For anyone who doesn’t know what Snapchat is, it is a social media app where participants can post a series of photo/video stories that remains on the app for 24 hours. People are then able to view your story and send photo/video responses directly to you (Direct Messaging).

Earlier this year, Snapchat (SNAP) became a publicly traded company. And… their stock has returned a dismal negative %43 return from their IPO price of $27 to their current price today, $15.25. Whatever you may feel about SNAP (bear or bull), their story is more common than you think.

Specifically, what I am referring to is the story of IPO’s and the life stages a company goes through when they IPO or go public.

I have been burned by investing in Etsy (ETSY) when they IPO’d and I want to help you avoid the burn.

Join me as I explain this common pattern that Snapchat has undergone, is undergoing, and will eventually go through!

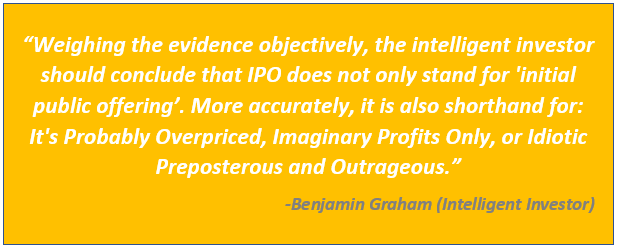

[[ IPO: “IDIOTS PAY FOR OVERPRICED STOCK” ]]

For people that are not familiar with financial/market terms, IPO stands for Initial Price Offering. An IPO is what a company does when they move from a private market (where only private individuals have access to buy, think Uber or Airbnb) to a public market.

Once a company has IPO’d, the public (people like you and me) is now able to purchase stocks of this company and become a part owner of the company’s stock that they purchased. The problem with IPO’s is that the hype associated with a stock going public increases the price of that stock to unreasonable levels.

Once a stock’s price has flown far above the intrinsic value of a company’s earnings, there is bound to be a point where pure hype can no longer keep the stock’s price at these unjustifiably high prices. The painful reality of having no growth or profit eventually kicks in and sends the stock tumbling down.

Take a look at some stocks of well-known companies below that all IPO’d earlier this year.

Blue Apron – The largest meal kit service company today in the U.S.

Redfin – An online real estate company – closest rival to Zillow

E.L.F. – Eyes, Lips, Face – A makeup company that sells low-cost products

Yoga Work – The first publicly traded Yoga Studio company.

Cloudera – IT company specializing in managing big data

All of these stocks have the exact same trend of being hyped up after going public and having a sharp decline after their first earnings report, resulting in a stock price decline anywhere from %20 to %35 from the stock’s highest recorded price.

It’s almost like the companies (and the underwriting banks) that went public purposely set their IPO stock price far higher than the stock’s intrinsic value. Hmm… seems fishy…

I leave it up to you, the reader, to judge whether company insiders, who own stocks before they go public, have an incentive to overvalue stocks that they own.

Just think about it, why does a private company go public? To make the general public wealthy by having their stock available on the market?

NO!

Instead, private companies go public because insiders who currently own the stock want to make a profit! They want to make a profit selling their stock at a much higher value than what they paid for it.

Don’t buy stocks that recently went public no matter how much hype there is around it unless you know something that only an “insider” would know.

[[ THE VALUE PLAY: STOCK FALLEN OUT OF FAVOR ]]

So, the next question I would ask is: What is the phase after a stock has had a huge drop in their price?

Well, simply put, unless the company goes bankrupt, the company will eventually find a “bottom”. When a stock has fallen out of favor with the majority of investors, the price of that stock will reach a point where it is below that of the intrinsic value of the company’s assets.

When the stock price reaches this point, the stock is called a “Value Stock”.

Some good examples of value stocks today are:

Nokia – My favorite cell phone company today – after all, their phones are indestructible

Fitbit – the fitness tracking device company that is getting crushed by the Apple Watch

Twitter – The Social Media app that has no clue how to monetize or grow its traffic

Ford – I think we all know Ford

Go Pro – Camera company that specializes in small action cameras

These stocks are all stocks that have had a rough time in recent years (especially if you bought when it was at the historical highest price) but are prime candidates for investing your money in today.

If you truly believe in the return of Nokia, like I do, then now is the best time to invest. Nokia has already beaten the market by a huge margin since December 2016, increasing by about %50 in just under a year.

