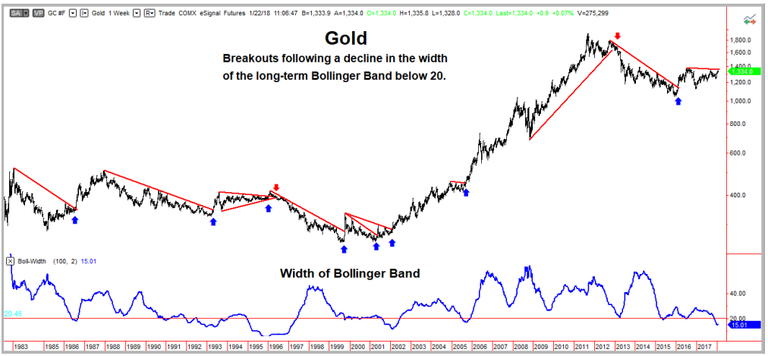

Over the last three decades, extreme narrowing of long-term Bollinger band indicated a subsequent break through either a resistance or a support line (see char below).

Currently Bollinger band width on gold is extremely low (very narrow Bollinger band), hence a likely break through either a resistance or support is very likely.

The questions is, will it be a significant resistance (say around $1400) or a significant support (say around $1220) that will be broken?

What is your opinion?

According to Ray Dalio and other great minds we are heading towards a blowout in the markets. This uncertainty will help gold as a hedge. It looks like the Trump Administration wants a lower the US dollar. This could bring the possibility of some kind of currency war -- Dragi has raised concerns. This uncertainty also helps gold. Ray Dalio believe we are in a bond bear market. This also favours gold as bonds are no longer viewed as a safe haven. Inflation doesn't seem to be a concern, so rate hikes will likely be slowed. As the end of the current bull cycle is nearing its end, when the next recession hits the FED will not be able to lower interest rates significantly as they are already very low. They will likely be forced to some form of QE. This is will help gold as it has before. Crypto currencies are currently very uncertain and this will cause more people to look to precious metals. We could see a few months of retracement in gold price before precious metals rise. We may even go down to the 1250s before we break 1400. cool nerves are needed. many thanks for the awesome posts!

1.39% @pushup from @myfinanceteacher