The Greater Fool Theory is the notion that even when an asset is fully valued or overvalued, there is room for that asset's value to increase even further because there are 'greater fools' out there to push prices up purely due to hype or speculation.

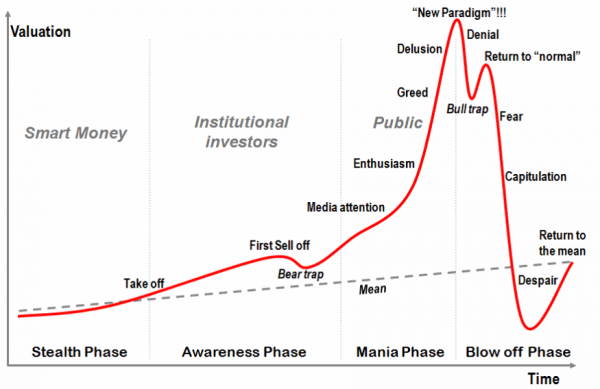

This can be strongly connected to economic bubbles where informed investors start buying an asset because it creates value to their portfolio. This creates some awareness and institutional investors make the price increase until the informed investors starts to sell off. The bubble escalades with media attention and public enthusiasm. The informed investors might even jump on the bandwagon in the media attention phase because they know that there are 'greater fools' out there. The bubble bursts and a paradigm shift pounds the asset value back to its true value. The figure below (by Vincent F. Hendricks) is a great starting point in the difficult task that is, to explain economic bubbles.

Congratulations @loffer! You have received a personal award!

Click on the badge to view your Board of Honor.

Congratulations @loffer! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!