In this video, I talk with author and economic analyst John Sneisen about the staggering level of bankruptcies Canadians face in the next year as the Bank of Canada raises interest rates three times.

Out of desperation and in anticipation of a crash, the Bank of Canada is to raise interest rates three times in 2018. This is one more than 2017. However, this does not bode well for nearly half (48%) of Canadians who are about $200 away from bankruptcy. Pushing interest rates up any more will likely dramatically affect those people and could very likely be the breaking point.

Teaming the vast inflation, regulatory burdens and tax burdens the Canadian people face, this is dangerous.

All fiat currency eventually reverts to its intrinsic value of zero. It always has, it always will. This goes back to 1024 AD in China. This will persist as long as people continue to have faulty fate in fiat and government.

This is all happening as the Canadian government makes a "decision" on NAFTA and is due to meet in Davos, Switzerland at the World Economic Forum with countless globalists.

These interest rate hikes appear to be a desperate attempt to put off the inevitable fiat dollar crash. We've seen this many times throughout history. They don't want to go into negative interest rate territory, but likely will all the same.

While so many Canadians go through a euphoric phase where they believe the dollar is growing in value just because the US dollar is devaluing at a faster rate, and that employment is up just because the government hides the numbers with the labor force participation rate, many will be blindsided.

That's why people must prepare! Self sustainability and financial responsibility are hallmarks of liberty and freedom itself. It's better to over prepare than under prepare and there's only so much time left. The fundamentals are off the table due to the level of manipulation in the monetary system (and markets), so you cannot put a date on the crash, but you know it's going to happen, so isn't it best if you have some form of nest egg to lean on rather than fall with the uneducated?

Spread the info and do whatever you can to decentralize and save yourself and your family!

See the FULL video report here:

Stay tuned for more from WAM! Don't forget to Upvote & Follow!

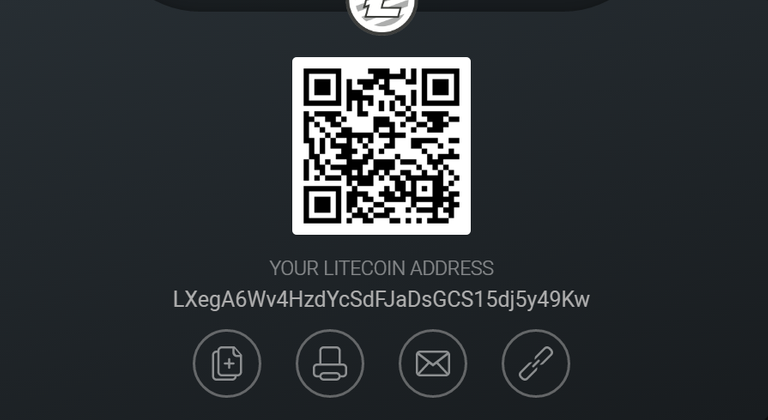

If you like what I do, you can donate to my Bitcoin, Litecoin or EOS addresses below as we're demonetized by YouTube and banned from sharing on Facebook!

Bitcoin:

Litecoin:

EOS:

So many people these days have too much debt. I think especially Canadians.

I learned my lesson back in 2009 when everything collapsed and I was laid off.

Took me 5 years to recover from that, but I learned a life-long lesson.

Now, I could deal with almost any crisis situation as I have kept my debt levels very low..

That sucks. I guess we should get use to Aunt Jemima maple syrup. Going to miss the 100% pure stuff:(

The whole world is laden with debt, if interest rates rise dramatically everyone will feel it, including the governments. Which is why they will never be able to raise interest rates any significant amount, else the whole system will get turned upside down and crash. We are in a crackup boom, thanks to the excess fiat currency pumped into the system and historically low-interest rates... this is the new norm.

Real estate speculators have pumped up prices, sadly many people who are just trying to maintain a home are going to lose again.

We have bigger problems than just money

https://steemit.com/conspiracy/@sallysmith/earthquake-emp-5g-attack-plans

She mentions Canada quite a bit.

Peace brother

That is a MASSIVE risk factor if this is spot on. The great correction continues in 2018 beyond the crypto markets?

Great video , and I just wanted to share something very interesting about these SCUMBAGS in our congress . Did you know that every disabled veteran gets a $20 deduction from their disability payments to the congress for some strange convoluted explination that you have to read to believe ⁉️ And on the paystub it says $20 for the congress ⁉️ It doesn’t explain , and then when you go to read what’s it for it just confuses you even more . These PARASITES must be EXTERMINATED ‼️🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀🐀. Great video 👏👍👊🏻