In this video, I talk with author and economic analyst John Sneisen about the crashing Toronto real estate market as house prices drop harder than they have in 30 years.

March sales in Toronto dropped 40% from last year, the lowest since 2009. The average selling price for all homes dropped 14% from a year earlier, the biggest drop since 1991.

Detached home prices dropped the most which is notable as condo sales are the only thing that has gone up. There's a reason for that. People can't afford the detached homes anymore, but they are largely downgrading to condos.

The Toronto Real Estate board in a recent report said,

"The share of high-end detached homes selling for over $2 million in March 2018 was half of what was reported in March 2017, further impacting the average selling price."

To top it all off, active listings went up 103.1% since March of 2017. That is a massive rise in homes for sale, a recipe for disaster.

We've been warning about this for a long time. We remember well the euphoria of people in Toronto telling us it would just keep going up forever. The bubble was growing larger and larger. People were looking at their house as an asset. Their eyes became glassy and the hockey stick reached its peak and now we see a massive drop out. We will soon see similar in Vancouver. We reported on BMO's collateralized debt obligations which many of us remember from 2006 and 2007 before the bubble burst.

Collateralized debt obligations (CDOs) are packages of a bunch of mortgages, mostly bad mortgages with a few good mortgages. The package is rated by the top few good mortgages, often triple A. That is insane.

The level of derivatives manipulating the markets into temporary prosperity will burst the bubble and cause long term pain.

We need to be self sustainable and not fall for the fake speculation.

See the FULL video report here:

Stay tuned for more on this story from WAM! Don't forget to Upvote & Follow!

If you like what I do, you can donate to my Bitcoin, Litecoin or EOS addresses below! :)

Bitcoin:

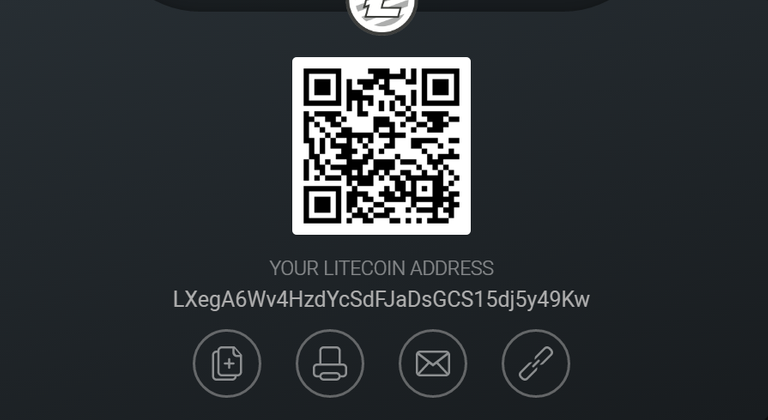

Litecoin:

EOS:

5 gold coins buy a condo up there yet?

The best friend my post

Good morning

Thanks you

The rentals in Toronto are crazy too, I thought about moving back but 2000 for bachelor apartment is crazy. It's New York or Tokyo, it's Toronto. This will cause more sprawl, destroy more forests and and farmland because the city is too expensive unless you are rich.

I've been to Toronto twice, once in 2015 and again in 2017. Both times locals told me there was a huge real estate bubble in Toronto that was eventually going to pop. Looks like the burst is upon us.

All interconnected to capital flows (primarily from Asia). Just as capital has moved out of USD it has seemingly topped off in its process of flowing into West Coast North American real estate.

This is the real reason property prices are topping out, and the speculators are just the last to try and make a quick buck in the face of rising interest rates. A poor bet to be making right now.

I think you might get another one here with CHICAGO and the state of Illinois ready to implode on its self . The previous budget arrangement was just like putting a bandaid on a self inflicted gun shot wound . It is massive taking pensions and most retirement plans with it . A lot of state and municipal employees are going to be let go and with no benefits package or pensions . Now I’m not trying to start any rioting , but humans riot when their favorite team wins a championship . So you do the math . Norther Illinois has one third of the states population , and a gun crime rate second only to Baltimore . With the toughest gun laws of course , they seem to go hand in hand . LOL