Get cash dish cash fast has been my gameplan if you know buy things that have real value with trash cash while you can before you be left holding a bag of trash.

The clown show just keeps on going. If stocks go up, my central bank increases. If stocks go down, my central bank increases. The Fed is simply a puppet on a string. Great video Greg!

Greg as you know since the creation of the fed in 1913 the dollar has devalued by about 96% I think. That doesn't leave a lot left they can't play this game forever. Cheers mike

Well, for the very short term silver will be taking out the flash crash low that was set at $AM EST on Mon anyhoo. After that, anything is possible in a deflationary environment that will soon be obvious to one and all. There might be a flash crash in bitcoin though. So if you are a "long termer"...better remove those stop loss orders.

I have a blog where I am tracking bitcoin via teh U.S. exchange traded bitcoin tracker GBTC. If you wait for me to update that call at buy time you won't have to worry about keeping limits open that "might" get shot through like shit through a goose. there will be no buy in bitcoin over the weekend. That's for sure. Not with this chart setup on GBTC.

You can pull that chart back to the 3 month daily timeframe and you will see that as "actual" bitcoin traded through the pre-Memorial day weekend high (May 25th to be eggzact) and then moved to $3000, GBTC made a lower high. That proved to be a tell. And "actual" bitcoin has been following GBTC ever since. There is a chance GBTC will trade sub $160. If that happens you will go down at least 20% on a bitcoin buy at $1500.

Hi bro, can you look at my userpage: @healthiswealth It says I have exceeded the bandwidth again and I am locked out again??

Steemit is beginning to Suck in a big fucking way!

This comes up when I try to use my wallet? Exceeded bandwidth, Please wait to transact or power up STEEM.

Its fucking bullshit there is no where to go or contact when STEEMIT is Fucking up?? piece of shit!

this is now the second time??????????????? fuck me?

Last time I was off for over three days?

Bad economic news is seen in tandem with more support from the fed. As long as the fed will back stop the market bad economic news will cause the market's to rise.

Market's will never provide good economic data as long as the fed is backstopping it with debt.

ie market's will continue to rise until the fed looses control of one of the aspects of the market which they are "managing"

I think Yellen knows this is her last few months left as head of FED. She is ready to have the dollar go down because of what Trump is doing in Washington. They do not like Trump because he is for the people not the Banks. Silver is my investment of choice for the long run.

Very interesting times @marketreport. Great video as always.

As Mike Maloney has been saying for a long long time there is going to be a huge wealth transfer soon enough. If I am honest I don't know if I am looking forward to it or not, when the credit eventually goes, what on earth happens to the quality of life that we are all used to? Potentially scary stuff.

Troo dat. Gonna be nothing short of ASTOUNDING! what a well placed short bet in the IWM, SPY, or QQQ put options will acheive. $1000 for every $100 wagered imo.

That would be a very impressive return if things don't go too far. If they do go too far though then you won't want that paper crap, you won't want bitcoin, ethereum, steem, gold, silver, or second properties. You will want a can of baked beans. If the credit system falls over then food won't get to the supermarkets and then you are only 9 meals away from anarchy.

That is why I am a bit apprehensive awaiting the inevitable collapse.

I think you listen to Bitcoin bubble boy Dollar Vigilante too much. All it will do is bring things back to true pricing. Gasoline will be selling for lessthan 1.50/gal by Labor day. The cost of materials will come way down, the cost of labor will come way down. teh cost of everything will come down. If anything it will revive the entrepeneurial spirit in teh U.S. again. Hell, you will be able to walk away from your $25K in credit card debt because Capital One bank will be in bankruptcy and there's no way they will be able to come after you. Settle out for .20 on teh dolar with whatever collection agency calls you to collect. they bought it for .10 on the dollar. Nirvana simply becuase all of the Silly Con Valley jerkoffs who "think" they came up with some lame ass idea to replace the dollar are on teh streets selling apples. A "perfect" world if you ask me. And if not, who cares? I happen to like baked beans. Bush's original of course.

Well I hope you are right. But I don't think deflation will happen. If you look throughout history the trend reveals that we are more than likely going to get hyper-inflation as all the exported inflationary dollars come home to roost.

If you meant credit bubble in U.S. govmint debt instruments you are sadly mistaken. This is not a credit bubble. It's a rest area before a move to a new 52 week high.

