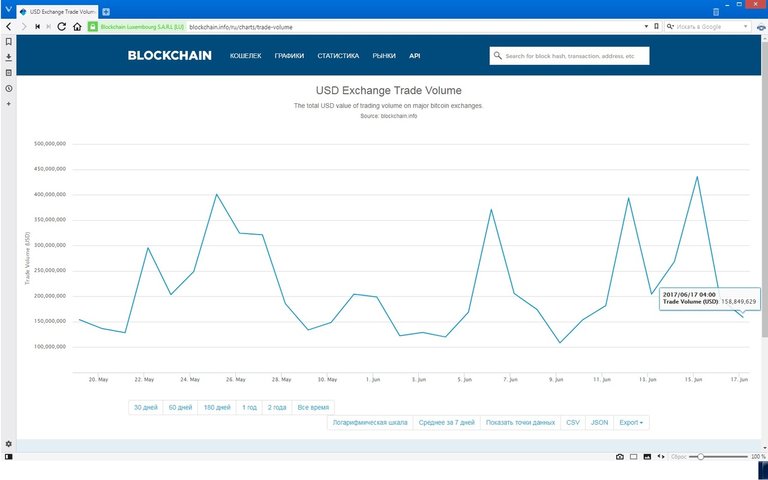

The total number of lots that have changed owners for the trading period is called the volume of trades

For example, yesterday's trading volume of bitcoin in US dollars was 158,849,629

The higher the trading volume, the higher the liquidity of the traded asset.

The price of an asset depends on the number of applications of sellers and buyers.

If the volume of buyers' applications is higher than the volume of applications of sellers, the price increases and vice versa.

You should understand that the exchange is the same market and no one can ever specifically tell what price the asset will have in half an hour, in a day, in a year.

But there is a clear trade analytics.

Analytics is divided into 2 types.

1. Fundamental analysis

2. Technical analysis

And about that and about the other hundreds of books are written and in a nutshell simply unrealistic to tell. But for a common understanding, you can reduce.

Fundamental analysis

Fundamental analysis is essentially a set of news or events that can affect the growth or fall in the price of an asset.

There is a lot of criticism towards this analysis because in fact it is impossible to implement it for one hundred percent. It is impossible to implement by many factors, since the price of an asset is affected by a huge number of factors, beyond which it is simply unrealistic to follow. Such factors include insider information.

Technical analysis

Technical analysis is a forecast of probable! Change in the price of an asset using forecasting tools.

In other words, we take with you the forecasting tools, look at the price chart in the past and analyze how the price behaved in such a situation.

To the forecasting tools are various oscillators, moving averages, Elliott waves, etc., and so on. There are a lot of them and a trading strategy depends on each instrument.

I will not be mistaken if I say that hundreds of books have been written on technical analysis, hundreds of different trading strategies have been disassembled. Here, every trader chooses for himself the strategy that he likes best. Then I came to the conclusion that there is no bad or good trading strategy. It is important to follow all the points of this strategy, then your trade with a greater degree of probability will be successful and break-even.

All about what I wrote above plays a huge role in the world of trading in stock markets. But this share is only 30-40 percent in a successful trade.

The bulk of the success of trade falls as always on our shoulders.

Psychology

For any successful trade, a trader must be mentally prepared. And this is far from joking.

In the stock markets, huge money is spinning and they always turn their heads. If you approach trading not systematically, anyhow, then forget about successful trading! You will always deposit your deposits. A person should be ready for the loss of money, but he must also be ready to exaggerate them. As you understand, not every person is ready for money psychologically. And the more so not everyone is ready to part with them.

This is also a huge topic, which is also written many books. But the essence is one - before trading on the exchange, a person must be tempered.

Stock markets do not tolerate careless ones and consume deposits of such people in a matter of seconds.

Trading Rules

In order to successfully trade, you must adhere to a number of rules that will help you not drain your capital, but multiply it!

When I started trading - I printed out these rules on A4 sheet and put it in front of the monitor, right before my eyes, in order not to forget about them! Otherwise - believe me, well, it's very difficult to stop!

I'll write you just a few rules that I remember for myself, and which always help me to stop.

1. Never, remember, never trade against a trend.

2. If you opened a position against the trend, remember rule number 1 and close it rather quickly, so as not to lose all the money.

3. Always plan your trade. You must clearly understand how much you need to earn and how much you are ready to drain today. If you fulfilled the plan and earned money,turn off the computer and go for a walk in the fresh air. If you have fulfilled the plan and have drained some money, do not worry, today is not your day, turn off the computer and go for a walk in the fresh air.

4. There is no concept - to recoup! There is a concept of merged a deposit, or merged a little. Sit down and analyze your actions - most likely you did something wrong! Analysis after draining is mandatory! Otherwise, there is a risk of losing the entire deposit!

5. Five losing trades! Only five. Then turn off the computer and go and analyze what went wrong. Do not try to recoup. In general, you understand;)

I always had before my eyes a sheet with these rules, as well as large figures I wrote a plan for today! If I overfulfilled the plan and everything went fine and I earned twice as much - great! But do not go into trade further! Trade is strictly by the rules!

In the next article I will describe the trading strategy of which I have been using for many years!

Good luck in the fields of stock and not just exchanges.

If you like this article please support me by clicking the up arrow at the bottom of the page

If you are interested in the topic of trade, subscribe to my blog, I will regularly write about my trading experience in the stock market and just be happy with your subscription

Hi. Welcome to Steemit. Looking forward to read more of your posts. cheers. :)

Thank you! I will try ;)