From this example, you can see that investing in a value stock requires one to have patience as it can take several years for a large company to get its act together.

The companies mentioned above have limited downside as much of the risk has been removed by the dramatic decrease in stock price. However, the problem is that no one truly knows where the “bottom” is. This is precisely why it is important to keep an eye on companies’ earnings reports so you can see if the company is turning the corner and is prime for a rebound.

Finding the “bottom” can be hard, especially when it comes to “timing”. For instance, you could have been tricked by Twitter in January 2015, thinking that TWTR was prime for a comeback. After all, Twitter had already lost %40 of their value since their IPO in 2014, clearly, the time from Nov 2014 to Jan 2015 was the “bottom”. You would have been disappointed if you thought like this since Twitter’s stock price dropped %50 from Jan 2015 to today.

My point is, finding the “bottom” is hard.

This inability to determine the “bottom” is why investors need to be patient when investing in value stocks.

[[ THE WAITING GAME PAYS OFF - VALUE STOCK TRANSFORM INTO A GROWTH STOCK ]]

Okay, so don’t buy a stock when they IPO and do buy a stock that has reached “bottom”.

Where and when is the bottom? Who knows, the point is that you need to buy and hold a stock long enough so that you can benefit from the eventual comeback a company may undergo.

This transformation can take months, a year, or even several years.

A few great examples of stocks that have hit rock bottom and came back with a fury are:

Amazon – E-commerce giant killing everything! – Besides Hong Kong Supermarket

Etsy (ETSY) – The e-commerce company that helps independent small companies sell their goods online – usually focusing on handcrafted items as their niche

Apple – The largest company in the stock market today – on track to become the first trillion dollar company

Weight Watchers – Company providing their customers with an all-encompassing healthy lifestyle

Yes! Even Amazon has been through this pattern. Amazon was not always the e-commerce giant it is today. Amazon used to be a Kindle only company selling e-books as their primary revenue stream. After the 2001 recession, Amazon was trailing along the bottom making small gains over a period of years. From 1999 to 2007, Amazon simply fell out of favor for a 6 year period and had very little growth as compared to the overall market.

However! If you were patient enough to buy Amazon in the early 2000’s, you would have reaped the benefit of Amazon transforming from a value stock to a growth stock! Amazon is now the best performing stock in the history of the stock market.

Just imagine if you had the foresight to know that the Nokia or Blackberry phones will eventually gain market share from Samsung and Apple, then the potential upside could be enormous! If Nokia ever reaches a substantial market share of phones, you can grow a $6 (Nokia’s stock price) investment by huge amounts. All you have to do is (1) research low-value stocks, (2) invest your money in promising undervalued stocks, and (3) wait for the company to turn around.

Just take a look at a stock that went public in May 2015, Shopify (SHOP), to see this cycle of (1) exuberant hype of a stock’s price, (2) the stock hitting the “bottom”, and (3) the transformation of a company’s stock from value stock to growth stock.

(1) Exuberant/unjustified hype – from May ‘15 to July ‘15

(2) Stock headed to the “bottom” – from July ‘15 to Feb ‘16

(3) Transformation from Value to Growth stock – from Feb ‘16 to today (Sept 15th, 2017)

Do you see the pattern yet? Stocks that are hyped are typically overvalued compared to the company’s intrinsic value. The precise opposite situation holds true as well – stocks that have been written off by the stock market are typically undervalued- sometimes justified, sometimes not.

—

The SNAP story, more importantly – the story of an IPO, is simple to explain and far more common than you think. The hype of the biggest social media IPO since Facebook simply caused unjustifiably high prices. Now, SNAP is currently headed towards “bottom” (or bankruptcy). Once SNAP has hit bottom, there will be nowhere to go but up!

So, if you plan to invest in a company that has recently IPO’d, then wait till the hype dies down and the stock’s price falls. Then buy the stock once you think the price has reached the bottom. Remember, the bottom is hard to find and sometimes the bottom won’t be reached for several years (like Amazon) or a few months (like Shopify).

So, be patient, be smart, and invest for the long haul!

As always, if you found this article helpful, insightful, motivational or the slightest bit entertaining, then please subscribe, follow, like, comment, and SHARE!!

-Jack

DISCLAIMER: The above is general investing advice. I have not taken your specific situation or risk profile into consideration. Jackedfinance may have interests in stocks mentioned above. All graphs were taken from Google search.