Almost everyone has some form of debt nowadays and many even have more debt than assets. Not only people are in debt, but also companies and governments are drowning in the continuously rising debt levels. On the surface it looks like debt gives us more possibilities, because we can do things that we couldn’t without a loan. But beware, debt is one of the best ways to control others and beside that a ticking time bomb under our society. Stay away from debt!

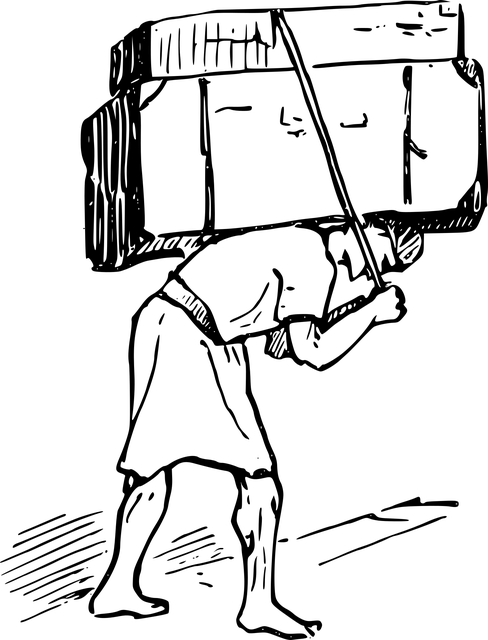

Debt is the main tool for modern slavery, avoid debt and be free!

Through debt your creditors will finally control you

You have a loan on your house and a student loan, and because you have a royal salary you take out a loan for a new car too. It looks like you have a perfect life, but this is only the case as long as you are able to convert your time and effort into enough money to pay for all the interest.

Actually, you are not being productive for yourself anymore, but you spend the entire time of your working days to be productive for others, being the ones who gave you the loan. Because you are working full time to be able to pay off the debt and interest, you don’t have any time to do anything for yourself. You are a machine for your creditors.

Until now the illusion of happiness and success can still be intact, but this will change when something happens to you and you can’t provide an income anymore or an economic recession starts and your liabilities rise above your income. From the moment you can’t easily pay the interest anymore, you will lose your freedom and be totally enslaved eventually.

When you are not able to pay for the debt anymore you will lose the assets you were thinking you own, but in case of an economic recession the execution price of the assets is probably lower than the debt you have on them, so you will be left without your assets and WITH the debt. Now the real enslavement starts.

Now your creditors will start to claim on you, but you don’t even have a penny to pay them. The case will go to court and they will designate someone to ‘help’ you with your finance to come out of debt. You will have to work your ass off to earn as much as possible while the designated person decides how much you can spend on food, how many off days you can have and other important factors of your life.

Now your entire life is controlled by your creditors and since housing prices are inflated through all kinds of government manipulation the debt will be huge and it will probably take a lifetime to pay it off. In some countries the government will also get involved to ‘help’ you and come up with further restrictions on your lifestyle.

You took a loan to own a house, until you found out that you own nothing and they own you. The worse thing is that they can play with the parameters to make it happen, because they are manipulating every fraction of the market.

Debt to control entire populations

The game as described above is also played on global scale by the western banking system and the IMF. Countries that are in financial trouble will receive ‘help’ in the form of unreasonable loans of which is known that they will never be able to pay back. By receiving the loan the country has to agree that the money is spend in the way the creditors advice them to.

The borrowed money is invested in a way that the local people don’t benefit at all and some western companies are able to make huge profits (they are hired for the projects). Because the local population have to pay for the loan they fall even deeper in poverty and they will eventually fail to pay the interest on the loan.

Happily, the IMF is so generous to give another loan to pay the interest on the first loan, but of course it have to be managed by them because you see how bad this country is managing their own financials? They clearly need help.

Warning! This will probably piss you off if you are a human being!

Only own debt free assets

All fiat money is debt based, because after it is printed out of nothing by the central bank it is given to the government in the form of a loan. A loan is debt and debt always comes with counterparty risk, when the other party is not able to pay back you will lose your money.

Since all the assets in the financial world except for precious metals and cryptocurrencies are based on fiat and often leveraged, non of them will be unaffected when the entire debt bubble pops. It is not only wise to not be in debt, but it is better to not own any debt too. When you own it you are dependent on the one that is in debt. Not smart and immoral.

Protect yourself against the results of debt

The huge amounts of debt in the world are also causing indirect changes to our world. Because governments are heavily in dept too, they will try to stimulate inflation and keep interest rates low to decrease their debt and interest liabilities. This means that the money you have been saving your entire life will devalue faster.

Since the 2008 crisis money printing (leads to inflation) is going exponential and interest rates are at an all time low. This means that your savings are vaporising faster than ever and prices of almost everything will certainly go up. The only way to keep your life savings from decreasing is to store it in hard assets like Bitcoin or gold that nobody can make more of without a lot of effort.

Disclaimer

This is no financial advice, just my view on the market.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Trade Cryptocurrencies

Binance Exchange

Buy Bitcoins anonymous with cash

Localbitcoins

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!

We need to understand that wants are insatiable and as long as we keep trying to satisfy our desires we will keep running into more debts.

I disagree on this one, if we had hard money and markets were free and not manipulated I strongly believe that everyone would be able to save for their desires. This short term thinking has evolved because we can't do anything for the long term because it is too uncertain. Hard money will make people save again and make overtime when they really desire something they can not afford.

