In my previous articles, “Intel – The Best $35 Investment You Can Make Today” and “The Snapchat Story – More Common Than You Think“, I mention the concept of different types of stocks (growth, value, dividend) but never really defined them.

So let me right my wrong and go back to some fundamental explanation of stocks.

Owning a stock means that you are now a partial owner of the company whose stock you purchased.

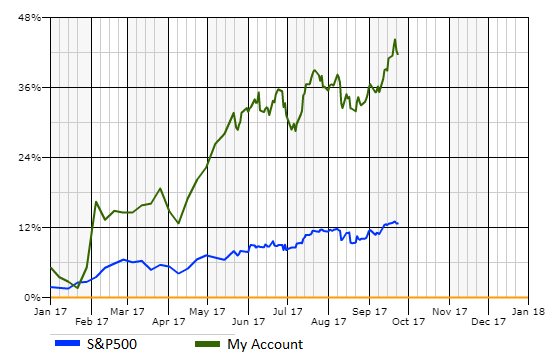

I promote and prefer the buying of individual stocks over the buying of low-cost index funds. This is because the potential returns from a single exceptional stock pick can provide returns far greater than the gains a market index fund will return. Just take a look at NFLX stock below compared to the S&P 500 (an index tracking the largest 500 companies in the U.S.).

Sure, 25% over 3 years isn’t terrible by any standards, but how can you even compare that small gain to the incredible %200 Netflix has returned? I don’t want average returns, I want phenomenal returns.

For example, if you invested $1,000 in the S&P 500, or a index that tracked it, then you would only end up with $1,250 over 3 years. If that $1,000 was invested in Netflix, you would have $3,000 in 3 years. This potential $1,750 difference is the reason why I invest in individual stocks.

Investing in individual stocks has enabled me to beat the market by 30%+ in less than a year’s time.

(The above is from eTrade)

The common advice for the layperson is to buy an index fund in order to match market gains over the long-term since the average investor is not able to consistently pick stocks that outperform the market. Also, humans tend to be more irrational than rational and consequently allow their emotions to defeat themselves when investing in stocks.

However, you are not the common populace that knows nothing of the stock market and finance.

You, my friend, are Jacked!

[[GROWTH STOCKS]]

Growth stocks are probably the most popular type of stock. If you follow any mainstream financial news sources, they mainly focus on growth stocks because they are simply the sexiest stocks to talk about.

Growth stocks are also referred to as “high flyers” for the precise reason that they soar above the rest of the market by a huge margin. Netflix (NFLX) is a great example of a growth stock that still promises huge growth opportunities as they single-handedly change how people watch and enjoy television/movies.

The problem with growth stocks is that they are typically some of the most “expensive” stocks for sale in the market today. Take for example, a few of the most popular stocks today: Amazon (AMZN), Netflix (NFLX), and Tesla (TSLA) all trade at insane P/E ratios at the moment (price to earnings ratios), 240 P/E, 229 P/E, and (-)50 P/E respectively.

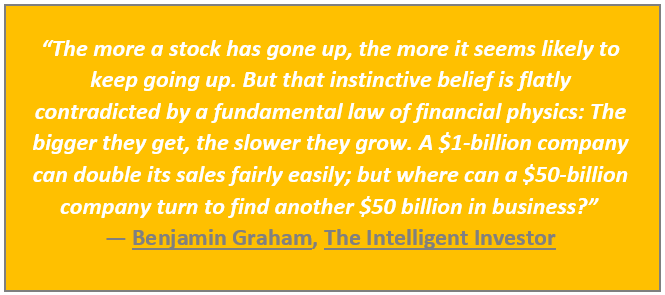

Keeping in mind that the price to earnings ratio is just one way to value a company’s stock: In the investment book “Intelligent Investor”, by Benjamin Graham, Ben states that investors should beware of such high price levels for these favored stocks. As these high-flying growth stocks seem to be far outpacing the rest of the market in growth, there will eventually be a point where there is no more room to grow and that stock’s price will get ahead of the company’s actual earnings growth rate.

It is here when the stock will face a dramatic “correction” in price, resulting in a huge drop as compared to where the stock once stood.

