SUMMARY

Note: For anyone who missed the BitcoinLive Information Webinar, here is the replay link: https://www.youtube.com/watch?v=32l40SNYOp4

As of June 4th, ALL Crypto Analysis will be posted on the BitcoinLive channel and Steemit will be dedicated for Equity, Commodity and Options Analysis. To Signup for the BitcoinLive limited Founding Membership slots, use this link: https://get.bitcoin.live/haejin/

__

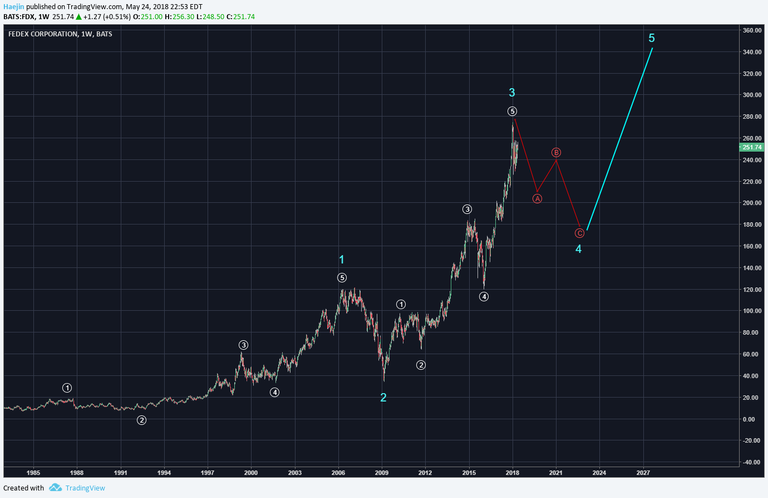

The performance of FedEx (FDX) stock price is often seen as a harbinger of what's to come. Given how bullish FDX had been since the 2008 Financial crisis which coincided with blue wave 2; price has surged to all time new highs. This has led to blue wave 3 which is likely complete and if not, it probably has one more wave up before declining into blue wave 4 correction. It's during this correction when news of slowing economy might arrive to justify the forecast.

The subwaves of blue wave 3 seem quite complete (white) and the same for blue wave 1. IF the blue wave 4 correction onsets, then the ABC pathway is likely. It would not be a crash scenario; but rather a healthy blue wave 4 retracement which will prepare the table for blue wave 5. But still, this blue wave 4 will also likely correlate with lowered shipments by FDX; hence, reflective of a slowing economy.

The MACD has declined from a very overbought state and should lead to red wave A completion. One other corrective pattern could be an ABCDE triangle as well. Regardless, once blue wave 4 completes, all time new highs will be ushered in by blue wave 5.

Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. Plain English: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

Follow me on StockTwits for UpDates!!

--

--

Thanx for research :-)

Thanks for the info and clearer elaboration

Better info than usual regarding the stock. As usual though killing it with the elliott wave analysis. In a month or two when it hits bottom of trough are you buying?

looks like it's about to go down for a while and by how far it would rise will be a shock to many. This is just my analysis though, thanks@haejin for the informative post.

First thanks for this information and knoweledgeable post for steemians and obviously its getting back to its worth its rise is like an empire outstanding great analysis according to fact and figures

thanks you! mr.haejin

I always look good in writing.

What do you think of Bloom?

super

This is an extensive but worthwhile write, @haejin. Thanks

Hello, I was wondering if you were ready to admit that you were wrong since the onset of this flag war and that the flags you receive are a representation of the sentiment of the community and a HEALTHY CORRECTION to your overvalued posts. I would also like to know if you are ready to confirm to your followers some of the allegations (such as collusion and voting abuse) made from the beginning. I think this would be a good step in a positive direction for you. If you'd like, I can help you prepare a statement.

I'm looking forward to your friendly response. :)