See that area to the right side of that chart for calendar year 2017? When price is moving higher it is considered an "uptrend." Don't EVER try and argue with the market...ever. Do you want to get your face ripped off? :O

The "almighty" dollah is next. It's been telling you of things to come for 5 years now. Now you understand why the gold and silver bugs are always crying and moaning. They are all eitehr too stupid, ignorant, or misinformed about how things happen in a "real" market. Wait'll this thing rocks your world! You will be "begging" Janet Yellen to QE4. Just like Peter Schiff will be.

Listen, go get a life. There are 10 pedophiles living within 20 blocks of you. Now get on it and report back to me after you have at least one of them arrested. Read the entire thread and go do something "useful" with your time. Nothing to see here.

It is really sad. You seem like such a bright person and I happen to agree with many of your financial opinions. Your humor is edgy and funny most of the time, but one should never cross certain lines just for "kicks". Karma is a bitch.

Hell, who knows as most of the people of this great country don't have a penny to their name and have a huge digital debt created through just that very same credit system. Does it mean you may have to dust off that old shotgun in the closet and actually have to use it? Beats me, and like you, I don't think I want to find out.

The either don't have a clue what they are doing or they have an agenda, who knows....

Btw Greg there is a buzzing sound in your videos.

It is not to criticize you don't get me wrong.

Just to let you know in case you might want to fix it :)

Agreed. Don't hold your breath that any regulator is going to say anything about market manipulation.

Also, I keep taking an occasional peek at that Fear & Greed Index that you brought up a few days ago - have you seen how quickly that swung from like 40 up to 63 today? What's your take on that? Is that normal for it to swing that quickly short term? Of course, the history shows it was at 90 a year ago!

In my retail job there isn't much money velocity but lots and lots of govt benefits velocity. It's becoming so skewed, it makes your head spin. Still practicing your tenets of become your own central bank and bet against the debt.

Thank you as always, Greg. I'm finally here after following you for six years on YT. One question I have always had about being one's own central bank; If one had stacked a little quantity of PM, is there any way to leverage that for profit, like the 'big' central banks do? Or is it just a hold-it hedge for if and when the big hammer comes down... Thanks again for all you do.

Look forward to your daily market reports. Love that you do them during market hours instead of after. Appreciate all your hard work. Keep on stackin..

Too much man! Over and over again you repeat yourself...LOL

I can't remember the last time there was any good new.

When will the latest bad news eventually set this thing off?

I said it yesterday that the Dollar was having trouble, and now it seems to be getting worse. I can't wait to see it below $90. I believe you said there was not much support below that.

We don't need inflation...we need Gold and Silver and a stable economy and currency. I know that growth is not as much as with fiat, but at least the small fish have a real chance at a life. Not this inflated dollar that destroys and enslaves us.

Btw, why do you think it is the Fed who is causing the selloff in bitcoin? I see no evidence of it. Highly unlikely there is a govmint entity trading bitcoin. I doubt the Fed is in collusion with the Chinese gamblers doing most of the data mining and controlling bitcoin prices. I'm sure there are some hedge funds "manipulating" price. I've proved beyond ANY doubt bitcoin price has been manipulated "higher"...not lower. All one needs to do is read my spews on teh volume characterisitics on the live bitcoin ticker. Bitcoin is 10 times more manipulated than silver or gold.

I'm sure this isn't a novel sense of things, but when I look back ,even two or three years ago, the warnings and worries weren't very different. I am not suggesting they are not valid, but doesn't it almost feel like Let's have doomsday already and get it over with.. By the way, even die hard optomists should be buying silver right now.

I've read an interesting article on Wolf Richter's website (http://wolfstreet.com/2017/07/13/what-will-the-fed-do-jobs-productivity-inflation-qe-tighten/). Long story short, he said that QE was deflationary because productivity fell. The reason is that cheap money fueled stock buybacks which are risk free instead of investing money in hiring people or in investing in new technology (more risky than buybacks). If the Fed unload its balance sheet, it will be inflationary because businesses will have to take on more risks to generate profits. Therefore, they will increase wages for higher skilled people and investing in productivity. From my point of view, I think it makes sense... what do you think?

Anything coming from the US economy is bad news and when it comes to gold and silver people should be hoarding as much as they can those metals are very undervalued due to the wreckless printing by the Fed throughout the years so i have little faith in the dollar or the health of our economy and its ability to survive much longer without a major correction across the board.