It is easy to be caught up in the hype of a growth stock, but I give a warning to any investor interested in investing in these high-flying stocks: As we learned from Greek mythological story of Icarus, avoid stocks that fly too close to the sun.

[[VALUE STOCKS]]

Value investing is the act of investing in stocks that have had their prices decreased to the point that the value of the stock is less than that of the intrinsic underlying value of the company, also known as “value stocks”. Warren Buffet, one of the greatest investors of our time, focuses on value investing as his primary investing strategy.

Value stocks are stocks that have fallen out of the limelight and have had their prices decreased to unjustifiably low levels. Typically, these value stocks are the runner-up stock to a leader in a specific industry or simply a company that is viewed as a defeated company.

For instance, Blackberry (BBRY), Nokia (NOK), and HTC (HTC) are all stocks that have lost ~%95 of their value in the past decade (from their historical highs). These three companies all got beat out by Apple and Samsung who dominated the cellphone market with their iPhone and Samsung Galaxy product lines.

Value stocks like the ones mentioned above are in a position where most of the risk has been taken out of the stock since the price is at historically low levels.

For example, take a look at my favorite value stock, AMD – the semiconductor company that lost to Intel and Nvidia:

AMD had taken a huge reduction in price from May 2000 to July 2015, losing 98% of its value from the high on about $100 per share to the price of just about $2 per share. AMD was getting beaten out by Intel and Nvidia simply because their processors and graphics cards were deemed as second best. Most major investors wrote them off mentally, and the stock price reflected that mentality.

If you were able to see past the pessimistic views of Wall Street in July 2015 and invested in AMD, you would have made a 700% return in just about 2 years.

This is the beauty of value stocks, their ability to transform into a growth stock and provide incredible returns.

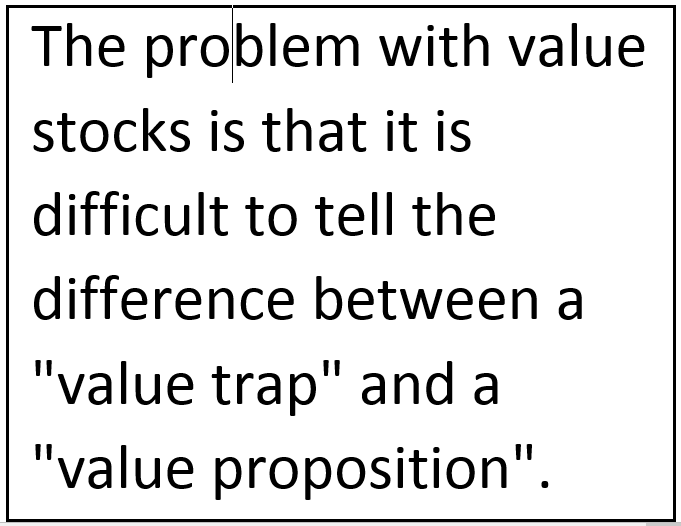

The problem with value stocks is that it is difficult to tell the difference between a “value trap” and a “value proposition”. You do not want to be caught in a value trap. Meaning, just because a stock’s price drops significantly, it does not mean that it is a promising investment opportunity.

Just take a look at Fitbit (FIT) to see what I mean by “Value Trap”. Since the IPO of Fitbit, it can be viewed as stock that has been ‘undervalued’ by the market. The problem is that even at the price of $6 a share, Fitbit can still go down even further.

Don’t invest in a value stock just because their chart is trending down, investigate earnings reports closely in order to see if a value stock is a good “Value Proposition” or just a “Value trap”.

[[DIVIDEND STOCKS (INCOME STOCKS)]]

Dividend stocks are a more traditional type of stock that pay out a specific dollar amount for every share a person holds. For instance, my favorite dividend stock – Intel, pays out $0.27 per share you own every quarter (which is about an annualized %3 return with today’s share price of $37). That means that no matter what happens to Intel’s stock price (up or down), you will be receiving this dividend payment as long as you did not sell your shares.

