I stumbled across this interesting article on AMD and NVIDIA beginning to build dedicated cards for mining. But more important than the article itself, is that this is an indicator that the news of rampant GPU shortages due to crypto mining is finally starting to trickle into the public consciousness, and crypto's impact on 'real world' economy begins to receive the spotlight.

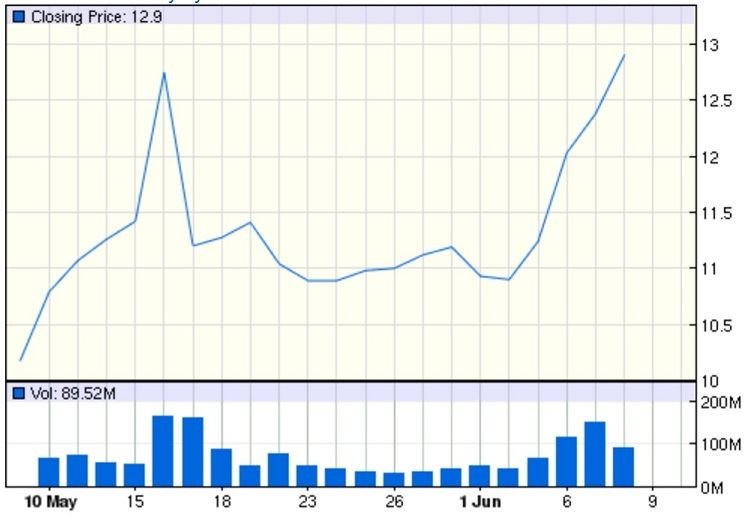

The fact that AMD's supply of optimal mining cards has been completely exhausted nearly worldwide has been common knowledge for those in the crypto community. But for the mainstream public to begin to hear about it- and act on it- could mean even bigger positive impacts on AMD's stock price. That combined with other recent news on new products and strategic sales partnerships appears to have AMD's share price surging

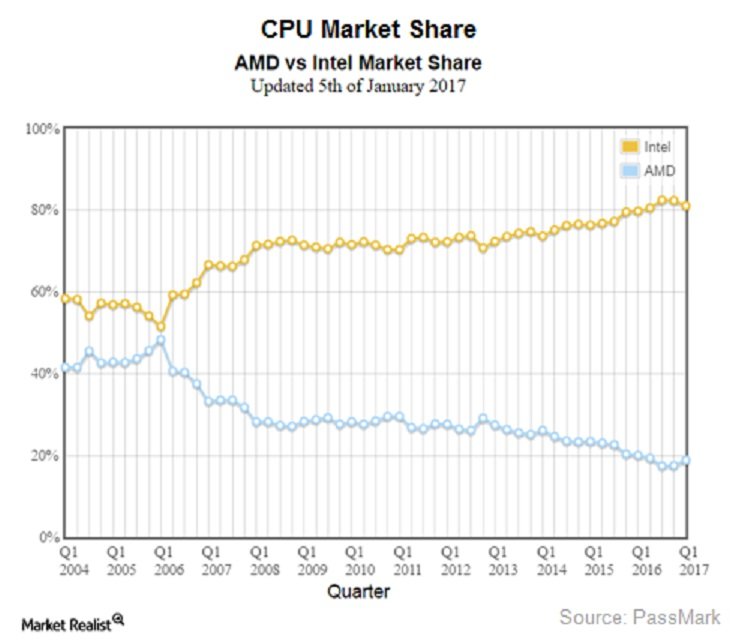

More optimal for mining than its' competitor's offerings, after bottoming out in terms of market share it appears AMD is turning the corner:

As Kumquat Research on Seeking Alpha so poignantly summarizes:

- AMD's dysfunction has allowed Intel to control the CPU market.

- Intel's cushy margins and dominant market share position are in jeopardy.

- AMD is returning with a vengeance.

- Intel should be afraid"

I would love to get feedback from others on whether this could turn out very well for AMD in the medium to long term, or whether it is, as some say, still a turkey?

Great Calc. Super