I now have UUP showing as a confirmed bottom as long as it moves no lower than the current 24.63. I'm going to wait for my buy signal before going long though. Not sure it materializes today. I already entered SPY short. Still waiting on teh Q's, IWM, and VIX. I will likely be entering SLV short whenn I enter UUP long. I'm sure that makes "logical" sense. And I truly hate trading on logic. Logic will get you kilt when trading teh markets. (Copyright: Joe..JUST Joe 7/14/17) :-)

I think we are seeing a long term stock market top here and we then move on to 2008-2009 lows. The first wave down will be devastating. The dollar will be one of the safe havens...along with U.S. govmint debt...and of course teh sexy VIXens. Let me handle these gals in the beginning at least, Greg. They like to party and they party HARD once they get started. When I'm up 700% on my VIX calls (still no buy yet), I'll let you know. "Hopefully" they will be ready to take it easy for a bit. Don't want to see them rip your face off. :-)

I envy the new Silver Stacker, getting in now, at these silver prices. Many experts are saying, there has never been a better time to buy physical silver.

This post has been ranked within the top 10 most undervalued posts in the second half of Jul 14. We estimate that this post is undervalued by $59.76 as compared to a scenario in which every voter had an equal say.

Yeah, dollar is going down and fast, see chart below. Also I have been writing in my daily blog as well that dollar is going down and gold and silver are poised to go higher. Gold closed above the all critical level of $1220. Dollar broke the 50% resistance line. Next line is around $93.

Whenever I buy silver, I always want to buy more than I do.

It's just fiat, trade it for something real!

Me too!!!! LOL My wallet holds me back!!!!

Get cash dish cash fast has been my gameplan if you know buy things that have real value with trash cash while you can before you be left holding a bag of trash.

Yea its easy to want to just get more and more.

The clown show just keeps on going. If stocks go up, my central bank increases. If stocks go down, my central bank increases. The Fed is simply a puppet on a string. Great video Greg!

Greg as you know since the creation of the fed in 1913 the dollar has devalued by about 96% I think. That doesn't leave a lot left they can't play this game forever. Cheers mike

Keep telling the truth brother.

nooo, down to 7 dollars is impossible!

Who would sell physical silver for $7? If silver went to $7 spot, the premium, for physical, would be $10.

Pray for it and buy if you can!

Nothing is impossible.

Well, for the very short term silver will be taking out the flash crash low that was set at $AM EST on Mon anyhoo. After that, anything is possible in a deflationary environment that will soon be obvious to one and all. There might be a flash crash in bitcoin though. So if you are a "long termer"...better remove those stop loss orders.

Thanx for the info Joe!!!

I have a buy on more bitcoin at $1500, $1250, $1000

ty

I have a blog where I am tracking bitcoin via teh U.S. exchange traded bitcoin tracker GBTC. If you wait for me to update that call at buy time you won't have to worry about keeping limits open that "might" get shot through like shit through a goose. there will be no buy in bitcoin over the weekend. That's for sure. Not with this chart setup on GBTC.

http://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=&symb=gbtc&x=48&y=11&time=18&startdate=1%2F4%2F1999&enddate=2%2F18%2F2017&freq=7&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=9&uf=0&lf=1024&lf2=2&lf3=8&type=2&style=320&size=4&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=11

You can pull that chart back to the 3 month daily timeframe and you will see that as "actual" bitcoin traded through the pre-Memorial day weekend high (May 25th to be eggzact) and then moved to $3000, GBTC made a lower high. That proved to be a tell. And "actual" bitcoin has been following GBTC ever since. There is a chance GBTC will trade sub $160. If that happens you will go down at least 20% on a bitcoin buy at $1500.

I like that call of $1500 joe.

Hope to see that happen.

Hi bro, can you look at my userpage: @healthiswealth It says I have exceeded the bandwidth again and I am locked out again??

Steemit is beginning to Suck in a big fucking way!

This comes up when I try to use my wallet? Exceeded bandwidth, Please wait to transact or power up STEEM.

Its fucking bullshit there is no where to go or contact when STEEMIT is Fucking up?? piece of shit!

this is now the second time??????????????? fuck me?

Last time I was off for over three days?

Do you know of whom to contact?