Dividend stocks are typically viewed as stocks that have given up on “growth” opportunities as these companies are the “Blue-chip” behemoths that have been around since before I was born. Since these companies have ‘plateaued’, they return value to the shareholder not by increasing the price of their stock, but by increasing their dividend payments.

Typically, growth stocks like Amazon, Netflix, and Tesla, do not provide any dividend payments since they are %100 committed to growing and reinvesting any profits back into the company.

Dividend stocks are typically less volatile, meaning that their stock prices do not change as dramatically as compared to the high flying growth stocks.

Just take a look as Johnson & Johnson (JNJ), one of the oldest dividend champions on the market today. Even the recession in 2001 and 2008-09 barely effected the tried and true dividend champion – Johnson and Johnson.

The only warning I give about dividend stocks is that they tend to be slow growers and do not reward their shareholders through dramatic gains, but instead reward their investors through steady and reliable dividend payments that increase gradually.

I typically suggest dividend stocks to investors who have a significant amount of wealth as these dividend stocks provide more safety with more consistent returns. Or to investors who are simply attracted to the idea of getting a consistent dividend payment every three months.

[[PENNY STOCKS - STAY AWAY]]

Penny stocks are stocks that are valued at less than a dollar. They are valued at penny increments for a reason. Any investment in penny stocks are speculative by nature due to the lack of any historical data and lack of insight as to how the company performs/operates.

These are typically small cap or micro-cap companies, that do not have a good track record of providing value back to share holders.

These are extremely attractive because they are so “cheap”, but only a fool would think 10,000 shares of a penny stock holds more potential returns than a single share of Google (GOOG/GOOGL) or Amazon (AMZN).

My advice to my readers are to STAY AWAY from these penny stocks as you will have minimal insight as to how these companies are run, and even less insight as to whether these companies are participating in shady activity.

Life is not “Wolf of Wall Street”, and you will not get rich by speculating.

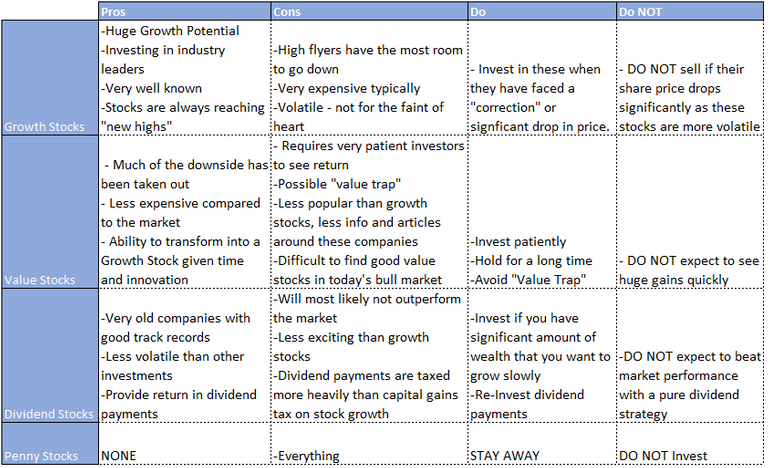

[[THE COMPARISON]]

As much as I prefer value investing over the other forms of stock investing, I do invest in all the types of stocks above (besides penny stocks).

The best strategy is the strategy of being flexible and taking advantage of timely drops in the market. For instance, I try to stay away from Growth Stocks unless they have had a significant ‘correction’ (or drop in price). Take Yelp (YELP) for example, earlier this year Yelp dropped 23% and would have been a prime growth stock candidate for investing. Yelp actually rebounded and gained 50%+ after that drop in May.

My point is that people should be flexible and invest in stocks that are good opportunities based on their current price level and projected future – based on most recent earnings reports.

Below is a chart I put together summarizing the pros, cons, do’s and DO NOT’s of all the stock types above.

As always, if you enjoyed this article, then please like, comment, share, subscribe, and follow!

-Jack

P.S. Do not invest in any stocks based solely on the information above. This article is for general education purposes only. I have not taken into account your personal risk profile and I may or may not have personal interest in stocks mentioned above.

Thanks for your work @jackedfinance Followed...

Hodorhodor, thank you for your kind words and also for holding the door

-Jack