In this video, I talk with author and economic analyst John Sneisen about the overvalued and incredibly dangerous stock market which seems to be on its last legs.

Now, while so many are euphoric with what they believe to be an incredibly prosperous stock market, the truth is far from the optimism. In fact, we are about to see an epic crash.

In this video, we analyze the most need to know information, heavily sourced, based on historical data going back more than a century.

Looking at share buybacks, as Market Watch reports,

"For the 12 months ending March 31, S&P said that the actual S&P 500 companies spent an almost unbelievable record total of $589.4 billion for buybacks. That is so much stock buying that it is almost like taking Apple private."

20 major companies have taken part in buying back the most stocks including:

Gilead Sciences

Apple

GE

Pfizer

McDonald's

Microsoft

Boeing

AIG

Express Scripts

Wal-Mart

Johnson & Johnson

Oracle

Alphabet

CVS Health

Disney

Wells Fargo

Visa

JP Morgan

Citigroup and

Goldman Sachs

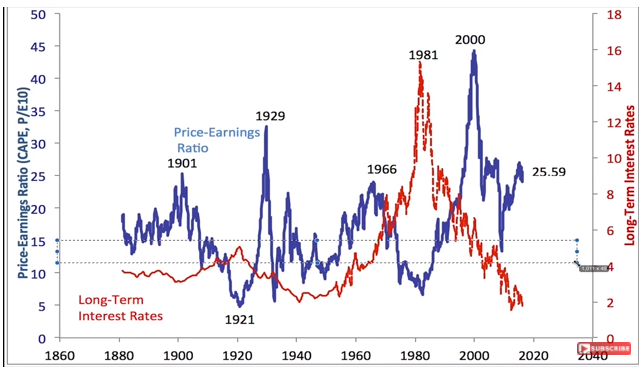

Examining 'Price Earning Ratios' (PE) throughout the world, overvaluing tends to happen between the 1-15 level. We see Italy in first place with a PE ratio of 29, Norway in second with 27.4 and the UK in third with 25.6 and that just scratches the surface.

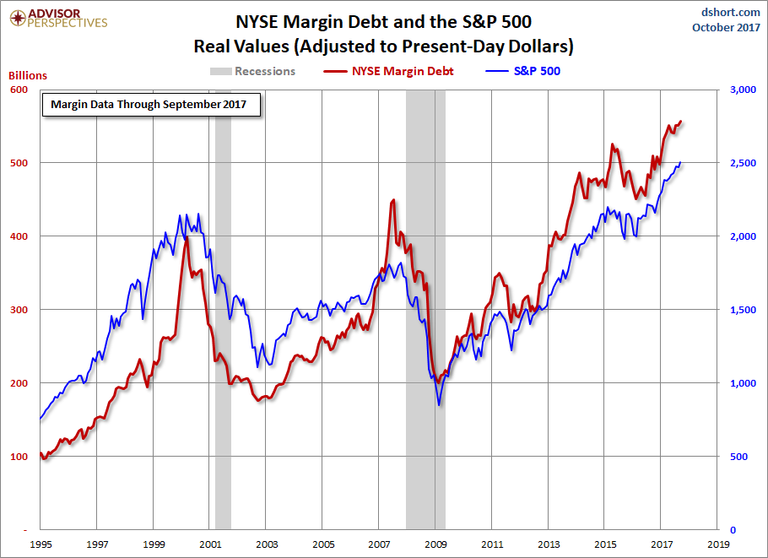

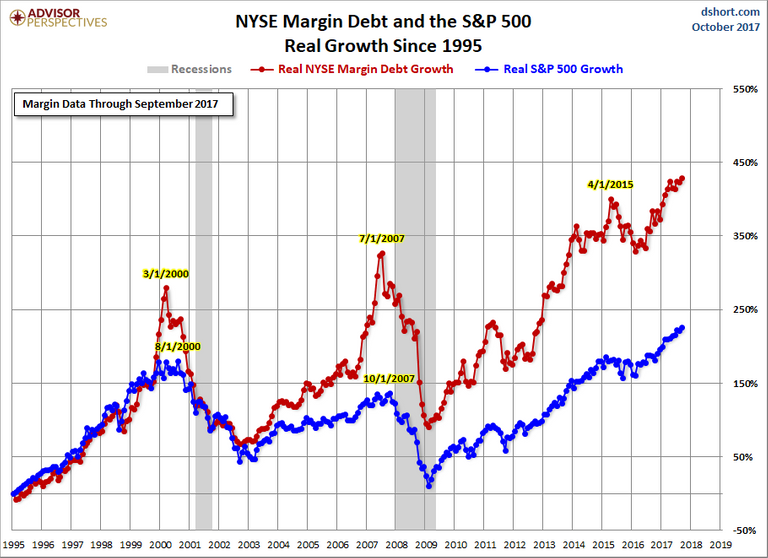

When we dig into margin debt we see even more manipulation and debt necessary to prop up the zombified market.

Everything from the markets to the monetary system are incredibly artificial and dangerous. About 30 Billion Dollars was recently pulled from US stocks in just 10 weeks. Ron Paul sees a likely 50% plunge in stocks in the near future.

The government and banking system thrive on debt but we as individuals do not. This will make 2008 look like a walk in the park. This will make the dot com bubble look like a good day for the stock markets. The bubbles will all burst and it will without a doubt be epic.

If you're pushed down a bottomless pit of debt, you are forced to ask for a ladder up from the government and banking system which puts you in perfect servitude to both entities.

This video gives a plethora of information and charts to help you understand the threat we face. This has nothing to do with Trump and everything to do with banker and government manipulation. It's better to be overly prepared than under prepared. We are witnessing the calm before the storm.

See the FULL video report here:

Stay tuned for more from WAM! Don't forget to Upvote & Follow!

If you like what I do, you can donate to my Bitcoin, Bitcoin Cash or Dash address here:

Bitcoin:

Bitcoin Cash:

Dash:

I have no doubt that we will see stories about people jumping out of windows in Manhatten's financial district.

At least for 2008, the Fed still had some ability to "help" in the short term. But not any more. They've used up all of their ammunition.

Same rule for any market-based equity...

I only hope they are smart enough and by crypto!

uses of Cryptocurrency is increasing. Have any effect of it on stock market?

@joshsigurdson

Great Analysis, Josh!

Added my 100% UV and VOTESWARM to promo this post!

The BIG RESET is COMING, imo 2018 will be it... EEK!

Nice post. Thanks for sharing

Do you honestly think this will happen?