Great video. Bad economic news and S&P is all time high. Silver up which I like a lot:) .

Bad economic news is seen in tandem with more support from the fed. As long as the fed will back stop the market bad economic news will cause the market's to rise.

Market's will never provide good economic data as long as the fed is backstopping it with debt.

ie market's will continue to rise until the fed looses control of one of the aspects of the market which they are "managing"

It is all true and thank you Greg for tell it like it really is

I think Yellen knows this is her last few months left as head of FED. She is ready to have the dollar go down because of what Trump is doing in Washington. They do not like Trump because he is for the people not the Banks. Silver is my investment of choice for the long run.

I agree with that statement. Silver is the investment of choice. Just when, when, when! I am tired of the manipulation and I am so ready for a change.

Seems like there is always bad economic news.

At least stocks went up.

Thanks for your analysis @marketreport

Very interesting times @marketreport. Great video as always.

As Mike Maloney has been saying for a long long time there is going to be a huge wealth transfer soon enough. If I am honest I don't know if I am looking forward to it or not, when the credit eventually goes, what on earth happens to the quality of life that we are all used to? Potentially scary stuff.

Troo dat. Gonna be nothing short of ASTOUNDING! what a well placed short bet in the IWM, SPY, or QQQ put options will acheive. $1000 for every $100 wagered imo.

That would be a very impressive return if things don't go too far. If they do go too far though then you won't want that paper crap, you won't want bitcoin, ethereum, steem, gold, silver, or second properties. You will want a can of baked beans. If the credit system falls over then food won't get to the supermarkets and then you are only 9 meals away from anarchy.

That is why I am a bit apprehensive awaiting the inevitable collapse.

I think you listen to Bitcoin bubble boy Dollar Vigilante too much. All it will do is bring things back to true pricing. Gasoline will be selling for lessthan 1.50/gal by Labor day. The cost of materials will come way down, the cost of labor will come way down. teh cost of everything will come down. If anything it will revive the entrepeneurial spirit in teh U.S. again. Hell, you will be able to walk away from your $25K in credit card debt because Capital One bank will be in bankruptcy and there's no way they will be able to come after you. Settle out for .20 on teh dolar with whatever collection agency calls you to collect. they bought it for .10 on the dollar. Nirvana simply becuase all of the Silly Con Valley jerkoffs who "think" they came up with some lame ass idea to replace the dollar are on teh streets selling apples. A "perfect" world if you ask me. And if not, who cares? I happen to like baked beans. Bush's original of course.

Well I hope you are right. But I don't think deflation will happen. If you look throughout history the trend reveals that we are more than likely going to get hyper-inflation as all the exported inflationary dollars come home to roost.

And dude Heinz are the best brand of beans. Lol.

OK, you sold me. I'll try some of them Heinz beans. Van Camps "used to be" great when I was a kid. Now they are Van Camp's soup n beans. :O

If you meant credit bubble in U.S. govmint debt instruments you are sadly mistaken. This is not a credit bubble. It's a rest area before a move to a new 52 week high.

http://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=&symb=tlt&x=54&y=17&time=10&startdate=1%2F4%2F1999&enddate=2%2F18%2F2017&freq=1&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=9&uf=0&lf=1024&lf2=2&lf3=8&type=2&style=320&size=4&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=11

See that area to the right side of that chart for calendar year 2017? When price is moving higher it is considered an "uptrend." Don't EVER try and argue with the market...ever. Do you want to get your face ripped off? :O

The "almighty" dollah is next. It's been telling you of things to come for 5 years now. Now you understand why the gold and silver bugs are always crying and moaning. They are all eitehr too stupid, ignorant, or misinformed about how things happen in a "real" market. Wait'll this thing rocks your world! You will be "begging" Janet Yellen to QE4. Just like Peter Schiff will be.

http://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=&symb=dxy&x=34&y=15&time=12&startdate=1%2F4%2F1999&enddate=2%2F18%2F2017&freq=1&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=9&uf=0&lf=1024&lf2=2&lf3=8&type=2&style=320&size=4&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=11

@joejustjoe

Are you an admitted pedophile? If you were joking, it was not funny and you should be arrested if it's true.

https://steemit.com/vixens/@joejustjoe/i-think-i-am-falling-in-luv-with-the-wrong-sexy-vixen-uvxy

Listen, go get a life. There are 10 pedophiles living within 20 blocks of you. Now get on it and report back to me after you have at least one of them arrested. Read the entire thread and go do something "useful" with your time. Nothing to see here.