Would you classify desires under needs or wants, we have our needs all right which we must satisfy but then there are wants also; things we don't necessarily need but want to acquire maybe because we need to keep up with the status quo or because we simply feel we can afford them- at once or over a period of time.

Regardless of the manipulation of the markets humans (most of us) just want a lot of things even though we don't really need them all. If we don't have the discipline we will just keep trying to get everything and run into more debt.

Even if the market was to be stable and free from manipulations, not everyone will be able to afford all they want, or even the basic life amenities that they need.

Donald Drumpf comes to mind.

This statement is mostly ignorant.

Governments that their debts is mostly denominated in their own currency and if their currency is not backed by some asset of limited amount, can go as far as they want into debt, can always pay it back in full, and in fact do not need it, since they do not need to loan amounts of what they can create at the stroke of a keyboard.

In addition to the above, if inflation occurs, the debt itself is devalued, which means, shrinks in real terms.

In short, we are under MMT rules, not under a gold or silver or bitcoin standard.

So you think the world bank gives out loans in local currencies when they lend to 3rd world counties? The world is bigger than only America and many countries are suffering because of their growing debt in USD.

Then what you wrote applies to such countries, but you wrote it in a way that is meant to frighten people out of debt, and to make it seem as if governments are in trouble whenever they are in debt.

The distinctions and reservations deserved to be mentioned.

You got a 16.39% upvote from @sleeplesswhale courtesy of @stimialiti!

This comment has received a 83.33 % upvote from @steemdiffuser thanks to: @stimialiti.

Bids above 0.1 SBD may get additional upvotes from our trail members.

Get Upvotes, Join Our Trail, or Delegate Some SP

You got upvoted from @adriatik bot! Thank you to you for using our service. We really hope this will hope to promote your quality content!

0.01 SBD to bid for upvote.You got a 80.00% upvote from @voteme courtesy of @stimialiti! For next round, send minimum

Do you know, you can also earn daily passive income simply by delegating your Steem Power to voteme by clicking following links: 10SP, 25SP, 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

This comment has received a 58.82 % upvote from @steemdiffuser thanks to: @stimialiti.

Bids above 0.1 SBD may get additional upvotes from our trail members.

Get Upvotes, Join Our Trail, or Delegate Some SP

i agree i don`t have any debt just gold silver and crypto as investment

Dept is that thing which can destroy a countries future..its really bad for success so avoiding it and do hard work instead of getting dept.

Yes, I really think debt is one of the biggest threats to humanity and once a tipping point is reached it is almost impossible to get rid of it.

Children "must" be taught as a course in the age of development

Yeah its must !

Yes, they pretend that we have to be protected against everything like smoking, drinking, driving 5 km/h to fast, ect, but young people can go heavily in debt without any warning and when you are 17 you can sign up to go to war areas to kill or be killed.

Control your desires, set the limit that you are going to buy after earning not after taking the loan.

Exactly, first earn the money and then spend it. The sad thing is that houses are so heavily inflated by socialist market manipulation that it is actually impossible to earn the money for a house first.

Exactly, we are on the same page at this point.

you are absolutely right.... you are free from debt means you are free from others

Sure thing, I think many people don't realise it.

But you can leverage debt to invest in real estate....

Indeed, but firstly I never investigated it, so I can't make content about it. Secondly, it is enriching yourself while others are carrying the risk, I prefer to HODL BTC and be active in the crypto space and not harm anyone, but make the world better and help systems grow to include the other 4 billion people in the economy.

I see your point, however I see it as if I can make more I can give more.

Agree. People forget they use to have debtor prisons and if you were in debt they would have to work while the income going to the person the money was owed too. Credit card companies are creating a lot of slaves.

Things are not always black or white, grey also. There are many issues you can resolve with (controlled, limited, reasonable) debt. For example, if your business has a 20 percent yield, you shoud take a credit with 5 percent interest. Or student loan can be the only way to make your carreer, mortgage the only reasonable way to leave mom's home. But I appreciate your effort with an upvote becouse you are making us think.

Great post!

I've been trying to tell my friends this for years, and still today many don't listen. If you can't pay for it cash don't buy it, control your desires and keep stacking blue faces till the ceiling. Buy income generating assets now and retire in a couple of years :)

Keep up the great work :D

Debting is not bad. what is bad is using the money or any other debited material in wrong way and issues. Let's say you've debited money in the bank for house construction or business expansion, and the first thing you do after getting the money, you buy a nice car, smartphone or have some leisure in a hotel at least half of the money is finished and you fail to accomplish what you debited money for. Then the problem was not that you debited money, the problem was that you used the money in wrong and unplanned issues. Better use money in benefiting issues than crediting issues. Thanks this is my idea @michiel.

Makes me think about rich dad poor dad reflection, a must to read, that i can't stop to recommend.

To borrow money could also be a good thing to do, if it's use for wise investment and not into a new car, phone, etc...

One of the biggest things I learned and I have been good with it so far. Not being in debt is a great feeling to have.

So true!

I agree so much with you! I had lost many friends to the debt gods. If you look at jobs with a different glass, would you say they are a form of debt as well?

I mean you sign a contract about giving up your own free time, yeah you get compensated but you kind of agree to the hourly payment they are giving you.

What would be a fair value for a person's free time? Considering the fact the we are all dying slowly? And on top of that some individuals decide to carry debt on their shoulders?

I mean it's brave but really not necessary.

Anyway thanks for the effort you put into it!! Very well written post.