This is a post I've been meaning to write for a long time. And then in my previous post I actually responded to a comment with this very line: This is why everyone needs to do their books.

Here I want to explain what the books are, and why you should do yours.

What Are "The Books?"

If you watch a lot of police dramas you'll no doubt have heard of people "cooking the books" related to some sort of financial crime. It sounds pretty nefarious. You might have also heard about keeping two sets of books - one real and one fake.

But what are these books everyone is talking about?

"The books" are the financial records of an enterprise, usually a company. In the bad-old-days these were physical journals that contained ledgers of income and expense, assets, and liabilities. These days most people use computer systems instead of physical journals. But I still have 3 or 4 clients who whip out their oversized green accounting sheets each year with their hand-written tallies.

In a ledger (the same ledger that everyone in crypto-world talks about) entries are made detailing transactions. I'm going to skip double entry vs. single entry, t charts, and all the rest of the minutiae here. The key takeaway is that every transaction is logged in the system.

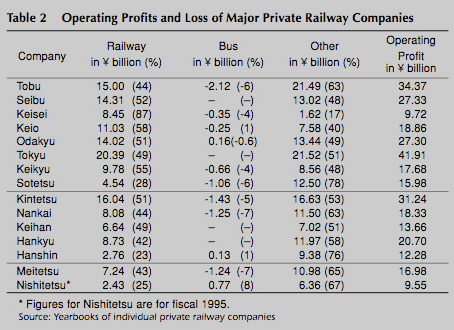

Those transactions are compiled into two summary reports: the income statement (or profit & loss statement - the p&l) and the balance sheet.

The P&L

The profit and loss is pretty much what it sounds like. It tallies up the various categories of income and expenses and displays them on a chart with income at the top and then expenses below. At the very bottom you'll find the difference between the income and expense, which is the net profit (or loss). If you end up with a net profit, then you are making money. If you end up with a net loss, you are losing money. Generally making money is the goal.

Most people have a pretty decent understanding of the p&l. Your bank statement is pretty much an un-categorized p&l statement. You see money coming in and money going out.

The Balance Sheet

The balance sheet is a different animal. The balance sheet shows your assets, liabilities, and equity. The assets balance out the liability and equity. This is the basic accounting equation: Assets = Liabilities + Equity.

You can also look at it as Assets - Equity = Liabilities. Or Assets - Liabilites = Equity

But what does this really mean?

I find examples are easiest to understand for the balance sheet.

Let's say you have a house worth 200k with a mortgage of 168k, a checking account with 1,248 fiats in it, and a credit card with a balance of 10,398.

What do we have in the assets column? A house worth 200k and a checking account with 1,248. So our total assets are 201,248. These are things that have value to us.

In the liabilities column we have a mortgage of 168k and a credit card of 10.398 for a total of 178,398. These are things of value that we owe others.

So our account equation looks like: 201,248 = 178,398 + Equity.

Solving for Equity we get 22,850. This is our "Net Worth." Fortunately in this case it is a positive number. We own more than we owe.

Why Does This Matter For You?

OK, so far good. But this is all business stuff, what does it have to do with you and your life? You're probably not an accountant.

Here's why it mattes: Everyone is broke.

I made this point in my last post talking about how much you are saving and investing matters more than the rate of return you are getting. But everyone always brings up the same objection, they can't save and invest enough. There's just no money left over after paying bills.

And that's why this matters to you and your household at the individual level.

99% of people, including business people, don't do their books! They have no idea what is going in their financial lives!

It's just wake up, go to work, get paid on Friday, pay bills and spend money, hopefully there's some left next Friday but probably not. Money came in. Where did it go? No idea!

It's no wonder everyone is broke. Imagine driving a car without a destination, without knowing the streets, without a map, and hoping to get somewhere. That's how people are treating their money. Some people make it out of sheer luck, but the overwhelming majority just end up nowhere.

Doing your books is the first step to figuring out where you are.

Doing your books regularly let's you know how you are progressing.

Because while doing your books one time can be terrifying, showing you where all that money went, doing your books on a regular basis shows you your financial state over time.

Is income up or down compared to last month, last quarter, last year? Are expenses rising or going down? What categories of expense are abnormal this time? What is too big? What is too small? Are assets increasing? Are liabilities decreasing? Is net worth going in the right direction and quickly enough?

These are all questions you can begin to answer when you start to do your books regularly and review them.

It is amazing how much money you can find if you just pay attention.

How to Do Your Books

Hire a bookkeeper.

It's that simple. There are lots of well trained people out there who do this kind of thing for a living and will take your mess, clean it up, and give you back all the pretty tables and graphs you could want. Go on upwork or look at quickbooks' profinder and try a couple people out. It's not like you can't hire and fire a few until you get someone you like.

And they are cheap! In the vast majority of cases it would cost less than 100 USD per month to hire this professional to work for you.

This is largely because a household doens't really require complicated bookkeeping. You don't have so many transactions that it will take hours and hours to compile. You don't have to worry about matching, where different time periods come into play. You have pretty straightforward income and expenses and relatively few assets and liabilities. your

I know, I know, I can hear it now. You're saying that what I'm saying makes sense, but spending 1200 USD a year on this is a waste of money because you could do this yourself.

But you're wrong.

Because you won't.

Best case scenario, if you ever get started at all, you do your books for 2 months and then something comes up. You get behind. And then you figure that it doesn't seem like such a priority anyways. After all, it hasn't changed your life so dramatically.

I know this because I've been there and I've worked with thousands of people who have been there. Everybody who tries to do it themselves fails. Even professional bookkeepers get lazy when it comes to their own books. They should hire someone else to do their books. Even if the records are actually compiled, they aren't reviewed monthly, quarterly, and annually to glean the insights you get from the whole process. And that is actually the point of the whole thing!

So what about that 1200 USD you spend? Here's the funny thing. When you actually have a clue about what is going on you will end up saving more than the cost of the bookkeeper. So it ends up being a great investment that pays better than just about anything else.

Clients ask me all the time if doing their books will save them money, and I have to tell them the directly no but indirectly yes. The cost of hiring the bookkeeper is an expense. Definitely. But the actionable knowledge you get out of the process has potentially millions of dollars of value.

Resources

- Source Image - August Brill

- Source Image - Payton Chung

- Source Image - Peter Baskerville

- Source image

I... holy shit yes it will save you money. I mean, I'm coming from the perspective of someone who isn't an accountant but is pretty obsessive about this, and my brain is breaking trying to imagine what it would cost me not to have those numbers available to me at all times.

The cost would be not a lot.

If you are willing to manage your bookkeeper a lot more than a local might require, you can hire people on Upwork for like $5/hr in the Philippines.

Upvoted ($0.21) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.

I am going to look into what you guys offer. I have dived into investing since graduating HS.

Fantastic. I hope you like what you see.

This is the first of your articles I have read, and I must say: I am very impressed! I also read the title of some of your other posts, and it seems like the type of content I love! Keep up the great work mate!