It is really sad. You seem like such a bright person and I happen to agree with many of your financial opinions. Your humor is edgy and funny most of the time, but one should never cross certain lines just for "kicks". Karma is a bitch.

Hell, who knows as most of the people of this great country don't have a penny to their name and have a huge digital debt created through just that very same credit system. Does it mean you may have to dust off that old shotgun in the closet and actually have to use it? Beats me, and like you, I don't think I want to find out.

The either don't have a clue what they are doing or they have an agenda, who knows....

Btw Greg there is a buzzing sound in your videos.

It is not to criticize you don't get me wrong.

Just to let you know in case you might want to fix it :)

Happy weekend to you too !

up is down and down is up

Thanks for keeping us informed!!

How long will it take to destroy the Dollar?

Agreed. Don't hold your breath that any regulator is going to say anything about market manipulation.

Also, I keep taking an occasional peek at that Fear & Greed Index that you brought up a few days ago - have you seen how quickly that swung from like 40 up to 63 today? What's your take on that? Is that normal for it to swing that quickly short term? Of course, the history shows it was at 90 a year ago!

Fantasy land. Exciting time to be alive. Wonder if this is the new normal???

In my retail job there isn't much money velocity but lots and lots of govt benefits velocity. It's becoming so skewed, it makes your head spin. Still practicing your tenets of become your own central bank and bet against the debt.

Thank you as always, Greg. I'm finally here after following you for six years on YT. One question I have always had about being one's own central bank; If one had stacked a little quantity of PM, is there any way to leverage that for profit, like the 'big' central banks do? Or is it just a hold-it hedge for if and when the big hammer comes down... Thanks again for all you do.

I continue to add to my physical positions.

Upvoted & RESTEEMED :]

Look forward to your daily market reports. Love that you do them during market hours instead of after. Appreciate all your hard work. Keep on stackin..

Too much man! Over and over again you repeat yourself...LOL

I can't remember the last time there was any good new.

When will the latest bad news eventually set this thing off?

Your guess is as good as mine. I don't even care anymore, I just want us all to capitalize on all this.

Keep Stacking & STEEM On! Another great update.

Why do you think the Crypto's are going down today when the precious metals are going up?

Because more and more people are wanting to pile in and up we go!

pickup some more silver today.. thanks greg

I am so grateful and thankful for your posts!

Thank You Greg, look forward to seeing you on Greg Hunter early Sunday release, I love what you do.

nice and yet crypto is tanking?!

I said it yesterday that the Dollar was having trouble, and now it seems to be getting worse. I can't wait to see it below $90. I believe you said there was not much support below that.

We don't need inflation...we need Gold and Silver and a stable economy and currency. I know that growth is not as much as with fiat, but at least the small fish have a real chance at a life. Not this inflated dollar that destroys and enslaves us.

You strongly remind me of Al Pacino heh!)

Oh i love movies with him.

Btw, why do you think it is the Fed who is causing the selloff in bitcoin? I see no evidence of it. Highly unlikely there is a govmint entity trading bitcoin. I doubt the Fed is in collusion with the Chinese gamblers doing most of the data mining and controlling bitcoin prices. I'm sure there are some hedge funds "manipulating" price. I've proved beyond ANY doubt bitcoin price has been manipulated "higher"...not lower. All one needs to do is read my spews on teh volume characterisitics on the live bitcoin ticker. Bitcoin is 10 times more manipulated than silver or gold.

http://bitcointicker.co

I'm sure this isn't a novel sense of things, but when I look back ,even two or three years ago, the warnings and worries weren't very different. I am not suggesting they are not valid, but doesn't it almost feel like Let's have doomsday already and get it over with.. By the way, even die hard optomists should be buying silver right now.

It does feel like it is coming. I want a change and I am tired of waiting to be honest with you.

Yes, vaguely I remember a name. It begins with a G and and ends with ...regory Mannarino or something.....😉😉

I've read an interesting article on Wolf Richter's website (http://wolfstreet.com/2017/07/13/what-will-the-fed-do-jobs-productivity-inflation-qe-tighten/). Long story short, he said that QE was deflationary because productivity fell. The reason is that cheap money fueled stock buybacks which are risk free instead of investing money in hiring people or in investing in new technology (more risky than buybacks). If the Fed unload its balance sheet, it will be inflationary because businesses will have to take on more risks to generate profits. Therefore, they will increase wages for higher skilled people and investing in productivity. From my point of view, I think it makes sense... what do you think?

