This past Wednesday we heard from the Federal Reserve with regard to monetary policy, and as I predicted they did raise the federal funds rate 25 basis points however, instead of yields rising, they are dropping.

More than a year and a half ago I had said publicly that the Federal Reserve's attempt at trying to normalize bond yields would backfire-and this is exactly what is happening.

It is clear to me that the Federal Reserve has absolutely lost control of what is occurring in the bond market. Remember, this is uncharted territory, we have never been here before in the history of the financial world-so the Federal Reserve actually has no idea of how the market will react in the current environment with regard to their attempt at normalizing interest rates.

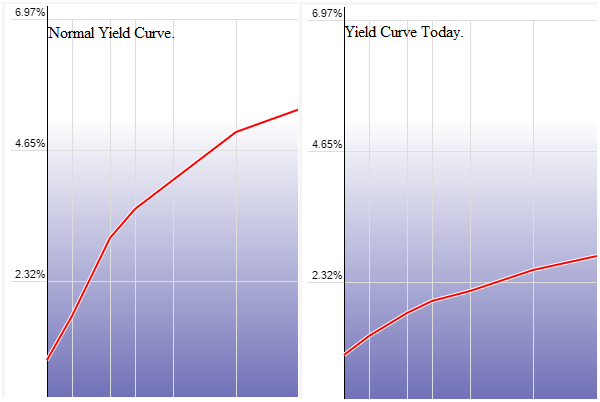

The yield curve as seen in the picture above continues to flatten out, and this trend will continue until the curve inverts.

The last time the yield curve inverted, the 2008 economic meltdown occurred, and the time before that we suffered the.com bubble meltdown.

The fact is we are existing in a multiple bubble economy at this time, worse, and unlike anything which has ever been seen before.

The reason why these bubbles exist is simple: the Federal Reserve has not allowed the market to do its one and only job, and that is to determine fair value.

The Federal Reserve's interest rate suppression cycle has not only allowed, but has been the driving force behind mass malinvestments across the entire spectrum of asset classes and as such, bubbles have been created.

The Federal Reserve has created distortions across the spectrum of asset classes which is frankly beyond belief, worse than has ever been witnessed in the history of finance. What this means is when the yield curve inverts this time, we will experience a meltdown magnitudes greater then the 2008 crash.

The irony is just like last time, the general public has no idea of what is coming and they are just as complacent as well.

In summary.

The federal reserves attempt at raising interest rates is having a paradoxical effect on the market as the yield curve continues to flatten.

I fully expect the yield curve to invert in the not so distant future. What this means is we can expect a market meltdown orders of magnitude worse than the last two times we had a yield curve inversion.

Gregory Mannarino

Greg, I completely agree and have been expecting this roughly since the 2007 bailout. I know you are a proponent of precious metals. I have been for some time, due to their obviously manipulated nature. I want to be in anything that's being held down, but I'm starting to wonder if it's going to be a good place to be when this happens. I feel like silver will still be stuck as a cheap, industrial metal. I think gold will act quite differently, because pretty much all we've ever mined is still out there, but even there I'm losing some faith in future utility vs. what crypto offers.

Thanks for the post.

Hold onto silver for the long haul, not for short term investment. Crypto's have been very profitable in the short term for many people, but they are very unstable. Crypto's rise is based primarily in the lack of trust in the dollar. If the dollar comes back, crypto's will once again return to their low value. I wouldn't bank on crypto's because we have an administration that is set on making America great again. The election of the Trump administration means the US is changing direction.

its all doom and gloom we gotta try live our lives people

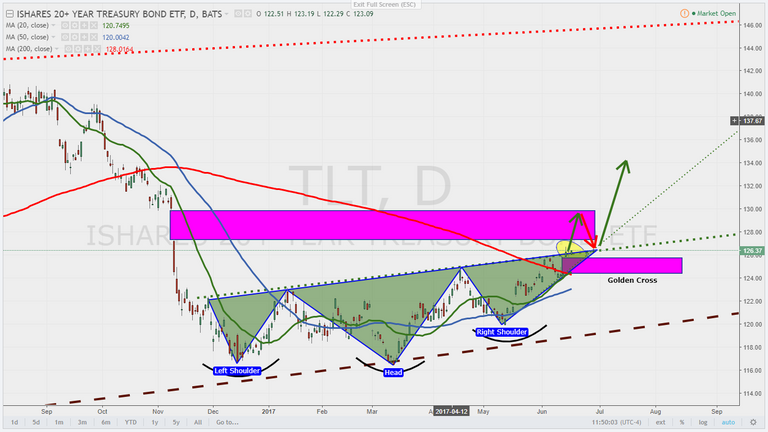

TLT... Inverse H&S and ABOVE the neckline.

TNX BELOW 3rd touch support.

