OK my pride of lions, I think it's time for me to give you a visual as to what is occurring in the bond/debt market, and the current flattening yield curve.

First allow me define for you what it means to have a flattening yield curve, and why it's important.

A Flattening of the yield curve is a situation that describes the relationship between short and long-term bonds (debt).

Generally a 30 year bond would have a greater yield then let's say a 10 year bond. The higher yield is offered to the investor because of the risk associated with holding a Long term debt instrument.

All the talk, even from the mainstream financial media about the current flattening yield curve comes down to this: it indicates that there is growing concern among investors regarding the longer-term macro economic outlook-it is just that simple.

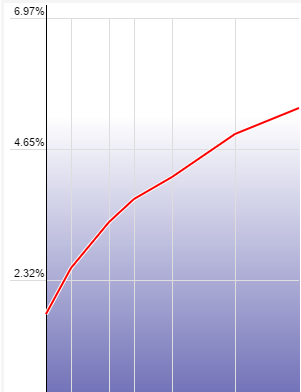

Have a look at this first chart below.

This is an example of what a normal yield curve looks like, this particular chart is from 2004.

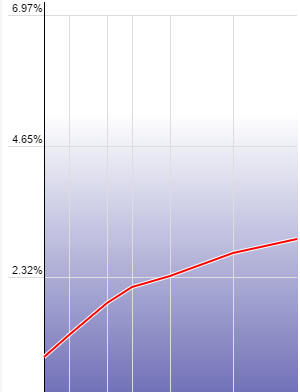

Now have a look at this other chart below.

This is our current yield curve. Notice anything?

What this says to me, and should say to you as well, is the longer-term macro economic outlook is not as blissful as the mainstream financial Pundits would like you to believe.

Well seeing is believing, and after getting a visual on the differences between a normal yield curve and our current situation, what do you think about this?

Gregory Mannarino

Greg, I think with what we are seeing with the dollar getting weaker, cryptocurrency sky rocketing, metals begining to move in the right directions. The yeild curve is flatning. I believe this maybe the starting of a collapse. Stockmarket is all over the board. Something for sure feels unusual. Great article. Thanks for what you do.

I believe this is the greatest time to be alive. To get very wealthy.

There will diffently be a wealth transfer. I also belive it will involve silver, gold and cryptocurrency

Good to have a diverse portfolio.

There's one more hard asset that most people are over-looking... It's Common Coinage which I believe will increase 100 fold in buying power once the Federal Reserve (Debt) Notes collapse... Pocket Change...

The venezuelan bond yield curve is inverted.

The bonds are rated CCC

http://www.worldgovernmentbonds.com/country/venezuela/

Looking at your graphs above I think it's wise to invest in the Crypto Market as other traditional ways to earn interest including bonds aren't working as good as it used to be.

Definitely something to watch. I never knew the importance of the bond market until watching you! Upvoted and resteemed thank you

Master Gregory,

Long term macro-economic thinking makes me want to shelter my grandchildren! Their lives will likely be twisted (like the impoverished childhoods of my parents who were born in 1924). Boil the cabbage one day and drink the water the next.

PPT will be there to save the day. Not worried here.

What if one day the PPT is told not to intervene?

Gold and silver is a good play. With cheap metal prices.

All together now.. ROARRRR! I just tagged you in a video on my page Greg, give it a look cheers👍🏻

Gold, Ground, Grub, Guns, Gas.....and Silver, Crypto Currencies. Mike Maloney talks about it. I will go with those for now.

I like the three g's gold guns getaway plan hahaha

I am listening greg what should we do next to prepare

duck and run?

Greg I've been listening to your reports for a while now and respect you for trying so hard to help others achieve the same success level you have .. kept up the great work and sharing your knowledge ..

I dont want to do that though

hide out in the safety names like AAPL AMZN GOOGL...they never go down...the NDX is like a money market that pays 20%....lol

let me see here....? Silver? Greg, what about silver? hahahaha just kidding bro.

Is this the first time in the US history that the yield curved is almost flat?

If my memory serves me right, the yield curve went even flatter just before the 2008 collapse (compared to now). If the same plays out again, there could be still some more time to go before the next collapse occurs. My guess is that it's probably going to happen in Sept/Oct of this year (as history suggests that these 2 months tend to be favourites for big crashes).

Knowing the fate of the bond market, I'm wondering what form(s) the market might take, post-collapse. If it will exist at all, that is.

The bond market is too under-estimated among equities traders.

Thank you Greg always learning from you !

I'm ready for this gargantuan sized collaspe to happen already, im tired of living paycheck to paycheck. If bitcoin gold/silver is going to do what the experts say, i'd be pretty freakin happy. Lets gooooo

lets be honest, no1 wants to see a collapse, they are just more prepared for it

Thanks for the explanation, I was unaware what this actually meant. See, this is why I keep coming back and checking out your material, never know what I am going to learn each day! Keep up the good work!

Always up vote your vids. Gotta show support! I agree with you but I'm hoping you're wrong as all chaos would ensue. I'd rather be prepared but not have to live in that sort of environment at all. The world my be a f****d up place but living under a post shtf event isn't going to be grand, glorious or easy at all. Most will die or wishin' they were, even the most "prepared" among us. Of course I'm sure there's a Tarzan or two out there who'll be just fine. And then again maybe it'll be another 08' where we somehow someway held it all together. Me thinks not this time.

Greg thank you very much for helping and waking up all us sheep. What you are doing is amazing and myself and my family are very grateful for you. I am pretty much a newbie to trading what is the best software to use and do you have a video that explains everything about the terminology? I have a schwab account and currently use street smart but have done very little trading with it. Thank you again have a wonderful evening with your family.

interesting time indeed...

Greg,thanks for the update. Does this mean that the end is hovering over the horizon?

The ticker symbol mentioned in this YouTube post that supposedly foretold the recent cyber attack is HACK (PureFunds ISE Cyber Security ETF - last share price approx. $30). Crash and rally alerts given for a number of securities and commodities, including the Dow and Gold.

TVR [#348] 05-15-2017 THIS GUY PREDICTED THE GLOBAL CYBER ATTACK DAYS IN ADVANCE

Algo Capitalist | May 15, 2017

Oh yes, I did an episode on the stocks, bonds and real estate markets a few weeks ago. Good info Gregory thank you!!!

I agree, I think our economy is in trouble and even though President Trump wants to help middle America, produce jobs and reduce taxes, congress a.k.a. the swamp does not want this.

I won't be surprised to see the Fed step in to keep the market propped up though till they think every last mom and pop is all in. Then they will sell!

I think the smart money knows that we are not going to get to 3-3.5% in time to cut to 0% and begin QE phase 4 prior to the next recession, which we are likely already in.

I've been following you and other financial gurus for over a year now and have been getting prepared for the worst that may happen, I'm praying that when it happens we will all be able to get through it together with minimal damage, mostly for my family and friends who are living in their fantasyland world while refusing to adhere to my warnings. I tell them do a little research if you don't believe me, but I know their not doing so. Guess who they will be expecting to bail them out when reality hits?

This post has been ranked within the top 50 most undervalued posts in the first half of May 17. We estimate that this post is undervalued by $12.04 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: May 17 - Part I. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.

Interesting observation.

Greg great stuff been watching you long time now, your friend Makebucks. p.s. still stacking.

I hear you! I've been following you and others in the alt media. It WILL happen, just pin pointing the when is a little trick given the trimverate - stock market, bond market and Realestate market! Wow, we are in for a doozy.