I was debating with a friend of mine who is a gold bug about the performance of gold and fiat currencies.

So my main points I was trying to make with him were:

Although the USD is fiat and gold has gained against the USD this last year, we are seeing weakness in gold in against other fiat currencies.

When the USD is referenced as crashing it is most commonly and almost exclusively benchmarked to other fiat currencies (not gold) which actually must have gains in order for the USD to crash.

He debated that gold had only been weak in terms of the USD over the last 5 years because of the strength of the USD.

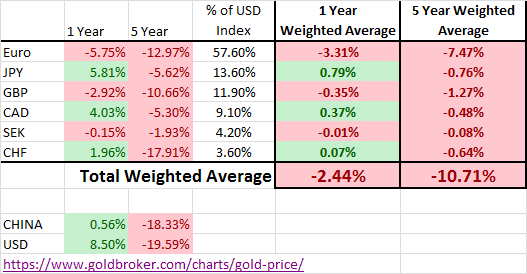

I was thinking we should take a look at the price of gold in terms of the currencies that make up the USD index (this does not include China) for the last year and 5 years and put it into a spreadsheet to review. Maybe there should be a factor for China, but I am not sure how to do that quickly into a weighted average so I just put that info below for reference. Anyway, I grabbed the data and put it into a spreadsheet.

What I found is was very interesting. Over the last year using the USD index currencies that are measured against the USD, the index showed that gold actually went down overall when you apply what percentage they make up of the USD index. So in the last year the price of gold was -2.44% overall for the index. For the last 5 years which accounts for the time the USD was strong gold had a weighted average of -10.71% drop (this excludes USD performance).

So the question is: Have we in fact entered in to a a global bull market for gold?

The answer might not be as clear as we thought.

This data was complied on February 6 2018

Congratulations @happygolucky! You received a personal award!

Happy Birthday! - You are on the Steem blockchain for 1 year!

Click here to view your Board

Congratulations @happygolucky! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!