I agree this is going higher. about to close out my naz future short from 1PM.

you have a good one. BTW I see what you are saying that it appears to be a INV H&S nice reversal catch.

chris

could you explain what these graphs are showing in layman's terms? What is the "Neckline"? How do you interpret this? Thanks in advance

TLT chart... Inverse head and shoulders is VERY BULLISH. So, we should see money pull out of equities and pile into 20-year treasuries (TLT). As for the second chart (TNX), it looks BEARISH which means money pulling out of equities and into treasuries.

Do you think this pullback out of equities also relevant for Miners and PM? What are your thoughts on that?

Thx!

that's a fine explanation - thanks for taking the time maestro :D

hey man, yeah its true there is a ton of stuff on that price chart the Maestro posted, its almost too much to explain, however the concepts arent hard to understand, they are just numerous. Best idea may be to search investopedia.com for key words he uses like "neck line," "chart pattern," "support line," or trend line,

in brief though, so that I may offer some resolution to your question, is that the neck line is the bottom trend line of the head and shoulders pattern, when price breaks it, it is considered a confirmation of the pattern and therefore a good predictor of future price action. Not all patterns are 100% but it seems to me that a head and shoulders pattern, when confirmed, is pretty legit.

let me know if this helps

Followed & Upvoted

Follow back please :) and upvote one of my blogs thankyou ;)

@thecrytotrader

😨

It's been happening. For almost a decade, we are living in the worse collapse that's coming soon 😳😬😀

agreed

Greg, I have enjoyed your interviews with USAwatchdog, but as much as we all know these "free" markets are currently run by the Fed, they will only collapse because of an event that the Fed can't control. But, in that event, you will have the worst crisis of all, a crisis of confidence in the system. It is easy to see how "Fed Up" people have become. Good Luck!

Exactly, and the Fed. Has lost control of the debt market.

Yeah, but remember this is not just the Fed. It is the BOJ, ECB, the SNB (I am in Geneva and shocked at the amount of US equities the SNB has purchased). During the housing crisis, the biggest borrowers of Fed funds were UBS and Credit Suisse. 2 Swiss banks. These guys all together have a lot of fire power. Don't get me wrong, the situation makes me furious and I am looking for signs that they truly have lost control.

Maybe we won't know they have lost control until the whole world knows it; I think like recessions we will only prove it by lagging indicators. Obviously, the Swiss think that nothing will unseat the US as issuer of the world reserve currency. I still think that things may unravel in the fall. Like Rickards believes, the IMF will then try to backstop the world with the SDR, maybe with inclusion of gold and silver in the basket. But I think China will not want to go along with anything tied to the debt-based US dollar; they have spent decades building the world with development projects, the US elites have spent decades destroying the enemies of Israel, and making Daddy Warbucks rich. We live in interesting times.

People will want nothing to do with the Bankster's SDR. I used to think Rickards was right on that SDR stuff - The Banksters will be Anathama when this next economic tsunami rolls in. The new currency will be Cryptos. So, get your ETH/BTC (and Silver) Now. Miniing shares will also do very well for a while.

good post

Thank you Greg for the heads up! Also thanks for the recommendation of this site

Greg you are on the top of your game on this and that you for all that you do

Yep! At some point this whole things gonna come crashing down or we're gonna be paying a wheel barrow load of paper for a potato while living under a huge military regime not being able to piss without having our chip checked. Don't forget the shitter tax each time you go..........

Exactly. Hyperinflation is coming and Soon.

Thanks Greg, the previous recessions will look like nothing compared to what is ahead!

Imagine this: In the 1970s folks were getting around 6 percent interest from bank savings accounts.

I remember my mother-in-law getting double digit returns on her CDs in the early 90s

forgot to include, if the interest rates on the tbills goes much higher, we will be devoting 1/3 of tax receipts to the interest alone; and tax receipts are falling!

Even if the US markets plummet it will be a great opportunity to make some major profits. Watching the bond markets (and commodities, stocks, etc.) closely. Thanks Gregory Mannarino, once again

Well if it goes down like that there is lots of opportunity. Let's see.

Yep. Although the market can stay irrational longer than most of us can stay solvent.

Yes. Mike Maloney says 'Wealth is never destroyed, it is only transferred'

@marketreport Can we use the yield curve (or straight line) to gauge how much life our financial markets have until they collapse? We've just raised rates but our 10 yr yields just keep going lower.

Greg, I've been around a long time. Lived through the 87' crash, I remember how I felt when the DOW pushed through 3000 for the first time, the dot-com bust, and 08 (that one was easy to see coming), and you are right, gen-pop has no idea what is right around the corner. All they see is 'Market Going Up - Lets get In!' But it should also be said "A fool and his money is soon parted" but will anyone listen? No, they will not, just like before. Same movie, different audience

Hi Dankh, can you share what similarities you see now with the times just before the previous crashes?

How far off d you estimate the crash is?

for the 08 crash I called it a year in advance to the week. It was easy. Ben Bernanke was raising rates at the same pace we are seeing now. But back then, as soon as Paulson (at the Treasury) said he was going to curtail printing money I knew it was over because you cannot, absolutely cannot stop creating debt and printing money in the current monetary system. I was one of the voices telling the pension fund directors to cash out of the market, they said I was the sole dissenting (out of 13 advisors) and that they would follow the majority voice. After the initial punch down they asked if it had bottomed and I told them they would see more pain the day after Christmas when retail sales was reported. They decided to listen then, but by then half the damage had already been done

Good analysis

Hello Greg

I write here the first time and I really hope you answer me. I am following you a long time and I fully agree with you, but...