And I just want to add that since the Fed started increasing rates, buybacks have decrease considerably. So his theory is holding so far.

Keep up the good work mate, upvoted!

Anything coming from the US economy is bad news and when it comes to gold and silver people should be hoarding as much as they can those metals are very undervalued due to the wreckless printing by the Fed throughout the years so i have little faith in the dollar or the health of our economy and its ability to survive much longer without a major correction across the board.

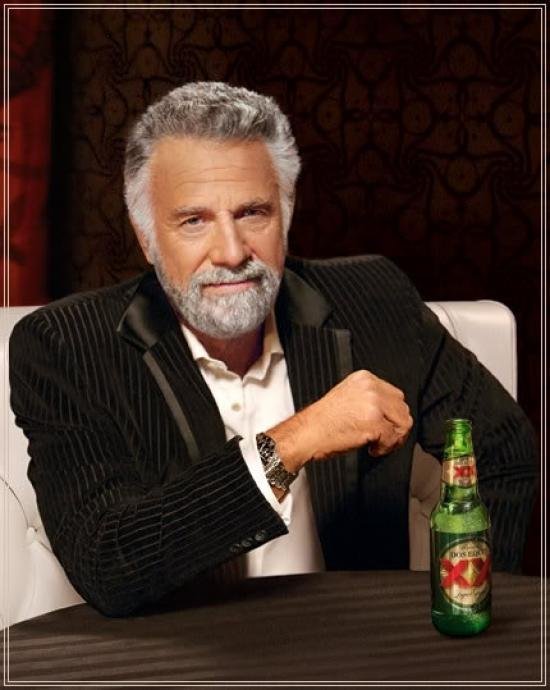

i don't always buy silver, but when i do, i buy by the pound.

I now have UUP showing as a confirmed bottom as long as it moves no lower than the current 24.63. I'm going to wait for my buy signal before going long though. Not sure it materializes today. I already entered SPY short. Still waiting on teh Q's, IWM, and VIX. I will likely be entering SLV short whenn I enter UUP long. I'm sure that makes "logical" sense. And I truly hate trading on logic. Logic will get you kilt when trading teh markets. (Copyright: Joe..JUST Joe 7/14/17) :-)

It certainly may bounce here however I still believe the longer term trend is lower. Great work Joe.

I think we are seeing a long term stock market top here and we then move on to 2008-2009 lows. The first wave down will be devastating. The dollar will be one of the safe havens...along with U.S. govmint debt...and of course teh sexy VIXens. Let me handle these gals in the beginning at least, Greg. They like to party and they party HARD once they get started. When I'm up 700% on my VIX calls (still no buy yet), I'll let you know. "Hopefully" they will be ready to take it easy for a bit. Don't want to see them rip your face off. :-)

Buying silver is prudent. Buying crypto might have a quicker rebound. I am uncertain, so I will wait and see. It is hard to straddle in smallville.

LOL.... I live in smallville, or is it "tiny town" this month

I envy the new Silver Stacker, getting in now, at these silver prices. Many experts are saying, there has never been a better time to buy physical silver.

This post has been ranked within the top 10 most undervalued posts in the second half of Jul 14. We estimate that this post is undervalued by $59.76 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Jul 14 - Part II. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.

Yeah, dollar is going down and fast, see chart below. Also I have been writing in my daily blog as well that dollar is going down and gold and silver are poised to go higher. Gold closed above the all critical level of $1220. Dollar broke the 50% resistance line. Next line is around $93.

https://steemit.com/steemsilvergold/@ajain/daily-blog-july-14-2017-overall-a-good-day

Looking forward to your interview with Greg Hunter on sunday!

Thank you for the update

Japan was the model for what is happening to the rest of the western markets. We know where this fraud is going and it looks ugly.

Yes, the Fed always gets it wrong.

Wow, the Dollar really looks like it wants (Sub-$95) today!

Can we just abolish the Fed already?!? I thought their 100 year old charter expired in 2013?

@marketreport Looking forward to your interview on Sunday with Greg Hunter.

Thanks resteemed. 👍😊