I was checking not only today after your video the curve but also a year ago or so. I am looking at the percentage delta today in the chart and then I go and look at the graph when we had the same delta of percentage. It's difficult to see the percentages but only from approximation on the graph I would say the last time we had the same difference between the short yield and the longest yield on this graph was about 2005. Check yourself. I hope you get what I mean. So can't it go on for another 2 years (because the last crisis started 2007)? You think the long end is coming down faster or why do you think it comes soon? Don't get me wrong, I am not a troll, I am just waiting for it to happen for years now and it just doesn't. I know, be carefull what you wish for...

Jim Rogers ( Not Jim Richards ) Said a few weeks ago the crash will come this year or next year at latest. He has never before said such a direct time. Normally he always says he knows it is coming but does not know when. Jim Rogers is in my view one of the best (Billionaire) investors out there.

I have also been waiting for years, even have a food stash of canned food that is expiring... I kind off start feeling dumb because it is thousand of Euro's worth, and wonder if I was wrong.. At least my gold an silver is not expiring :)

Be happy it takes such a long time, it gives us more time to prepare. Get your own water well, solar system, electric car, gold, silver, bitcoin, garden for planting potato's.

The longer it takes the better our chance to survive and prosper gets.

It is not if but when and you are right the meltdown is coming very soon. Thanks.

Beware the flattening yield curve.

Bet against the debt.

Become your own central bank.

My mantra for the duration. It's stuck in my head, as it should be stuck in the heads of the masses. Keep preachin' it!!!

brace for impact, thanks for all your info.

Great post! Thanks for sharing this!

Good article.... here we go!!!

upvoted...

resteemed... :-)

no smiles here. Although the price to pay of seeing all those assholes with leased vehicles/mortgages in the 100,000 will be the only benefit. Told you so ain't gonna help.

Cant they just print and re-inflate?

Following you in YouTube. I just created my Steemit account and already voted in favor of this article. I still don't have a clue how to earn SBDs yet, :-)

SBDs come from comments and posts that earn... they can be traded into steem power and vice versa same for steem

Finger on the pulse as always ! Thank you good sir Brother Greg @ marketreport ! www.traderschoice.net

Most people still do not see what's coming, may they wake up soon.

Thank you Greg, we are now ready

Bond Yields - "You Ain't Seen Nothin' Yet"

http://www.zerohedge.com/news/2017-06-16/bond-yields-you-aint-seen-nothin-yet

http://investinghaven.com/screening/10-year-yields-next-trend-markets/attachment/10_year_yields_june_2017/

Greg could we see a Black Friday Event? Crash? Thanks for sharing

I think China will be the catalyst this time. There are bleeding harder and faster than we are. There is articles about China manipulating bitcoin price, and that they lied about outflows. They are having problems also with net bond issuance as well. The chinese already have an inversion with their bonds. My best bet is China will blow before we do.

I agree and that will start the falling dominos, USA will be hit toward the end of the stack. China and Russia will rise quickly once USA starts falling because they are already putting infrastructure in place to start a new.

Greg as you always say look to the Debt market for what is happening. Thanks for all you do for us.

You the man Greg! Just thought I'd drop by to build up your self-esteem!

Another great article Gregory. Thank you for sharing with proof.

Anyone who says he has 100% proof of anything is most probably wrong.

Wow. Great article Greg. So what can people do to prepare for this? I understand stocking up on food, water, supplies, but what about precious metals and stacking cash? Is there anything safe to invest in?

shit is gonna hit the fence.

and if you not prepared for it.

or don't own any crypto, then you are screwed before it happens.

Thank you Greg, i just caught your video at you tube and came here for the chart. I did not understand bonds & the yield curve until I began to watch your videos. So grateful that you share your years of experience with all of us. I am transferring my assets from a traditional IRA to a self directed IRA at this time & hope to be done before this blows up.

Thanks for the thorough analysis and valid sound predictions based on factual efforts making by the federal reserves

When yield curve invert, all hell will break loose .

thus...load up the truck with gold/silver!

And don't forget the cryptos.

The big crash is coming

If one analyst such as yourself can see the yield curve inverting as well as recognize that when this has happened historically a crash follows, why are they not concerned? Do you believe they are inverting the yield curve on purpose to blame the next crash on the trump administration?

thank you Greg for the great info that you've provided to help us.

Thanks for your work Greg.

Great post. Thanks Greg

Thanks Greg- do you think it will be weeks or months until it goes inverse and do you think it will have immediate reaction in equities??

Yield Curve = Economic flat line approaching.

I know that it is inncorect to ask when will the melt down start (because we are in he thick of the meltdown that started about 100 years ago) but how bad will it get?